MISHEEL.E

Research organizations consistently predict a lack of robust global economic growth in 2024. A prevailing assumption suggests a potential decline in China’s economy, a pivotal market for Mongolia’s mining exports, compared to the preceding year. Mongolia has incorporated the export of 60 million tonnes of coal in its 2024 budget. The year 2023 witnessed a historic high of approximately 70 million tonnes of coal exports, setting the stage for this projection. However, the feasibility of achieving this target and the prevailing conditions warrant examination. While China aims for a 5.2 percent economic growth in 2023, prominent research centers anticipate a slight deceleration in 2024. Morgan Stanley projects a growth rate of 4.2 percent, while JPMorgan offers the highest estimate at 4.9 percent, with an average of 4.6 percent. The anticipated downturn in China’s economy from the previous year is attributed to the country’s historically high debt of USD 12.58 trillion, equivalent to 287.8 percent of the GDP. Additionally, the uncertainty surrounding investments has led to the withdrawal of foreign direct investment, including funding for factory construction in 2023. (See table: China’s economic growth forecast by major research organizations) The economic growth of major importers from China is anticipated to exhibit variations. The most substantial ASEAN countries experienced a growth rate of 4.2 percent last year, projected to elevate to 4.6 percent in 2024. Conversely, the European Central Bank lowered its economic growth forecast for the European Union, the subsequent major exporter, to a range of 0.9-0.6 percent in January. South Korea’s economic growth remains optimistic at 1.4- 2.1 percent, while Japan’s is expected to decline to 2.4 percent. The United Nations Economic Outlook predicts a slowdown in the United States to 1.4 percent, although the country anticipates growth towards the year-end.

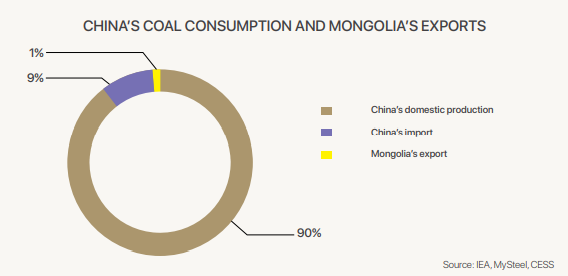

This trend highlights a scenario where, in 2024, developing countries engaging in trade with China will witness high economic growth, while developed countries will experience a more subdued pace. Nevertheless, demand from developed and large economies is expected to persist. (See graph: China’s domestic production and import volume, Mongolia’s export volume) China’s coal consumption surged by 5 percent last year, driven by electricity demand and energy security considerations. Consequently, thermal coal imports reached a record 370 million tonnes. As part of its commitment to reducing carbon emissions, China aims to increase renewable energy capacity by 2,060 GW by 2028. The levels of coal imports observed last year are anticipated to continue, given the ongoing closures of domestic coal mines due to greenhouse gas emissions. The International Energy Agency (IEA) also forecasts a decline in sea transportation of thermal coal due to weather-related issues in exporting countries like Indonesia and Australia, leading to an expected rise in land transport imports. China Metallurgical Industry Planning and Research Institute (MPI) forecasts a 4 percent decline in the country’s steel production in 2024. The construction sector is anticipated to experience a more pronounced decrease, while the infrastructure sector is expected to see an increase. Particularly noteworthy is the growing demand for steel in the energy sector. Despite this, the demand for coking coal is expected to remain high, considering China’s position as the world’s largest steel producer. Given these circumstances, it is unlikely that the import of coking coal in 2024 will see a significant decrease compared to 2023. China’s coking coal imports surpassed 100 million tonnes last year, setting a new record, with over half originating from Mongolia.

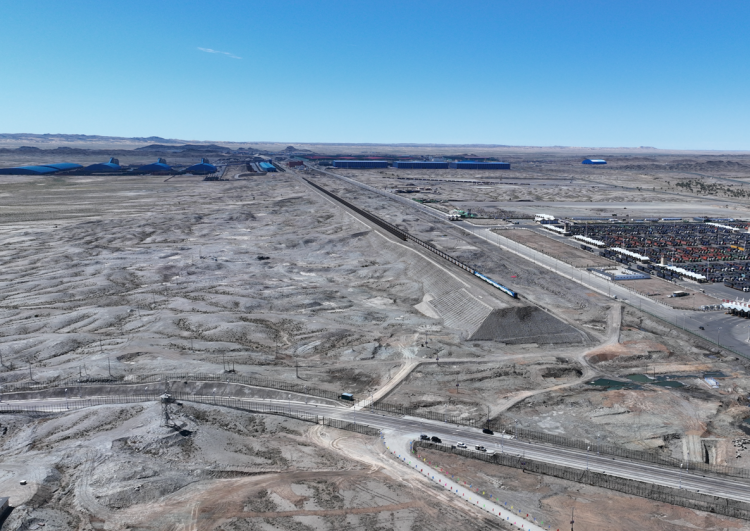

Some Chinese research organizations posit a potential 10 percent increase in the amount of coal imported from Mongolia in 2024. Mongolia’s target to export 60 million tonnes of coal in 2024 appears feasible in terms of transportation and logistics, supported by the evidence of exporting 70 million tonnes of coal last year. Plans for 2024 include enhancing the operation of coal transportation ports in Mongolia. Gashuunsukhait, the primary coal export port, facilitated the passage of 36.5 million tonnes of coal last year, constituting 52 percent of total exports. The goal for 2024 is to produce a minimum of 40 million tonnes of coal, representing 67 percent of the total budgeted amount. A pivotal event in 2024 concerning coal exports is the implementation of the coal tax. On December 28 of the previous year, the State Council of China declared its decision to reinstate the coal import tax. Apart from ASEAN and Australia, countries such as Mongolia, Russia, the USA, Canada, and South Africa are poised to initiate tax payments. Coking coal exporting companies’ sources indicate that Mongolia has been subject to a 3-6 percent coal tax since the beginning of the year. Researchers and experts assert that, even with the reintroduction of the tax, it is unlikely to significantly impact Mongolia’s coal transactions. While the future remains uncertain, the current situation is affirmed. ETT, for instance, has exported 2.3 million tonnes of coal since the beginning of the year, marking a 56 percent increase from the same period last year.

Another noteworthy indicator related to coal exports is stock trading on the Mongolian Stock Exchange, with 20 coal trades announced in January (until January 26, 2024), all but one of which were successful. (See table: Volume of coal traded on the exchange) Measures adopted in response to climate change and energy security suggest that China’s coal imports are unlikely to see a significant decline in 2024. Regarding Mongolia, the coal exported last year exceeded the planned amount for 2024, indicating that there are no anticipated transportation and logistics issues if appropriately managed. This affirmation comes from experts not only in China but also from various other countries, reinforcing the belief that Mongolia’s coal exports can reach the intended level barring unforeseen circumstances.

Mining Insight Magazine, January 2024