bold@mininginsight.mn

The Government of Mongolia and Rio Tinto, the shareholder of Oyu Tolgoi LLC, are once again set to sit at the negotiating table. While this round of talks resembles those held in 2021 in several ways, there are also many differences some of them quite significant. Both sides have new leadership that has been in office only a short time, and most of the negotiators themselves have changed as well. In particular, the operational and managerial restructuring underway at Rio Tinto, and whether the new leadership prioritizes Oyu Tolgoi and Mongolia, will likely determine the outcome of the negotiations. It may therefore be prudent for the Government to temporarily set aside its expectations, closely observe the internal changes at Rio Tinto, and adapt its negotiation strategy accordingly.

THE NEW CEO’S “MISSION” AT RIO TINTO

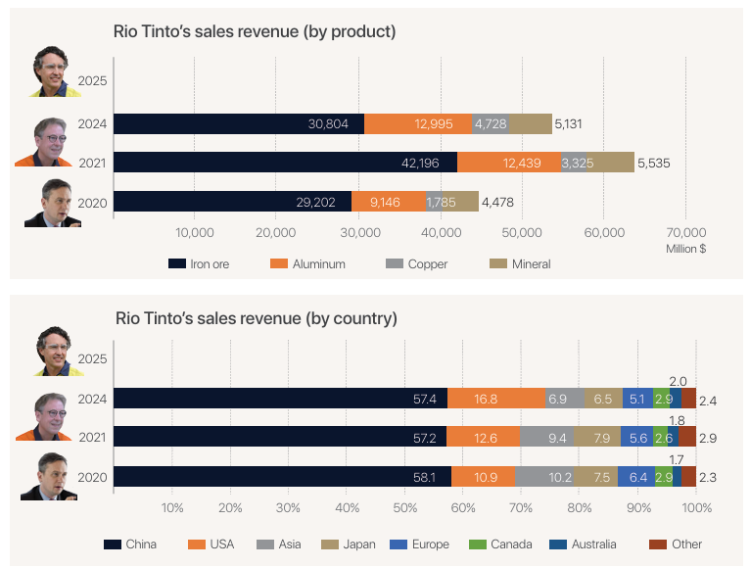

Mongolians are already familiar with Rio Tinto’s Chief Executive Officers. The previous two CEOs visited Mongolia multiple times and paid close attention to the construction and operations of Oyu Tolgoi. Yet, both were dismissed before completing their terms. Jean-Sébastien Jacques, appointed in 2016, served four and a half years before being forced to resign over the destruction of a cave sacred to Indigenous Australians. His successor, Jakob Stausholm, unexpectedly announced his resignation in May this year. In July, Simon Trott was appointed as the new CEO and made his first visit to Mongolia in September. The company’s revenue structure often reveals which commodities and markets its executives prioritize. Under Jacques, Rio Tinto shifted away from coal and focused heavily on copper.

The results became evident under Stausholm, when copper sales nearly tripled. The company also increased its sales in the United States, maintaining its market position in China while expanding in the U.S. during the height of the U.S.–China trade tensions. It has become almost a tradition that each new CEO initiates corporate restructuring and declares a strategic direction. For example, Stausholm emphasized improving the company’s reputation and prioritizing ESG (Environmental, Social, and Governance) principles. He even appointed a CEO specifically responsible for relations with Australia, home to the company’s core iron ore operations. Similarly, Simon Trott has already begun a broad restructuring process, stating that his goal is to focus on the most promising opportunities that will enhance long-term shareholder value. He aims to cut costs and optimize production efficiency. Australian media outlets have responded positively to these reforms.

The results became evident under Stausholm, when copper sales nearly tripled. The company also increased its sales in the United States, maintaining its market position in China while expanding in the U.S. during the height of the U.S.–China trade tensions. It has become almost a tradition that each new CEO initiates corporate restructuring and declares a strategic direction. For example, Stausholm emphasized improving the company’s reputation and prioritizing ESG (Environmental, Social, and Governance) principles. He even appointed a CEO specifically responsible for relations with Australia, home to the company’s core iron ore operations. Similarly, Simon Trott has already begun a broad restructuring process, stating that his goal is to focus on the most promising opportunities that will enhance long-term shareholder value. He aims to cut costs and optimize production efficiency. Australian media outlets have responded positively to these reforms.

OYU TOLGOI NEGOTIATIONS TURN “HARDCORE”

What has drawn even greater attention is that the new CEO appears focused on resolving Rio Tinto’s most complex challenges. Just as the company’s leadership has changed significantly over the past four years, the Mongolian Government has also undergone a complete transformation, with Prime Minister G. Zandanshatar’s Cabinet leading this round of negotiations. As the new leadership of both shareholders defines their policy for Oyu Tolgoi, several intriguing developments are unfolding. On October 22, Reuters reported that Rio Tinto is exploring an asset-swap deal to reduce the 11% stake held by its largest shareholder, China’s state-owned Chinalco. Chinalco’s ownership has long been described as a “toothache” for Rio Tinto a chronic issue. That the largest shareholder of one of the West’s biggest mining companies is a Chinese state owned enterprise has been a major strategic concern. According to Reuters, Rio Tinto is considering transferring a portion of either the Simandou iron ore project in Guinea or the Oyu Tolgoi mine in Mongolia to Chinalco in exchange for reducing its shareholding by 2–3 percentage points equivalent to roughly USD 2.2–3.3 billion. If the new CEO’s mandate includes reducing Chinalco’s stake, this may take precedence over Oyu Tolgoi or Simandou in strategic importance. Three years ago, Rio Tinto acquired Turquoise Hill Resources including a 33% stake in Oyu Tolgoi for USD 3.3 billion. Remarkably, the day after Reuters’ report, Mongolia’s General Intelligence Agency arrested several employees of Oyu Tolgoi’s Procurement Department on corruption charges, an event that seems hardly coincidental. Sources indicate these employees had been under investigation for some time.

Meanwhile, Oyu Tolgoi representatives have repeatedly declined to attend parliamentary committee hearings on the project’s implementation. The Cabinet Secretariat announced it will enter negotiations with Rio Tinto, and the Government is preparing to sign an investment agreement with the Canadian company Entr e. An arbitration hearing related to Oyu Tolgoi’s tax dispute was recently held in London, and Mongolia’s corruption lawsuit against Rio Tinto in the U.K. High Court was dismissed in September. Against this backdrop, it is difficult to determine whether these developments are tactical maneuvers or signs of escalating tensions. Another crucial matter is the ongoing discussion among shareholders to reduce Oyu Tolgoi’s loan interest rates, which could have significant financial implications. Objectively assessed, Rio Tinto may not be as accommodating toward Oyu Tolgoi and Mongolia as it was in 2021. The new leadership’s focus on other pressing issues, the recent delay in appointing a new Oyu Tolgoi CEO, and the September visit of foreign guests all reinforce this impression. For its part, the Government appears inclined to use traditional pressure tactics an approach that may not succeed this time. Unlike in 2021, there is currently no one at Rio Tinto’s executive or board level to “translate” the Government’s intentions. Back then, Bold Baatar, Rio Tinto’s Copper CEO, and G. Batsukh, Oyu Tolgoi’s Board Chair, played a crucial role in bridging the gap. Furthermore, the Government seems to have few bargaining chips this time. Pressing Rio Tinto to lower interest rates a move that could cost hundreds of millions annually is hard to balance when there is little to offer in return. Negotiations progress only through mutual give-and-take. In any case, the Government and Rio Tinto are returning to the negotiating table. The outcome will be critical for both sides. The Mongolian Government must avoid repeating past mistakes and take a more deliberate, strategic approach. To do so, it needs to carefully assess the domestic and international contexts surrounding Oyu Tolgoi and conduct a deep analysis of the situation.

Above all, it must determine whether Oyu Tolgoi whose valuation continues to rise remains a strategically significant business for Rio Tinto under its new leadership, or whether it has lost that status. The answer may ultimately decide the fate of these negotiations.

Mining Insight Magazine, October 2025 №10 (047)