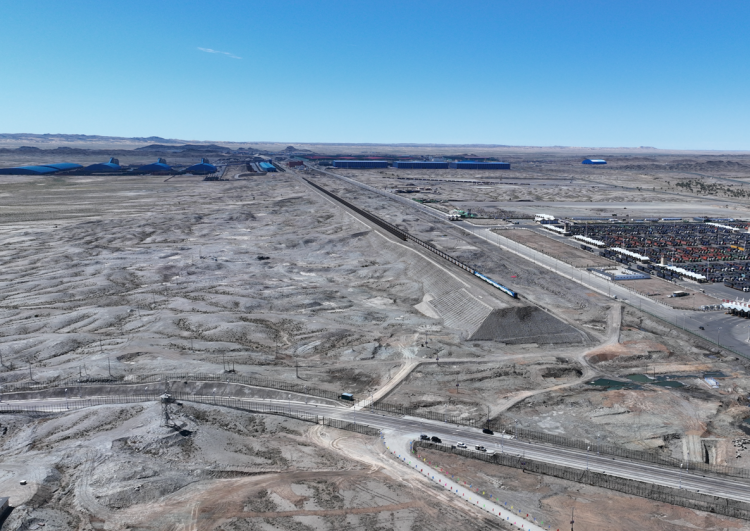

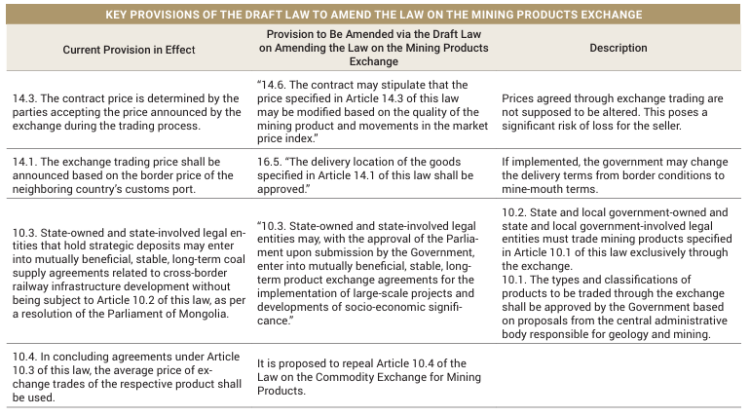

On March 27, the Government submitted a draft amendment to the Law on the Mining Products Exchange to the Parliament under an urgent procedure. However, due to strong criticism from Members of Parliament, the bill was withdrawn on April 22. The amendment was considered necessary in light of the significant decline in trade volume-particularly coal-on the Mining Products Exchange. The proposed amendment aimed to add nine provisions, remove one, and revise two in the current law. However, it faced opposition on the grounds that it would alter the original intent of the law and potentially revive coal-related corruption. In essence, the primary purpose of the amendment was to revise legal provisions that hinder the implementation of an intergovernmental agreement with China and to enable Erdenes Tavan Tolgoi (ETT) to enter into a long-term contract with China Energy without violating the law. Additionally, the amendment sought to align the law with practical needs by addressing inconsistencies, expanding the pool of domestic buyers-especially local processing companies-and formally integrating the trading of yellowcake into the legal framework. Nevertheless, due to controversy surrounding certain provisions related to ETT’s sales practices, the draft law was ultimately withdrawn.

WHAT WERE THE PROBLEMATIC PROVISIONS IN THE DRAFT LAW?

The most heavily contested provision was the proposed amendment to Clause 10.3 of the law. This clause had originally been added in 2023 to allow ETT to enter into a long-term coal supply agreement with China Energy, linked to the cross border railway. However, in the revised version of the clause, it was stated that "...a long-term product exchange agreement may be approved by Parliament upon submission by the Government," which sparked criticism from Members of Parliament (MPs). The phrase "product exchange" was particularly contentious, as many MPs, including J. Zoljargal and B. Enkhbayar, argued that it would pave the way for new offtake agreements. The original purpose of adopting the Law on the Mining Products Exchange was to prohibit ETT from entering into further offtake agreements and instead ensure that all coal is traded transparently through the exchange. Amending this clause was therefore seen as contradicting the law's founding principles. Another controversial proposal was the removal of Clause 10.4, which currently mandates that long term contracts must be based on the average price traded on the exchange. Repealing this clause would allow the use of pricing terms included in the intergovernmental agreement with China. Under the “Intergovernmental Agreement between the Government of Mongolia and the Government of the People’s Republic of China on Cross-Border Railway, Coal Trade through Gashuunsukhait-Gantsmod Port, and Expansion of Tavan Tolgoi Coal Mine Capacity” ratified by Parliament, the coal supply price was agreed to be based on mine-mouth prices with seasonal index adjustments-similar to the pricing terms of the 2012 agreement with Chalco. Removing Clause 10.4 would thus provide legal grounds for implementing this agreement and enable ETT to sell coal to China Energy without violating the law.

MP's also opposed the newly proposed Clause 16.5, arguing that it contradicted the original intent of the law. This clause would give the Government the authority to determine the location of coal sales through the exchange, which could shift the trading terms from border delivery to mine-mouth terms. According to some MPs, such a shift could revive the "coal theft" cases seen several years ago. Additionally, another proposed clause-14.6-faced opposition for potentially causing losses to companies that already sold products through the exchange. This clause allowed the sale price to be adjusted based on product quality and price index fluctuations. In other words, it would permit renegotiation and downward revision of prices already traded on the exchange. The main justification for this change was that the price at the Gantsmod port had fallen by about 45% compared to the same period last year, which halted the procurement of 6.8 million tonnes of coal from 31 trades by ETT, causing significant losses to buyers. The intent was to reduce the risks for buyers. However, many MPs opposed the proposal. “An exchange functions regardless of price increases or decreases. You can’t change prices after a trade is completed. It’s unacceptable to modify agreed prices due to quality. Many companies will sue ETT to lower prices. It will cause serious issues,” MP O. Batnairamdal emphasized.

MP's also opposed the newly proposed Clause 16.5, arguing that it contradicted the original intent of the law. This clause would give the Government the authority to determine the location of coal sales through the exchange, which could shift the trading terms from border delivery to mine-mouth terms. According to some MPs, such a shift could revive the "coal theft" cases seen several years ago. Additionally, another proposed clause-14.6-faced opposition for potentially causing losses to companies that already sold products through the exchange. This clause allowed the sale price to be adjusted based on product quality and price index fluctuations. In other words, it would permit renegotiation and downward revision of prices already traded on the exchange. The main justification for this change was that the price at the Gantsmod port had fallen by about 45% compared to the same period last year, which halted the procurement of 6.8 million tonnes of coal from 31 trades by ETT, causing significant losses to buyers. The intent was to reduce the risks for buyers. However, many MPs opposed the proposal. “An exchange functions regardless of price increases or decreases. You can’t change prices after a trade is completed. It’s unacceptable to modify agreed prices due to quality. Many companies will sue ETT to lower prices. It will cause serious issues,” MP O. Batnairamdal emphasized.

WHAT ABOUT ISSUES OTHER THAN “OYU TOLGOI”?

The other provisions of the draft amendments to the Law on the Mineral Products Exchange aimed to address several pressing challenges. Despite the existence of 47 processing plants for fluorspar, coal, and iron ore across Mongolia, many have experienced raw material shortages and stagnation due to current legal limitations under the amendments. These plants have raised concerns that they are in a difficult position because the law only permits the sale of raw materials intended for export via the exchange, with no legal mechanism for domestic procurement through the same channel. To resolve this issue, the draft amendments proposed a new clause allowing domestic beneficiation and processing plants to purchase raw materials through the exchange, provided they increase value-added processing and export the final products. Specifically, the amendment stated: “Entities specified in Article 10.2 of this law may sell mineral products through the exchange to domestic beneficiation and processing plants for the purpose of increasing value-added processing and export.”

Additionally, the draft amendments included provisions to address issues faced by state- and locally-owned thermal coal companies. They also aimed to regulate the sale of yellowcake produced and exported by Badrakh Energy, a state-involved enterprise. All of these potential solutions were sent back with the withdrawal of the bill. Meanwhile, Oyu Tolgoi, which had been unable to export its products in recent months due to the law, is now exempt from the exchange requirements, regardless of the draft amendments. Article 10.1 of the amendments states that the list of products to be traded on the exchange is determined by the Government. Under Resolution No. 223 of 2023, the Government designated fluorspar, iron, coal, copper, and molybdenum as products to be traded through the exchange. However, on March 12 of this year, the Government issued an amendment to that resolution, exempting legal entities that have entered into investment agreements with the Government. As a result, Oyu Tolgoi is no longer required to sell its copper concentrate through the exchange. The company had been unable to sell or export more than 200,000 tonnes of copper concentrate in recent months. Under its Investment Agreement with the Government, Oyu Tolgoi is entitled to sell and export its products at international market prices, meaning the exchange law no longer applies to it. The draft law to amend the Mining Products Exchange is now being revised and is expected to be resubmitted to Parliament.

MP J.Zoljargal “There are several fundamentally serious changes in the draft law. At a time when we are discussing the implementation of numerous mega projects, I cannot support the inclusion of a provision in the amendments to the Law on Mining Products Exchange that allows state-owned enterprises to enter into product swap agreements for the purpose of implementing large scale projects. This provision is being added to the wrong law. The introduction of the concept of a price index is also problematic. It seems designed to reduce the price of coal that has already been sold under contract and stockpiled at border depots. This gives the appearance of lobbying to cover the losses of trading companies. Another provision shifts the responsibility of transportation to the buyer. What this really means is that coal will be sold under mine-mouth terms, and transportation will be handled by Chinese companies. According to the Bank of Mongolia’s report, the services sector has incurred the largest losses—exceeding USD 1 billion—primarily due to transportation costs, which are heavily linked to Chinese companies. The exchange is operational and there are improvements to be made. We should aim to move toward the principles of a classical exchange, but not in this manner.”

Minister of Industry and Mineral Resources Ts.Tuvaan “To be frank, auctions are currently being held on the exchange, but it’s not operating under classical exchange principles yet. Preparations are underway. When prices are rising, there are no complaints. But when prices drop, coal buyers are unable to sell their purchased coal and face significant losses. The law now includes a provision to allow price indexation, where prices can rise or fall depending on the market. The lack of indexation has discouraged buyers from participating in the exchange. Because they don’t know how far prices might fall, they avoid trading to protect themselves from potential losses. Currently, we are contractually obligated to deliver coal traded on the exchange within 2 to 12 months. On average, ETT delivers coal to the Gantsmod terminal within 3–4 months under DAP terms. The clause that assigns transport responsibility to the buyer is being introduced on the basis that it will let the buyer decide whether to receive coal at Tsagaan Khad or Gantsmod, which would speed up the process and increase trading volumes. At present, 44 contracts are stalled because buyers haven’t collected their coal. The Gantsmod terminal is full, and containers can’t be unloaded.”

Mining Insight Magazine, April 2025