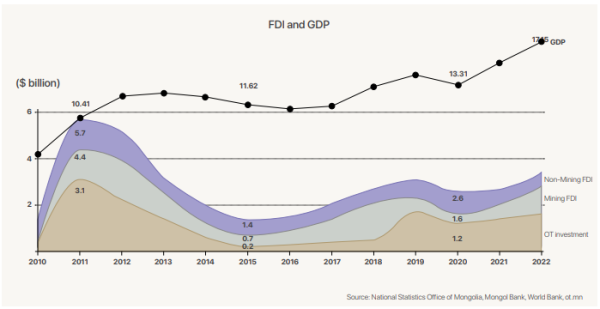

A new economic landscape is emerging in Mongolia, where Foreign Direct Investment (FDI) plays a crucial role in the growth of developing nations, particularly those reliant on mining. Historically, Mongolia has witnessed a correlation between FDI and GDP from 2013 to 2019, notably influenced by the export of coal. However, recent years have seen a shift in this dynamic, with the FDI remaining relatively stable while GDP has surged by USD 7 billion over the past four years, indicating a changing economic scenario. Looking ahead, experts emphasize the necessity of fostering increased foreign investment, recognizing that present investments will serve as the bedrock for sustained long-term GDP growth. The mining and oil sector, with its abundant resources, stands poised to attract significant FDI rapidly, contributing substantially to this foundational growth.

FDI expected to fall by USD 800 million

From 1990 to the third quarter of 2023, Mongolia attracted a total of USD 42.4 billion in foreign direct investment (FDI). A significant portion of this, specifically 73 percent, equivalent to USD 31 billion, is attributed solely to the mining and extraction sector. The implementation of the Oyu Tolgoi project has notably contributed to the increased inflow of FDI, with nearly half of the FDI from 2010-2022, amounting to USD 36.6 billion, originating from this project. According to a report by the Central Bank of Mongolia, FDI inflows are projected to decrease by USD 800 million in 2025 compared to 2024. This decline is notably linked to the substantial commencement of the Oyu Tolgoi underground production. The absence of concrete mega projects, apart from the 236 km railway in the Khuut-Bichigt route, is highlighted as a contributing factor. Economists caution that failure to address the reduction in FDI may pose challenges for the mining sector, which traditionally constitutes approximately 30% of the budget, potentially impacting the overall economy. It’s worth noting that the peak of FDI inflow into Mongolia was in 2011, representing 54 percent of GDP. Despite subsequent GDP growth of over 60 percent by 2022, FDI inflows have nearly halved since then.

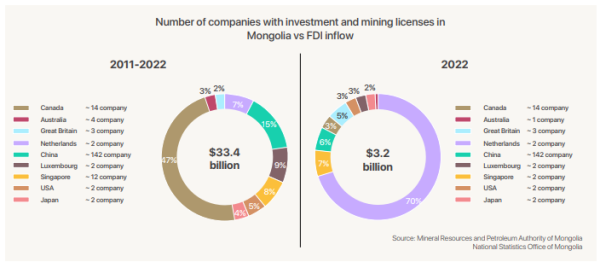

Mineral license holders and the FDI amount

Decision-makers are divided on the issue of the temporary use of land to attract foreign investment. The revised Investment Law, in its non-tax support section, specifies that land can be utilized under a contract for up to 60 years, with a one-time extension of up to 40 years under the initial conditions. This provision, which has become a source of controversy and even political debate in the lead-up to elections, is unlikely to significantly impact the attraction of foreign investment in the mining sector, whether positively or negatively. According to the mining industry, the presence or absence of this provision is not crucial, as the duration of land use for mining is not a critical factor; it is directly linked to the size and age of mining resources. For instance, the Dutch investor, who was the largest contributor to our mining sector in the past, had two companies with 100 percent investment in our country holding 10 licenses for 6,620 hectares. Despite this, it constituted 45 percent of the total investment. In contrast, China, with the largest number of owners, permits, and fields, accounted for only 15 percent.

A law that can facilitate industry growth

Mongolia’s mining industry production surged from USD 2.4 billion to USD 4 billion between 2010 and 2022. If the average growth rate of the last decade, which stands at 10 percent, continues, it is projected to reach USD 4.9 billion by 2025, occupying approximately 1/5 of the GDP. While the industry’s position is expected to be sustained as the GDP grows, attracting FDI remains crucial for a miningcentric country like Mongolia. To achieve this, building trust in Mongolia’s laws is paramount, and the revised Investment Law plays a pivotal role in this regard. Let’s delve into the provisions of the revised law that impact the mining industry. Industry experts highlight the lack of clarity regarding responsibility for investor complaints and disputes, coupled with a slow resolution process. The revised version addresses this concern through two dedicated chapters. Notably, the option to escalate a complaint from a state administrative organization to a Cabinet meeting is retained. If a resolution cannot be reached within three months, the right to appeal to international arbitration has been introduced. The rights and functions of state administrative organizations supporting investment have been delineated comprehensively. The government has explicitly outlined powers, ranging from policy decisions to oversight by local self-governing organizations. These local bodies will monitor government decisions’ implementation and aid project execution for signatories of investment agreements. The revised law aligns with international standards, reflecting inputs from diplomatic missions of various countries in Mongolia. These missions actively promote opportunities and cooperation conditions in the mining industry, sharing information on investment law, legal frameworks, domestic market conditions, and investment-seeking projects and programs. Reintroduced in 2015, the provision on the “Authority of the central administrative body in charge of investment” changed. Notably, the central administrative body responsible for investment matters will issue operating permits to foreign state-owned legal entities, granting operating licenses to companies where the government holds over 50 percent of the shares.

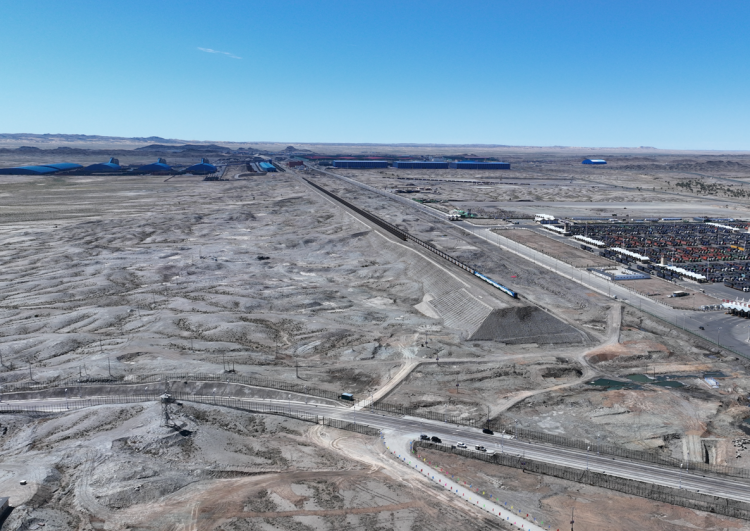

OUTPUT: A small investment, but an investment nonetheless

Several projects in the mining and oil sector have been initiated or are on the verge of implementation, with three of them poised to attract billions of dollars in annual investment. Notably, investments in oil refinery construction projects have recently reached approximately USD 1.6 billion. The initial phase of non-technological civil constructions has been completed with the arrival of USD 97 million in funding. The remaining three packages are anticipated to receive funding this spring, enabling simultaneous commencement of construction for technological buildings and thermal power plants. The “Mongolian Oil Refinery” project plans to release its first product in 2027, indicating an average annual investment of around half a billion US dollars in the oil refining industry. Another imminent investment is the “Zuuvch Ovoo” uranium project, with Erdenes Mongol LLC, the stakeholder from the Mongolian side, stating that the Investment Agreement for this highly anticipated project will be submitted to Parliament in March. Upon signing the Investment Agreement, direct funding of USD 1.6 billion is expected until 2028, with approximately USD 400 million likely to be invested this year. Rare-earth elements are in high demand in the global market. Mongolia currently has six discovered deposits, out of which the Khalzan Buregdei project is operating successfully. The estimated cost of the project’s processing plant is USD 500-600 million. The project team anticipates attracting half of the total project funding from foreign sources, emphasizing the importance of the government’s continuous support to keep the project advancing without delays for the benefit of the economy. In addition to the aforementioned projects, oil and unconventional oil exploration initiatives are poised for operation. “Petro Matad,” an oil exploration company, is prepared to commence the first production drilling in spring pending the issuance of the operating permit. Simultaneously, unconventional oil company TMK Energy LLC aims to become operational by 2024. Alongside these efforts, three coalbed methane gas companies, namely GOH LLC, Petrovis Resources LLC, and Methane Gas Resource LLC, are successfully advancing their exploration activities. Rather than focusing solely on mega projects, Mongolia’s mining and oil industry may witness the intensive implementation of smaller-scale projects. Researchers suggest that these junior projects can be beneficial, particularly when major deposits like Oyu Tolgoi are rediscovered and large-scale projects are not immediately implemented. Researchers anticipate a USD 800 million decrease in FDI in 2025. While recent years have shown a less direct correlation between GDP growth and FDI inflows, increasing short-term investments remains crucial for long-term GDP growth. Therefore, government approval and support for ready-made projects this year could result in the mining, extraction, and processing sectors alone attracting investments exceeding a billion dollars.

Mining Insight Magazine February 2024, №2 (027)