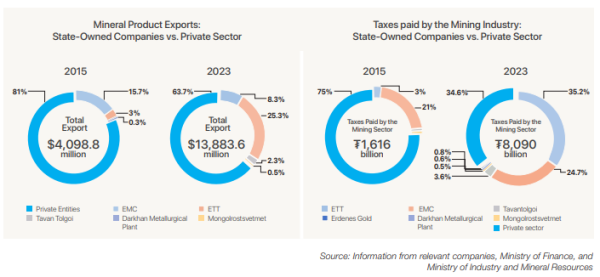

The influence of state-owned companies in Mongolia’s mining industry is expanding. The accompanying chart highlights the share of state-owned companies in mining exports and the tax revenues these companies contribute to the mining sector’s budget. The substantial increase in exports and taxes paid by these entities has led to the growing dominance of state-owned companies and an increased governmental interest in acquiring stakes in major privately invested companies within the sector.

In 2005, as Mongolia began exporting coking coal, only two major state-owned mining companies, Erdenet Mining Corporation (EMC) and Mongolrostsvetmet, were in operation. Five state-owned and locally operated companies also supplied thermal coal to power plants. The launch of coal exports opened doors for private sector growth in mining. By 2010, nationally owned private companies like Energy Resources and MAK exported up to 5 million tonnes of coal annually, strengthening their financial positions. In 2010, with the establishment of the Oyu Tolgoi landfill and the commencement of operations at Erdenes Tavan Tolgoi (ETT), both state-owned companies and foreign investors began operating Mongolia’s two largest deposits. However, by 2015, public and private mining companies faced severe financial challenges, with some nearing insolvency. This crisis underscored for the government the risks associated with the mining sector, particularly with ETT’s debt and Oyu Tolgoi’s shareholder pressures. Consequently, the government declared it would no longer pursue ownership stakes in mining companies, rejecting a stake in the Gatsuurt deposit. Since then, the mining sector has rebounded, with export tax revenue increasing significantly. The government has arguably benefited most from this recovery, rekindling interest in expanding state involvement in mining.

Post-Covid, Mongolia’s mining sector saw rapid growth, largely driven by government actions. Between 2018 and 2020, the state emerged as a leading player in mining by taking over select companies and initiating new mines. This growth is underscored by statistical data, emphasising only state-owned and locally-owned companies with export-focused operations. Last year, the mining sector contributed MNT 8 trillion in tax revenue, of which MNT 5.3 trillion came from state-owned companies. This indicates that nearly two-thirds of mining tax revenue is paid by state-owned entities. Notably, around 90 per cent of this amount was contributed by just two companies: ETT and EMC, currently the largest mining companies in Mongolia. In comparison, in 2015, state-owned companies accounted for only 25% of the MNT 1.6 trillion in mining tax revenue. Since then, taxes paid by EMC have increased sixfold, and those by ETT have surged nearly sixtyfold. Export income has similarly risen: in 2015, total mineral exports were around USD 4.1 billion, with ETT and EMC accounting for USD 760 million, or about 19%. Last year, these two companies made up 34% of mineral exports, valued at approximately USD 13.9 billion. The growth of the two state-owned companies referred to as the “Two Es,” is primarily due to three factors: rising prices of copper and coal, ETT’s export of high-quality coking coal, and the high royalty they pay. EMC remains Mongolia’s only significant royaltypaying company. This underscores a clear distinction between state-owned and private-sector companies, as private companies struggle to operate under such high tax conditions. For example, the royalty increase on copper applies only to EMC, making it challenging for private firms to compete in this tax environment. In addition to the “Two Es,” another notable change since 2015 has been the transfer of two large companies, Darkhan Metallurgical Plant and Erdenes Gold Resources, to state ownership. Together, these companies exported products worth about USD 140 million last year and paid over MNT 150 billion in taxes. Although their contributions are smaller than those of the “Two Es,” they still represent some of the highest income and tax revenue among Mongolian mining companies, aside from a few major coal exporters. According to N. Uchral, head of the Government of Mongolia, companies operating in strategic deposits are paying twice as much tax as the private sector. This reflects the state’s perspective, while the private sector sees an increase in state ownership in mining as a potential hindrance to further private-sector growth.

Post-Covid, Mongolia’s mining sector saw rapid growth, largely driven by government actions. Between 2018 and 2020, the state emerged as a leading player in mining by taking over select companies and initiating new mines. This growth is underscored by statistical data, emphasising only state-owned and locally-owned companies with export-focused operations. Last year, the mining sector contributed MNT 8 trillion in tax revenue, of which MNT 5.3 trillion came from state-owned companies. This indicates that nearly two-thirds of mining tax revenue is paid by state-owned entities. Notably, around 90 per cent of this amount was contributed by just two companies: ETT and EMC, currently the largest mining companies in Mongolia. In comparison, in 2015, state-owned companies accounted for only 25% of the MNT 1.6 trillion in mining tax revenue. Since then, taxes paid by EMC have increased sixfold, and those by ETT have surged nearly sixtyfold. Export income has similarly risen: in 2015, total mineral exports were around USD 4.1 billion, with ETT and EMC accounting for USD 760 million, or about 19%. Last year, these two companies made up 34% of mineral exports, valued at approximately USD 13.9 billion. The growth of the two state-owned companies referred to as the “Two Es,” is primarily due to three factors: rising prices of copper and coal, ETT’s export of high-quality coking coal, and the high royalty they pay. EMC remains Mongolia’s only significant royaltypaying company. This underscores a clear distinction between state-owned and private-sector companies, as private companies struggle to operate under such high tax conditions. For example, the royalty increase on copper applies only to EMC, making it challenging for private firms to compete in this tax environment. In addition to the “Two Es,” another notable change since 2015 has been the transfer of two large companies, Darkhan Metallurgical Plant and Erdenes Gold Resources, to state ownership. Together, these companies exported products worth about USD 140 million last year and paid over MNT 150 billion in taxes. Although their contributions are smaller than those of the “Two Es,” they still represent some of the highest income and tax revenue among Mongolian mining companies, aside from a few major coal exporters. According to N. Uchral, head of the Government of Mongolia, companies operating in strategic deposits are paying twice as much tax as the private sector. This reflects the state’s perspective, while the private sector sees an increase in state ownership in mining as a potential hindrance to further private-sector growth.

Mining Insight Magazine, October 2024