In the Budget Law for next year, resubmitted to the Parliament, the government plans to reduce budget expenditures by MNT 2.9 trillion to avoid a deficit. However, total revenues have been reduced by MNT 394 billion. Mongolia exported 83 million tonnes of coal, with the equilibrium price at USA129 per tonne. The unfavourable Chinese market and the tendency for coal prices to continue declining next year remain the main economic and budgetary challenges for 2025.

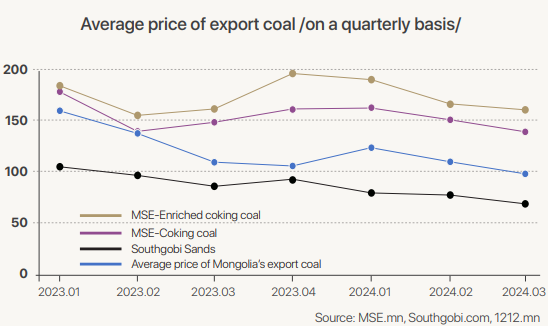

Mongolia's coal exports amounted to 68.5 million tonnes in the first 10 months, nearly matching the 2023 level. Export revenue reached USD 7.4 billion. In 2023, 69.6 million tonnes of coal were exported, earning USD 8.9 billion, with an average export price of USD 127.8 per tonne. This year's target of 80 million tonnes is achievable in terms of volume, but the continued decline in coal prices increases the likelihood that revenue will not rise. Coal prices have been slowly declining since the beginning of the year. The average price of export coal was USD 129 per tonne in the first quarter, dropping to USD 92.4 per tonne in October, a decrease of almost 30 per cent. Prices will likely decline rapidly next year, especially in the second half. The graph shows how Mongolia's export coal prices are declining, calculated as quarterly average prices. The prices of coal sold on the Mongolian Stock Exchange (MSE) are also declining in each category. The prices of the main category, the most exported coal, have decreased by 16-30 per cent. The price of the most expensive, enriched hard coking coal with delivery to the Gantsmod port, decreased by 16 per cent from an average of USD 190.6 in the first quarter to USD 161 in the third quarter. The average price in November was USD 147. This type of coal is exported only by the Mongolian Mining Corporation. The price of hard coking coal, the main product of Erdenes Tavan Tolgoi and Tavan Tolgoi JSC, decreased by 19 per cent from USD 161.8 to USD 131. However, half-coking coal, or 1/3 of coking coal, is mostly exported from the Nariinsukhait group of deposits. This group accounts for about 40 per cent of total exports. The average export price of their main representative, South Gobi Sands, fell by 27 per cent from USD 92.9 in the fourth quarter of last year to USD 67.8 in the third quarter of this year.

Mongolia's coal exports amounted to 68.5 million tonnes in the first 10 months, nearly matching the 2023 level. Export revenue reached USD 7.4 billion. In 2023, 69.6 million tonnes of coal were exported, earning USD 8.9 billion, with an average export price of USD 127.8 per tonne. This year's target of 80 million tonnes is achievable in terms of volume, but the continued decline in coal prices increases the likelihood that revenue will not rise. Coal prices have been slowly declining since the beginning of the year. The average price of export coal was USD 129 per tonne in the first quarter, dropping to USD 92.4 per tonne in October, a decrease of almost 30 per cent. Prices will likely decline rapidly next year, especially in the second half. The graph shows how Mongolia's export coal prices are declining, calculated as quarterly average prices. The prices of coal sold on the Mongolian Stock Exchange (MSE) are also declining in each category. The prices of the main category, the most exported coal, have decreased by 16-30 per cent. The price of the most expensive, enriched hard coking coal with delivery to the Gantsmod port, decreased by 16 per cent from an average of USD 190.6 in the first quarter to USD 161 in the third quarter. The average price in November was USD 147. This type of coal is exported only by the Mongolian Mining Corporation. The price of hard coking coal, the main product of Erdenes Tavan Tolgoi and Tavan Tolgoi JSC, decreased by 19 per cent from USD 161.8 to USD 131. However, half-coking coal, or 1/3 of coking coal, is mostly exported from the Nariinsukhait group of deposits. This group accounts for about 40 per cent of total exports. The average export price of their main representative, South Gobi Sands, fell by 27 per cent from USD 92.9 in the fourth quarter of last year to USD 67.8 in the third quarter of this year.

According to the first half-year reports of Mongolian coal exporting companies, the export volume is increasing significantly due to the decline in coal prices, but revenue growth is expected to slow down. MMC exported about 6.7 million tonnes of coal last year, but in the first nine months of this year, it has exported 6 million tonnes. South Gobi Sands exported 3.6 million tonnes of coal last year, but in the first three quarters of this year, it exported about 4.4 million tonnes. However, in the first half of the year, MMC's sales revenue amounted to USD 541 million, a slight increase from the same period last year. South Gobi Sands' sales revenue amounted to about USD 320 million. Mongolia Energy Corporation sold one million tonnes of coal in the first half of 2024, generating revenue of USD 218.5 million. In the previous year, it sold 1.9 million tonnes of coal and generated revenue of USD 407 million. The company washes and enriches raw coal extracted from the Khushuut mine and sells it across the border, which is why the average price of coal sold by the company has decreased slightly, reaching an average of USD 216.7 in the last six months. Last year, the coal sector exported a total of USD 8.9 billion, bringing in MNT 4.3 trillion in tax revenue to the state. The average price of coal exports was about USD 128 per tonne. This means that coal alone accounted for about 17 percent of the consolidated budget revenue. The Ministry of Finance believes that this ratio will be maintained next year. The plan is toexport 83 million tonnes of coal at a balanced price of USD 129 per tonne. The disadvantage is that the balanced price is calculated using a specific method, making it difficult to reflect the price drop in the next 1-2 years when the price was high.

However, the Ministry of Finance believes that the commissioning of the Tavan Tolgoi coal concentrator will increase the export of high-priced enriched coal and increase the average price.

The World Bank’s economic outlook report for next year predicts that coal prices will fall by up to 13 per cent. The main market, China’s steel consumption and exports, will decrease by about 5-10 per cent, leading to a decrease in demand for coking coal. The trend of increasing exports to China from Russia and the United States presents an unfavorable picture for the Mongolian coal market. Unless our southern neighbor buys more of our coal and gives us "preferential rights" as in the past two years, the outlook remains challenging.

Mining Insight Magazine, November 2024 №11 (036)