Ph.D Candidate at the German University of Administrative Sciences Speyer

Mongolian laws include policies to encourage and support Corporate Social Responsibility (CSR) practices such as implementing CSR standards, creating jobs, introducing advanced technologies, and adopting environmentally friendly technology. However, these laws need more enforcement and clear mechanisms, limiting their effectiveness. In response, the newly formed Parliament has amended the Corporate Income Tax (CIT) Law during an extraordinary session, aiming to provide substantial support to companies practising CSR, thereby promoting and broadening these initiatives across industries.

Tax policy support

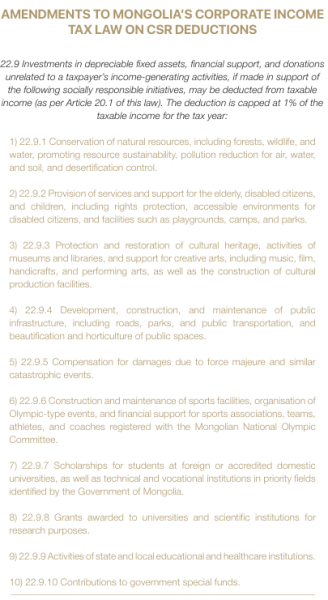

The recent amendment to CIT Law (effective August 30, 2024) introduces, for the first time, a tax policy incentivising private sector investments in social responsibility initiatives. This provision allows tax deductions for private companies engaging in social investments, donations, and financial support, provided these contributions align with law-specified conditions. However, the deductible amount is capped at 1% of the taxable income for the current year. Qualifying CSR activities eligible for this tax relief include 10 types of areas: environmental protection and restoration, resource conservation, pollution reduction, support for public spaces, assistance to elderly, people with disabilities and children, cultural heritage preservation, development of public infrastructure like roads and parks, damage recovery for force majeure events, and support for physical education, education, science, and health institutions at both the state and local levels. This regulatory amendment, set to take effect on September 19, 2024, also requires that industry specific standards for eligible investments and projects be approved and monitored by the relevant sectoral ministers. However, specific guidelines for these standards have yet to be released by the ministries involved, leaving questions about the detailed criteria for tax relief eligibility. Previously, Mongolia’s policies limited social responsibility efforts to voluntary registration and reporting. Now, with this policy change, businesses can directly deduct socially responsible investments from their taxable income, offering substantial incentives for CSR. This marks a crucial turning point, providing companies a real choice: pay taxes or actively invest in the betterment of society. This not only gives meaningful support to CSR-driven businesses but also paves the way for a more widespread culture of social responsibility. This amendment shift aligns with an international movement toward sustainable corporate practices. Today’s businesses are increasingly integrating social and environmental commitments into their core strategies-a principle embodied in Environmental, Social, and Governance (ESG) standards. ESG pushes corporate responsibility to a new level, demanding more accountability from businesses while encouraging them to tackle challenges with a holistic approach. With ESG principles becoming foundational, a robust CSR policy has evolved into more than a line item; it’s a growth engine, driving companies forward with purpose and impact.

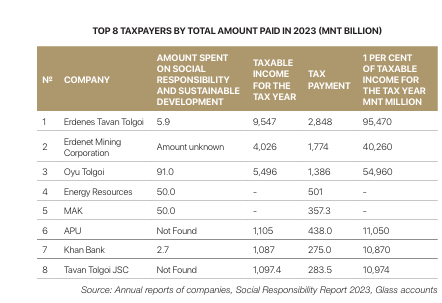

This brings up the question of how this tax policy can effectively support and incentivise companies engaging in social responsibility initiatives. The impact is highlighted by data from the top eight taxpayers of 2023, who contributed the most in taxes. Using the eight largest taxpayers in Mongolia as an example, applying a 1% deduction of taxable sales illustrates the potential tax benefits for companies that actively engage in social responsibility. For instance, Erdenes Tavan Tolgoi could potentially deduct up to MNT 95 billion, and at minimum, MNT 10 billion. Mongolian Mining Corporation (MMC), the parent company of Energy Resources LLC, reported sales of MNT 3,554 billion in 2023; applying the 1% rate could allow MMC to deduct up to MNT 35 billion from its taxable income. However, this calculation serves as a general guide based on last year’s tax rates and the maximum allowable deduction. Annual tax deductions vary depending on each company’s specific investment in socially responsible activities and the sector’s CSR investment standards. This comparison highlights the scale of tax incentives available for companies committed to social responsibility and, in particular, illustrates the deduction potential for the top taxpayers who consistently allocate resources to CSR initiatives. In Mongolia, companies in the mining sector, regardless of their operational stage, often lead in CSR efforts by contributing to national and local projects. Given that these companies tend to allocate substantial funds towards sustainable development, this tax policy is particularly beneficial for the mineral resources sector, where the Responsible Mining Codex includes social responsibility measures and is increasingly adopted by companies. While sector-specific requirements approved by relevant ministers may encourage more companies to invest in social responsibility, they could also present challenges for companies if certain CSR initiatives don’t align with the stipulated criteria, potentially limiting some critical progress.

Efforts in 2014 to Secure Government Support for CSR

This change in tax policy significantly contributes to the establishment of a system that promotes, develops, and encourages CSR in Mongolia, a topic that has been under discussion since 2010. Since the onset of the 2010s, many countries have recognised the critical importance of CSR and have developed policies aligned with their national development strategies. In 2013, Mongolia formed a working group to develop a national CSR policy. This group was tasked with creating a CSR framework alongside a draft resolution for Parliament, aimed at promoting and supporting the socially responsible initiatives undertaken by enterprises and organisations, ultimately enhancing their contribution to the country’s sustainable development. The policy outlines five key objectives to ensure effective CSR implementation:

1. Integration of social responsibility into the operations of state-owned and joint-stock companies.

2. Establishment of a transparent reporting system for CSR activities.

3. Increased involvement of scientific, educational, and research organisations in raising awareness about CSR.

4. Enhanced corporate contributions towards addressing social challenges.

5. Improved conditions for the effective implementation of CSR.

However, before this policy could be debated in Parliament, the Ministry of Economic Development was dissolved at the end of 2014, leading to the establishment of the Ministry of Industry. Despite this setback, the foundational ideas behind the policy can still be realised through the recent tax policy changes.

Social Responsibility 2.0 – ESG

This regulation concerning tax incentives for CSR investments represents a significant advancement, encouraging companies to enhance their CSR efforts and broaden their societal contributions. However, companies need to reassess their understanding of CSR. While many Mongolian businesses are now familiar with the concept and have implemented their own CSR programmes, there remains a common misconception that equates CSR solely with donations or public relations activities. In reality, CSR involves integrating social and environmental considerations into business operations at the same strategic level as other management functions. Companies that embrace CSR contribute meaningfully to the sustainable development of the country, positively influencing the economic, social, and cultural well-being of their communities. Achieving meaningful outcomes requires a comprehensive approach to social responsibility, underscoring the necessity for effective CSR strategies. Thus, companies should revise their social responsibility and sustainable development strategies to align with contemporary social trends and the principles of ESG. They should also strengthen their responsible teams and human resources, prepare detailed social responsibility reports, and actively promote these efforts to inspire and guide others. We are in an era where a company’s goals and vision increasingly align with societal values, with many dedicating a portion of their profits to societal welfare, reflecting their reputation in the process. The progressive initiative to support such companies through tax policy will likely encourage more organisations to lead society toward greater welfare.

Mining Insight Magazin, October 2024