E.MISHEEL

E.MISHEEL

misheel@mininginsight.mn

- The energy consumption of these projects equals that of three provincial centers -

The Mineral Resources and Petroleum Authority of Mongolia (MRPAM) annually publishes a list of “Projects Requiring Investment.” According to the latest update released in August, 54 projects from 49 enterprises require a total investment of 4.1 trillion MNT. In addition, 376 enterprises reported to MRPAM that they have not been able to conduct operations in 484 licensed mining areas due to a lack of investment. Here is a summary of the projects that require 4.1 trillion MNT in investment. Of the 54 projects, 10 are focused on exploration to identify or increase reserves, 40 are aimed at exploitation to bring deposits into economic circulation, and 4 are aimed to build beneficiation and processing plants to produce valueadded products. These projects cover a total of 16 types of mineral resources. Some of them require particularly large investments. For example, the Ovoot coal project needs 2.4 trillion MNT, and the Bayanmunkh Tolgoi iron ore project requires 892 billion MNT. Together, these two projects account for 80 percent of the total required investment. Of the 40 exploitation projects, 34 have projected their sales revenue. Their total revenue amounts to 78 trillion MNT. Sixteen of these projects are goldrelated, with a combined estimated sales revenue of 1.4 trillion MNT.

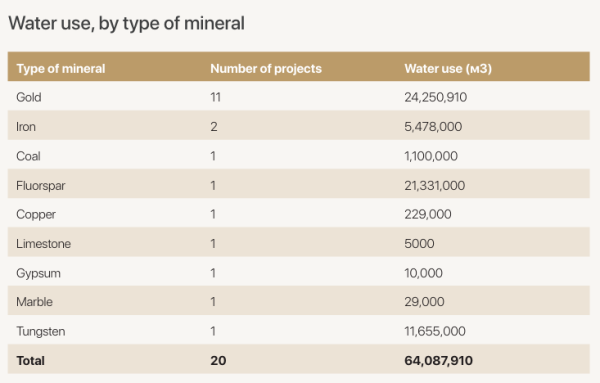

Among all projects, the Ovoot project leads by a wide margin, with projected sales revenue of 64.8 trillion MNT. In addition, several other projects stand out, including the Khalzan Buregtei and Ar Khuren rare earth projects, the Tsagaansuvarga copper molybdenum project, the Tsagaan Teeg marble project, and the Ongon Khairkhan1 tungsten project. The combined revenue of these projects is expected to reach 9.2 trillion MNT. The energy consumption of the projects is estimated to be equivalent to that of three provincial centers. For example, one rare earth project requires 137.9 million kWh, 11 gold projects 28.7 million kWh, two iron ore projects 17.2 million kWh, two copper projects 3.3 million kWh, three fluorspar projects 1.7 million kWh, one marble project 1.2 million kWh, one tungsten project 426,000 kWh, one graphite project 261,000 kWh, three coal projects 206,000 kWh, and two limestone projects 25,400 kWh. Altogether, these projects would consume more than 190 million kWh almost double the electricity usage of the AltaiUliastai integrated grid, the country’s fourth largest network. However, according to information submitted to MRPAM, some projects plan to meet their energy demand through imports. For instance, the Tsagaansuvarga project expects to source 3.2 million kWh of electricity from imports. The lifespan of the deposits varies. The average lifespan of hard rock gold deposits is 5.06 years, while placer gold deposits average 7.4 years, with overall ranges between 1 and 26 years. For example, the Dorgonot and Ulaan Ukhaa projects in Dashinchilen soum, Bulgan province, have a lifespan of 26 years and require an investment of 5 billion MNT. In addition, the Ikhetiin Am project in Zaamar soum, Tuv province, requires an investment of 10 billion MNT, has a lifespan of 22 years, and is expected to yield 75 kilograms of product. Fluorspar projects have lifespans of 5–10 years, coal projects 5–37 years, and the two copper projects 10–13 years. Water use is one of the key concerns in the mining sector. According to the available data, one deposit stands out with particularly high consumption.

Among all projects, the Ovoot project leads by a wide margin, with projected sales revenue of 64.8 trillion MNT. In addition, several other projects stand out, including the Khalzan Buregtei and Ar Khuren rare earth projects, the Tsagaansuvarga copper molybdenum project, the Tsagaan Teeg marble project, and the Ongon Khairkhan1 tungsten project. The combined revenue of these projects is expected to reach 9.2 trillion MNT. The energy consumption of the projects is estimated to be equivalent to that of three provincial centers. For example, one rare earth project requires 137.9 million kWh, 11 gold projects 28.7 million kWh, two iron ore projects 17.2 million kWh, two copper projects 3.3 million kWh, three fluorspar projects 1.7 million kWh, one marble project 1.2 million kWh, one tungsten project 426,000 kWh, one graphite project 261,000 kWh, three coal projects 206,000 kWh, and two limestone projects 25,400 kWh. Altogether, these projects would consume more than 190 million kWh almost double the electricity usage of the AltaiUliastai integrated grid, the country’s fourth largest network. However, according to information submitted to MRPAM, some projects plan to meet their energy demand through imports. For instance, the Tsagaansuvarga project expects to source 3.2 million kWh of electricity from imports. The lifespan of the deposits varies. The average lifespan of hard rock gold deposits is 5.06 years, while placer gold deposits average 7.4 years, with overall ranges between 1 and 26 years. For example, the Dorgonot and Ulaan Ukhaa projects in Dashinchilen soum, Bulgan province, have a lifespan of 26 years and require an investment of 5 billion MNT. In addition, the Ikhetiin Am project in Zaamar soum, Tuv province, requires an investment of 10 billion MNT, has a lifespan of 22 years, and is expected to yield 75 kilograms of product. Fluorspar projects have lifespans of 5–10 years, coal projects 5–37 years, and the two copper projects 10–13 years. Water use is one of the key concerns in the mining sector. According to the available data, one deposit stands out with particularly high consumption.

This is the Tsagaan Chuluut Khudag placer gold project, located in Bayandun soum, Dornod province. The project aims to extract 73.2 kg of gold, with an annual water consumption of 20 million cubic meters. The water source is an artificial lake. By comparison, the Bichigt Khad placer gold project in Khongor soum, DarkhanUul province which has five times the production capacity requires only 200,000 cubic meters of surface water annually. Among gold projects, total water use for 11 projects amounts to 24.2 million cubic meters. Other large water users include the Tsagaan Elgen fluorspar project (21.3 million cubic meters) and the Ongon Khairkhan1 tungsten project (11.6 million cubic meters).

IN SEARCH OF INVESTMENT: WHAT DO THE PROJECTS SAY?

We contacted some of these projects to get clarification on issues related to investment.

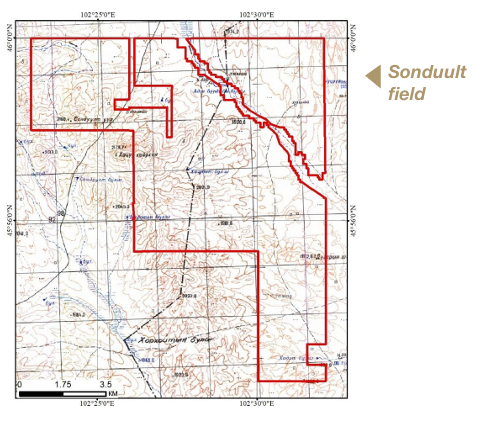

J. Sodnombaljir, Director of Universal Logging LLC, holder of the Sondoult iron and manganese exploration license:

“OUR MANGANESE DEPOSIT HOLDS AN ESTIMATED 6 MILLION TONS OF UNCONFIRMED RESERVES, MAKING IT ONE OF THE LARGEST IN MONGOLIA”

“In 2023, through the tender announced by MRPAM, we acquired the Sonduult exploration license. Our site covers 9,100 hectares across Khairkhandulaan and Taragt soums of Uvurkhangai province. Back in 2008–2009, during a 1:50,000 scale mapping project by Geo San, several iron manganese and copper occurrences were identified within this area. The primary minerals in our site are iron and manganese, with additional copper occurrences. Since obtaining the license, we have conducted geological mapping, spot sampling, and preliminary prospecting work. Because exploration has not yet been carried out intensively, we haven’t faced any significant opposition from local communities or authorities so far. Both soums where our site is located have poor infrastructure. Since iron will need to be beneficiated by both dry and wet methods, electricity shortages are likely to pose challenges. Geologically, the site has a relatively simple composite structure, with 2–3 occurrences and mineralized points, making it a promising target. Because of the high manganese reserves, our site has attracted interest from investors. Manganese is, in fact, one of the critical minerals. However, awareness about it seems somewhat limited. The reason may be that some investors categorize it simply as an iron project, while on the other hand, manganese is not a major export product for Mongolia, so it has relatively low visibility. Still, our site’s estimated unconfirmed manganese reserves of 6 million tons place it among the largest in Mongolia. At present, 4–5 smaller manganese deposits have been identified in the country.”

J. Dashnyam, CEO of “Khukhdel-Invest” LLC, license holder of the Khar serven hard-rock and placer gold deposits:

“GOLD-3” CAMPAIGN HAS YET TO SUPPORT DEPOSITS LIKE OURS”

Our company has been conducting exploration at the Khar serven site since 1997 and converted the license into a mining license in 2016. The deposit is located 35 kilometers from Matad soum, Dornod province, with a hardrock gold reserve of 1,992 kilograms. The average ore grade is 0.7 g/t, and leaching tests indicate that heap leach technology has a 97 percent recovery rate. We have already drilled five boreholes on site and confirmed that the deposit is viable for mining. As for the placer deposit, it contained only a small reserve, which we mined over the past five years and is now nearly depleted. During the placer mining phase, we faced no local opposition. This is partly because our site is far from settlements, livestock, wildlife, and rivers, and partly because we maintain strong cooperation with local authorities under a tripartite agreement. Each year, we contribute MNT 50 million to the Local Development Fund under this agreement, supporting priority community projects and maintaining good relations with the province. Since 2022, we have been seeking investors for the hardrock deposit. However, under the “Gold3” campaign, deposits of our size have yet to receive support. The government seems to be focusing mainly on three large deposits though one of those, from a technological standpoint, is not feasible for mining. If Mongolia truly intends to expand gold exports to strengthen the economy, then investment should also target midsized deposits like ours. Such deposits have the potential to expand reserves during mining. In our project’s case, additional resources are expected to be identified as mining progresses. During the previous “Gold1” and “Gold2” programs, we submitted our required investment figures to the Bank of Mongolia. The Ministry then issued letters stating that these gold companies were eligible for loans. However, when these requests reached commercial banks, the process stalled twice once at the Development Bank. This is why we are now seeking investors from abroad. Previously, we had interest from Australia, Germany, and Europe, and even participated in programs, but due to the government’s unstable policies, we lost the opportunity to secure investment. Currently, no investors are coming to Mongolia except from China. In China, gold is mined by stateowned companies, while private firms invest overseas. Most of their experience comes from mining in African countries, where environmentally harmful practices and the use of illegal chemicals are common methods we deliberately avoid. At the same time, large stateowned enterprises generally ignore midsized deposits like ours. These are the types of challenges that currently hinder investment in Mongolia’s gold sector.

N.Gan-Orgil, Geologist at “Kherlen-Impex” LLC, license holder of the South Altat fluorspar deposit:

“OUR PROJECT WILL CONSUME 1.2 MILLION KWH OF ELECTRICITY ANNUALLY”

Our site is located in Airag soum, Dornogovi province. In February 2008, by decision of the Director of the Mineral Resources and Petroleum Authority (MRPAM), our company was granted a 31.64hectare mining license. In July 2010, we registered 107.1 thousand tons of fluorspar ore of B+C category in the State Reserve. The deposit will be mined using both openpit and underground methods. The mine is designed to produce 30,000 tons of fluorspar ore annually. To date, considerable investment has been made into the project, but we currently require an additional 2 billion MNT. As for electricity, there will be no supply issues since power will be provided from the Central Energy System. Our project is expected to consume 1.2 million kWh of electricity annually.. From a technological perspective, our processing calculations demonstrate strong economic efficiency. The final product will be a fluorspar concentrate with a grade of 98%, considered highquality. Our output will be supplied to “Khukh Jonsh” LLC, Dunfanglongma LLC, and Eclisia LLC. In terms of water usage, we have adopted an environmentally friendly solution: our operations will rely on treated wastewater socalled “grey water” from a nearby plant.

Mining Insight Magazine, September 2025, №09 (046)