- Mongolia commences exchange trading of coal -

Our country has recently started selling some of its export products on the stock exchange, with coal being traded for the first time on the Mongolian Stock Exchange (MSE). The transition to this system will take place over half a year and the Law on Mineral Commodity Exchange will come into effect in July, officially making the switch to a Mineral Commodity Exchange system.

The exchange trading of minerals will ensure transparency in coal sales and contracts and will phase out the export of raw coal. This will help to resolve the controversy surrounding royalties.

Mongolia is taking the first step towards a system that offers these benefits. “Energy Resources” LLC was the first private entity to participate in the trial trade, selling its coal on the MSE. This resulted in higher price bids and faster completion of exports. The first trading of state-owned “Erdenes Tavantolgoi” was announced on the MSE on February 9-10. The two-day trading balance is USD 1,714,560, O with a total of 96,000 tonnes of hard coking coal to be sold at a minimum price of USD 178.6 per tonne under the border terms. Before the implementation of the Law on Mineral Commodity Exchange, state-owned and private companies will trade their coal on the exchange under the “Regulation on Online Trading of Export Coal.” Export activities will be regulated through the container transport terminal at Gashuunsukhait port. Under the temporary regulation, the company will auction no more than 160,000 tonnes of coal in one transaction, with transportation being organized through a special procedure.

The issue of regulating Mongolia’s mineral exports through a single-channel policy has been under discussion for a decade. The legal framework has been established with the adoption of the Mineral Commodity Exchange Law on December 23, 2022. The success of the Mineral Commodity Exchange will largely depend on the trial period of 6 months, particularly the organization of online coal trading and transportation logistics. Coal trading is being tested on the MSE, but it is unclear whether it will continue on this platform or whether a separate entity will be established. The Minister of Mining and Heavy Industry J.Ganbaatar mentioned the possibility of creating a subsidiary at the MSE, while D.Galsandorj, President of the Mongolian Exporters’ Association, suggested that it would be more appropriate for the exchange to operate independently as it will trade various types of commodities in the future.

The government will need to address this issue soon. Exchange trading is not a new or complex system, and is distinctive in trading quality goods with a set of standards. According to international standards, a complex infrastructure such as road transport, accredited laboratories, and warehouses are essential for the standards of the mineral commodity exchange. This ensures that the products are of guaranteed quality, the warehouses have sufficient resources, and the transportation is based on comprehensive services that can be reliably delivered on time. This is why the Mineral Commodity Exchange Law’s Article 5.3.2 states that the exchange shall have “warehouses, terminals, transportation logistics centers, and testing laboratories that meet the requirements for storing products traded on the exchange.” These infrastructures have been registered by the stock exchange and authorized for operation. Last year, coal, the most in-demand raw material in the world, reached a historic record price of USD 457. However, our country missed this opportunity due to transport and logistics limitations.

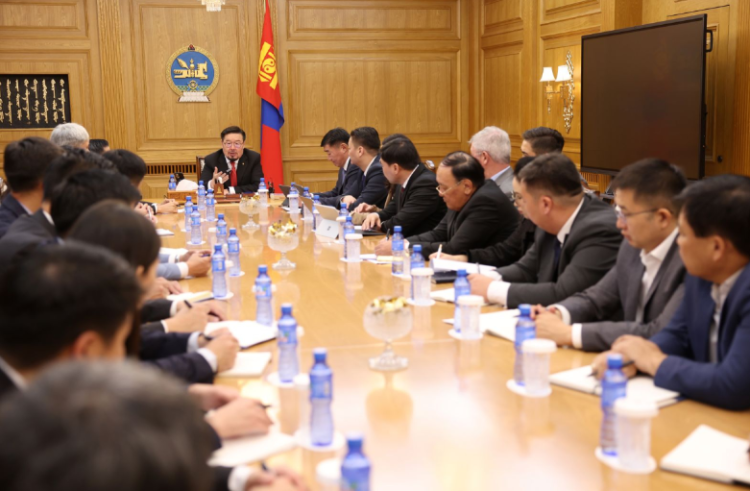

Minister of Economy and Development, Ch.Khurelbaatar stated at a meeting of the Mongolian People’s Party group that 130 Chinese companies imported coal from Mongolia during the first nine months of the previous year. Along with the Chinese market, there was expressed interest in purchasing Mongolian coal from other countries such as India, Germany, and Japan.

The Executive Director of “Energy Resources,” G.Batsengel, said that to increase participation in exchange trading, economic incentives are necessary to attract interest. A shortage of exchange-traded products is one such driver. If more coal were sold at the actual market price on the exchange, the current transportation conditions and output capacity would not be sufficient. However, projects such as connecting the Tavantolgoi-Gashuunsukhait and ZuunbayanKhangi railways, starting the Shiveekhuren-Sekhee and Bichigt-Zuunkhatavch cross-border railways, putting the Shiveekhuren port container terminal into operation, and building a terminal at the Khangi port are expected to improve these limitations.

According to the law, the government shall approve the types and categories of products to be traded on the stock exchange, based on the recommendation of the central state organization in charge of geology and mining. In the temporary regulation in effect for six months, coal that meets the type, classification, and quality parameters specified in the standard “Classification of Coal and Coal Products MNS 6457:2022” will be traded online. The Ministry of Mining and Heavy Industry aims to trade coal, copper concentrate, and eventually iron ore through the mineral commodity exchange. However, categorizing and coding exchange-traded products remains a complex issue, as there are many types of coal and each company’s product is different. For instance, “Energy Resources” LLC produces three standard products: hard coking coal, semi-soft coking coal, and thermal coal (6000 Kcal, non-coking), while “Erdenes Tavantolgoi” LLC exports raw coal. Companies operating in the Nariinsukhait deposit also export different types of coal. The challenge is to compare prices for the same product. Regarding copper, Oyutolgoi copper concentrate contains gold, while Erdenet Mining Corporation produces copper concentrate with molybdenum. All six types of metals traded on the London Metal Exchange must have pure elements and strict A-grade standards. Fine copper with a .999 composition is particularly traded and accepted by buyers.

When it comes to iron ore, some of Mongolia’s exporting companies primarily produce concentrated iron ore of varying grades and contents, making the concentration and processing industries crucial for the Mineral Commodity Exchange’s operation. However, the quality of the product will be determined by the consumer and buyer, not by Mongolia. Experts also warn of potential issues with supply and consistency. The quality and standards of exchange-traded products will be established by accredited laboratories. To ensure this, the relevant government agencies are in the process of approving accreditation rules and regulations. Former Minister of Mining and Heavy Industry, G. Yondon, stated that there are already three laboratories certified by the London Metal Commodity Exchange in Mongolia and that geological laboratories are recognized by 73 countries, so there is no need to establish a new laboratory at the Mineral Commodity Exchange. The Customs Laboratory will be responsible for determining the quality of coal for the current online trading. These arrangements are expected to be made within the next six months. If these infrastructure requirements such as road transport, port terminals, and laboratories are not organized, industry experts warn that there is a risk of disruption to stock exchange trading.

Mining Insight Magazine, January 2023