misheel@mininginsight.mn

The mining industry faced risks during the pandemic, but successfully overcame them. Mongolia, a mining country, relies heavily on this sector to support the economy and contribute significantly to the budget. However, over the past four years, the government has been lax in promoting this crucial sector. To ensure the advancement of our main economic sector over the next four years, let’s examine the goals related to the mineral resources sector included in the Government Action Program 2024-2028 (GAP) and the extent of their implementation.

ALL THREE ACTIONS ARE FULLY COMPLETED

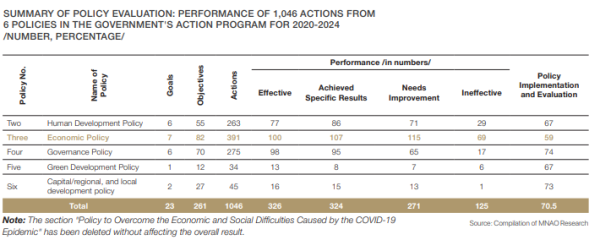

Within the framework of six policies in the GAP (2020-2024), 1,046 actions are planned. One of these policies is the Economic Policy, which accounts for 37 percent, or more than one-third, of the total government actions. However, the National Audit Office (MNAO) evaluated the Economic Policy as the worst of the six policies, with a rating of 59 percent. One of the seven goals of the economic policy focuses on developing mining and heavy industry, comprising 66 specific actions. Regrettably, out of the 100 actions effectively implemented under the seven Economic Goals, only three pertain to mining and heavy industry. These include the commissioning of Erdenet Mining Corporation (EMC) SOE's Emulsion Explosives Factory, upgrading of Baganuur JSC's open pit mining equipment, and the launch of Concentration-2 Factory under the "Utilization of Salkhit Silver Deposit" project. However, these initiatives encountered delays. Among the remaining actions, 20 have achieved specific results, 23 need improvements, and 20 have been deemed ineffective.

SOME ACTIONS REMAIN HAVE NO EVALUATIONS

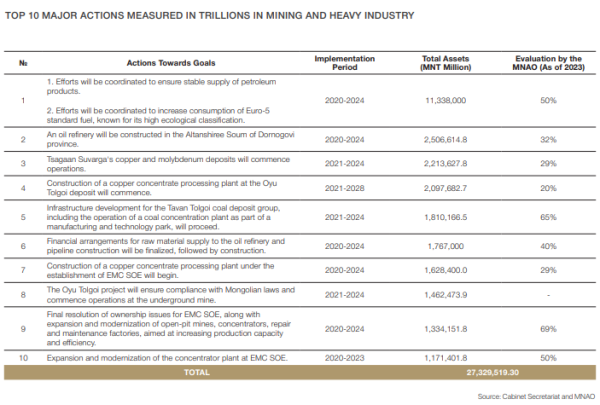

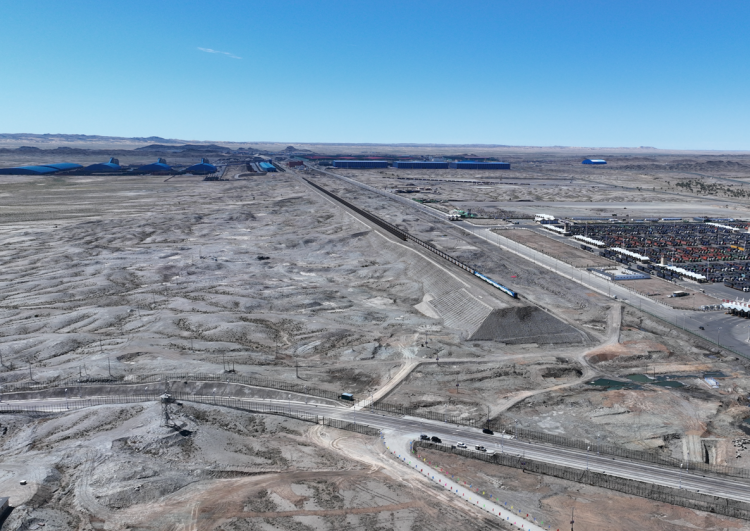

Some projects intended for implementation in the mining and heavy industry sector have not been evaluated by the MNAO. For instance, the establishment of a sampling laboratory by the Precious Metals Specimen Inspection Department to expand activities in sampling precious metals and identifying gemstones, and enhance service quality and availability to citizens, including the construction of a branch laboratory, was postponed to 2023 by the Office of the Deputy Prime Minister and the Cabinet Secretariat, citing that "the time has not yet arrived." Additionally, it appears that evaluation reports for 10 implementation efforts have not been submitted by the relevant authorities, as they were not found in the MNAO's report. One such project involves bringing the Oyu Tolgoi project, Mongolia's largest project, into compliance with Mongolian laws and commencing operations at the underground mine. The primary implementer is Oyu Tolgoi LLC, with the Ministry of Mining and Heavy Industry (MMHI) as a partner and Erdenes Oyu Tolgoi LLC as a participant. Nine actions remain without specific evaluations. These include intensifying geological and research work funded by the state budget to increase mineral resources, strengthening mining institutions, promoting responsible mining practices, making licensing transparent to the public, revoking permits issued unlawfully, and constructing an oil refinery based on domestic raw materials. Nonetheless, the average rating for the 55 evaluated actions stands at 51 percent.

ACTIONS THAT NEED IMPROVEMENTS (30-69%)

Among the 23 actions that need improvements, three tasks unrelated to the MMHI include bills for the Sovereign Wealth Fund and Development Fund, financing for the oil refinery pipeline construction project, and land acquisition along the route for special state needs. The primary implementing organizations for these tasks are the Cabinet Secretariat, Cabinet, and the Ministry of Finance. Notably, the Sovereign Wealth Fund and Development Fund have been evaluated at 30-50 percent, despite being implemented shortly after the year began. Additionally, actions that need improvements are being undertaken in collaboration with the relevant ministry, state-owned enterprises such as EMC, Baganuur JSC, Shivee-Ovoo JSC, Erdenes Tavan Tolgoi JSC, and the private sector. Evaluation of 20 tasks conducted solely or in partnership with state-owned enterprises by the Ministry yielded an average score of 56 percent, while joint efforts with Ministry-affiliated companies scored between 50- 69 percent. Furthermore, two objectives managed solely by the MMHI aimed at intensifying geological and research activities funded by the state budget, enhancing mineral resources, developing the National Geodatabase, introducing an electronic system, and expediting government service delivery, achieved the highest ratings of 40-69 percent. However, postponed measures include the goal of constructing an oil refinery, specifically the refinery in Altanshiree Soum, Dornogobi Province.

INEFFECTIVE ACTIONS (0-29%)

20 ineffective measures are currently being I would like to emphasize one point here: The evaluation provided by the MNAO to the GAP is more significant than the hearing itself. However, it did not capture public attention and quietly concluded under a name it had previously established implemented with government and private sector involvement. Among these, efforts to intensify geological and research work funded by the state budget and increase mineral resources include commencing detailed geological mapping on a 1:25,000 scale, covering 0.15 percent of the territory, and constructing an oil refinery. Additionally, two initiatives aim to establish a small-scale oil product factory in Khovd province with private sector investment to meet a specific percentage of fuel consumption in the western region. An intriguing measure involves the evaluation of Tsagaan Suvarga copper and molybdenum deposits with private sector involvement from Mongolyn Alt (MAK) LLC, achieving a 29 percent rating. However, construction progress for the concentration plant has not reached the targeted operational capacity.

POTENTIAL FOR THE MINING SECTOR TO BECOME A BENCHMARK INDUSTRY

As evident, only three measures within the economic policy framework for mining and heavy industry have achieved 100% implementation. Conversely, only two initiatives have yet to commence, indicating that work is already underway for the remaining tasks. However, the average evaluation score for the 55 assessed measures stands at 51%. This is largely influenced by the underperformance of mining and heavy industry goals, rated at 59%, which dragged down the overall economic policy rating. Given that the mining and heavy industry sectors contribute significantly to state revenue, with financing from entities like Erdenes Tavan Tolgoi JSC and Erdenes Mongol LLC, these sectors show promising performance and could potentially set benchmarks in the future. Specifically, 41 projects requiring investments totaling MNT 4.1 trillion are estimated. It is certain that future economic benefits will be substantial if industry stakeholders prioritize adequate funding for these initiatives alongside major investments.

Mining Insight Magazine, June 2024