The draft law on the Sovereign Wealth Fund, submitted by Prime Minister Oyun-Erdene. L on April 4, 2024, underwent two weeks of negotiations and was subsequently approved as law on April 19, 2024. Apart from the expedited procedure, public attention towards this significant draft law was minimal prior to its approval, despite open information provided in the assembly regarding the Prime Minister's proposal. Additionally, an announcement was made stating that members who continued to oppose the Wealth Fund Law would not be nominated for parliamentary elections. The parliamentarians themselves did not contribute noteworthy ideas, with the proposals mainly consisting of populist measures advocating for strong state intervention, reminiscent of pre-election strategies. These proposals managed to find their way into the law. Although it is reported that political parties within the parliament reached an agreement on the bill, and party leaders have signed it, doubts linger regarding the attainment of political consensus and stability, especially considering the position of the Democratic Party (DP) and statements made by the parliamentary group. The approval in the assembly saw 39 out of 40 members of Parliament in favor, with the lone dissenter being former Prime Minister Altankhuyag. N. Notably, 44.4% of the parliamentarians abstained from participation, and during the deliberation, the Parliament Speaker was absent, filming a documentary. Despite this, all government members, resembling figures of prominence, attended the session. This situation prompts consideration of a completely new approach.

Resolution No.27: Savings Fund

The Sovereign Wealth Fund comprises three specialized funds: the Future Heritage Fund, the Savings Fund, and the Development Fund, each serving distinct functions of accumulation, distribution, and investment. The "Future Heritage Fund" is aimed at securing savings from natural resources for future generations, while the "Savings Fund" is designated to distribute natural resource benefits to citizens. Meanwhile, the "Development Fund" is intended to finance significant development projects. Recognizing that these three goals, which differ fundamentally in principle, cannot be effectively pursued simultaneously by a single fund, the arrangement of three diversified funds is established. Of these, the "Future Heritage Fund" and the "Development Fund" have long been established processes in our country. However, the "Savings Fund" represents a novel concept, introducing the policy of establishing a "named savings account" for all citizens and disbursing dividends of up to 34 percent of the state property derived from strategic deposits to citizens. This initiative reflects extensive deliberations on how to extend the benefits of mining to every citizen and ensure equitable access to them, addressing longstanding criticisms regarding the inaccessibility of mining benefits to citizens. Furthermore, it aims to address one of the primary grievances of local communities and citizens opposing mining activities. Moreover, the regulation aims to curb the practice of distributing dividends from state-owned companies to citizens before elections. By stipulating that state-owned companies in the mining sector will annually distribute dividends in accordance with the law if profitable, irrespective of election cycles, this legislation aims to establish a system independent of election-related politicization. The formation of such a crucial fund and its viability as a dependable and sustainable financial source are equally significant concerns, mirroring the importance of its distribution mechanism. The viability of the Savings Fund hinges on whether it will truly materialize as a substantial fund or merely exist as a nominal entity. The reserve fund will be funded by a 34 percent dividend from the state's ownership stake in mining sector companies. Consequently, in cases of joint utilization of strategic deposits and their derivatives with private entities, the state will retain ownership of up to 50 percent without charge. Similarly, in exploration ventures financed by private funds, the state will retain ownership of up to 34 percent without charge. Notably, the transformation of a legal entity holding a strategic deposit license into an open joint-stock company is prohibited, preventing any individual or related parties from owning more than 34 percent of the total shares. Just seven days after the enactment of the Sovereign Wealth Fund law on April 24, 2024, the Cabinet decided to transfer a 34% stake in the company "Achit Ikht" to the "Erdenet Mining Corporation" StateOwned Enterprise. This swift decision suggests that the process will unfold rapidly. During a conference, Amarbayasgalan. D, the Chief Cabinet Secretariat, highlighted the collaborative efforts between private sector companies operating on strategic deposits and the government. He cited examples such as the expiration of a 10-year stability agreement at the Nariinsukhait coal deposit and the Parliament's decision in 2014 to relinquish state ownership of the Tsagaansuvarga deposit, signaling a shift towards submitting this decision to the National Development Committee (NDC). Additionally, a 15-year Sustainability Agreement was signed at the Tumurtei deposit, emphasizing a commitment to work within Mongolia's existing legal framework instead of resorting to forced confiscation of private property. He further explained that the expiration of stability agreements presents an opportunity to reassess the percentage of state ownership and allocate benefits to the wealth fund. It appears that Amarbayasgalan.D's emphasis on operating within the legal framework pertains to Parliament Resolution No. 27. In connection with the implementation of the Sovereign Wealth Fund Law, conference discussions underscored the importance of evaluating the execution of Parliamentary Resolution No. 27, devising proposals for further actions, and presenting them to the National Assembly during the regular spring session of 2024. Parliament Resolution No. 27 was ratified in 2007 and pertains to the classification of specific deposits as strategic. This decree comprises two appendices: the first appendix designates 15 deposits, including the Erdenet copper-molybdenum deposit, Tumurtein Ovoon zinc deposit, Nariiinsukhait coal deposit, and Boroo Gold deposit, which are subject to Stability Agreements, while instructing the government to ascertain the reserves of 39 other named deposits and decide on their classification as strategic deposits. The resolution also mandates the government to propose measures to the Parliament regarding state ownership of strategically significant deposits like Oyu Tolgoi, Tavan Tolgoi, Tsagaansuvarga, and Asgat, and their acquisition. This resolution is not static but dynamic, designed to expand as new deposits are discovered or resources are depleted. Presently, Mongolia acknowledges 16 strategic deposits with an additional 39under consideration. In 2015, Gatsuurt was included in the list of strategic deposits, alongside Parliament's deliberations on state ownership and acquisition methods for Oyu Tolgoi, Tavan Tolgoi, and Tsagaansuvarga deposits. However, beyond these developments, it has been 17 years since any substantive progress has been made in alignment with the resolution's directives, with no definitive decisions reached.

Who are the strategic depositors for dividend accumulation in mutual funds?

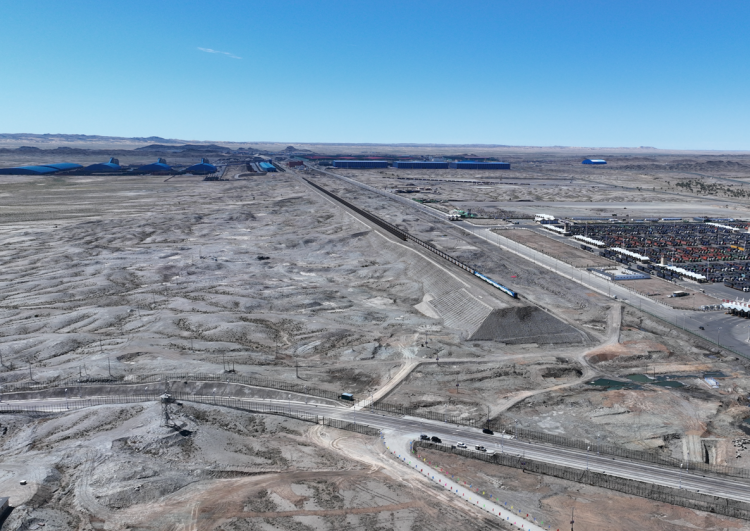

According to the provided list, seven deposits are attributed to the "Erdenes Mongol": Tavan Tolgoi, Baganuur, ShiveeOvoo, Tumurtei, Oyu Tolgoi, Erdenet, and Asgat. Notably, Erdenes Mongol exercises control over 10 out of the 16 strategic deposits. While three uranium deposits were named in the 2007 list sanctioned by Parliament, uranium is considered a strategic deposit under the Nuclear Energy Law irrespective of reserve quantity. MonAtom, wholly owned by Erdenes Mongol, manages the state's participation in the uranium sector. Mon-Atom currently holds shares in three joint ventures for uranium projects: 51 percent of MonCzech Uranium, 34 percent of Badrakh Energy (comprising Zuuvch-Ovoo, Dulaan-Uul, and Umnut uranium deposits), and 15 percent of Gurvansaikhan. Among these, Zuuvch-Ovoo underwent substantial activity in 2023, culminating in the signing of an Investment Agreement with the French Orano Group regarding the uranium deposit, although recent progress has slowed. The enactment of the Sovereign Wealth Fund law will alter the previously agreed terms of the contract with Orano. Regarding the Asgat deposit, it remains outside of economic circulation, presenting significant challenges for entry. Currently, operational entities include Erdenes Tavan Tolgoi, Baganuur, ShiveeOvoo, Erdenet, Oyu Tolgoi, and Darkhan Metallurgical Plant. Baganuur and ShiveeOvoo operate at a loss and have never distributed profits to their parent company, making profit distribution unfeasible in their case. The timing of dividend disbursement for Oyu Tolgoi remains uncertain. Among these entities, only Erdenes Tavan Tolgoi, Erdenet, and Darkhan Metallurgical Plant have the capacity to distribute dividends. The remaining six deposits are under private sector ownership. Among these, the reserves of the Boroo Gold deposit have been depleted. The Burenkhaan phosphorite deposit, Gatsuurt gold deposit, Tsagaansuvarga copper deposit, Tumurtein Ovoon zinc deposit, and Nariinsukhait coal deposit are included. However, the Burenkhaan phosphorite and Gatsuurt gold deposits face significant uncertainties and are subject to considerable political and social opposition. While construction progresses at the Tsagaansuvarga deposit, challenges related to investment are difficult to forecast due to regulations associated with the Sovereign Wealth Fund. Operations at the Narynsukhait deposit involve MAK, Usukh Zoos, and Southgobi Resources, while the Tumurtein-Ovoo zinc deposit is managed by Tsairt Mineral LLC, and the Tavan Tolgoi deposit is operated by Energy Resources and Tavan Tolgoi LLCs. Notably, Energy Resources and Southgobi Resources are publicly traded companies listed on the Hong Kong Stock Exchange, while Southgobi Resources and Tsairt Mineral attract foreign investments. Tavan Tolgoi JSC is listed on the Mongolian Stock Exchange, with 51 percent ownership by Umnugovi Province and the remaining 49 percent held by citizens and enterprises from 23 countries. MAK and Usukh Zoos are state-owned enterprises.

What will be the outcome if discovered reserves are evaluated in accordance with Resolution No. 27?

In the foreseeable future, the implementation of the Sovereign Wealth Fund Law is likely to raise significant questions regarding the determination of state ownership percentages in collaboration with foreign-invested and private sector entities mentioned earlier. Numerous uncertainties arise in this context. Firstly, the status of ongoing projects initiated under investment agreement negotiations with these private sector and foreign-invested companies remains uncertain. Additionally, the implications for listed companies and the subsequent consequences remain ambiguous. Moreover, the inclusion of the newly discovered reserves, in addition to the existing 16 strategic deposits, under the framework of Resolution No. 27 poses further challenges. Historically, discussions on aligning Mongolia's mining industry regulations with international standards often led to the rejection of the strategic deposit concept, advocating for limitations to the 16 existing deposits. However, the recent expansion of the list of strategic deposits, encompassing newly discovered reserves, has sparked apprehension within the mining industry and among domestic and foreign investors. Consequently, a perception is emerging that Mongolia will exclusively engage in state-owned mining, potentially deterring investment opportunities, stalling planned projects, and hindering business ventures. This trend may not only weaken the role of the private sector and foreign investment in the mining sector but also impede the activities of domestic companies. Limiting the scope of the issue to a select few deposits today risks creating a system counterproductive to its intended purpose and may have significant adverse repercussions for the future of mining. Without policies safeguarding substantial investments and business risks, the mining industry could gradually become monopolized by the government, discouraging foreign investment essential for industry growth. Without the opening of new deposits facilitated by foreign investment, the mining industry's development will stagnate. Consequently, the prosperity and stability of the Wealth Fund are contingent upon a thriving mining industry characterized by continuous expansion.

Mining Insight Magazine, April 2024, №4 (029)