Mongolia has global competitiveness with its mineral resources and capacity. In terms of resources, it is similar to Australia, Canada, and Zambia, in some ways, even better. At a time when demand for copper and rare metals is rising through the green transition, the world’s reserves of largest deposits are declining, adding onto Mongolia’s advantage of mineral wealth. In addition, there is an opportunity to attract foreign investment in the mining sector,” highlighted the Mongolian Mining Industry and Supply Chain – Investment Climate Benchmarking Study. The study also provided recommendations for attracting investment and improving the business environment.

The study was commissioned by the European Bank for Reconstruction and Development in cooperation with the Ministry of Mining and Heavy Industry and conducted by Adam Smith International. Using the Fraser Institute methodology of Canada, Mongolia’s investment climate was compared with Australia, Chile, and Zambia in terms of socio-economic, policy-institutional, and supply-production factors. Also compared to the 2017 survey, the study aims at showing the investment opportunities and positive and negative changes in the Mongolian mineral sector over the past 5 years. On the other hand, the study comes at a time when Mongolia is redefining its long-term development policy of the past 30 years and working to improve the legal and business environment to attract foreign investment. The workshop was attended by the EBRD Resident Representative in Mongolia Hannes Takach, Senior Manager of Adam Smith International Julia Baxter, Leader of the Research Team Ron Smith, Deputy Minister of Mining and Heavy Industry Batnairamdal.O, Chief Operating Officer of Rio Tinto Mongolia Amarjargal.Kh, Vice President of Erdene Resource Development Corporation Jon Lyons, CEO of Energy Resources Battsengel.G, CEO of Aspire Mining Achit-Erdene.D, and CEO of QMC Dagva.M. Resident Representative of the European Bank for Reconstruction and Development in Mongolia Hannes Takach emphasized “the importance of stability for Mongolia, which has abundant mineral resources, is an opportunity to develop its economy by attracting foreign investment in the mining sector”.

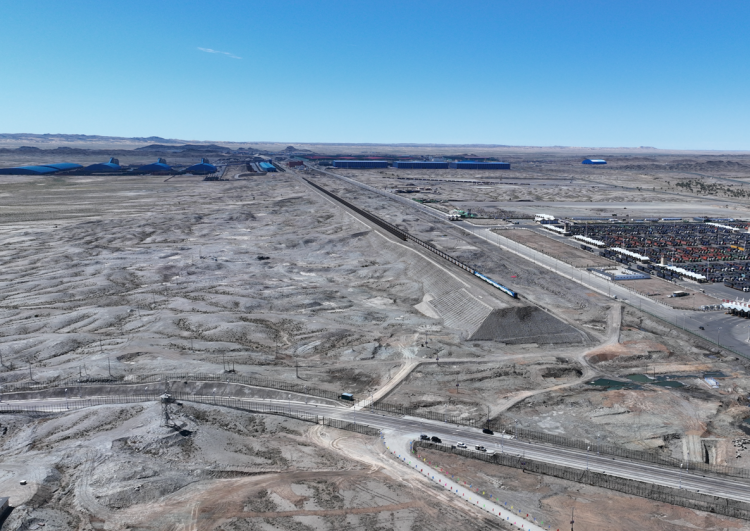

The survey included 137 governmental and non-governmental organizations, professional associations, and foreign and domestic companies from the Mongolian mining sector. According to a study on the mining sector investment, 79 percent of the participants have answered that they are ready to invest in Mongolia due to its abundant mineral resources. Positive changes over the past five years are improved infrastructure, increased labor, younger labor, and lower labor costs. Given the natural resources, including high-quality copper, gold, and coal deposits, and unexplored areas, there is a huge potential for additional discoveries. Mongolia is geographically bordered by China, a major consumer market and the center of global demand. There are no security risks or terrorist threats within the country. Cellular and internet coverage is good nationwide. The Extractive Industries Transparency Initiative (EITI) principles are well followed. It has the advantage of attracting investment due to its sparse population. In addition, changes and trends around the world are creating new opportunities for Mongolia due to the high demand for mineral products and commodity prices. For example, copper demand and prices are rising on the back of “green” transition. Large mineral deposits are being discovered in Mongolia.

The country has the opportunity to attract foreign direct investment to build value-added processing plants and develop related industries to support mining. In recent years, it has been important for the government to provide the public with positive information regarding the Oyu Tolgoi project, said Ron Smith, head of the research team. However, the study notes that the barriers to attracting investment in Mongolia have not been eliminated. Unified information on the availability of globally competitive mineral resources is closed.

Access to geological exploration information has declined. There is no effective licensing system. Resolvency of disputes remains inadequate and difficult to enforce. International dispute resolution mechanisms are avoided as much as possible. The tax environment has deteriorated. The legal system is unclear.

Law enforcement procedures conflict with one another. These are the major obstacles. Political instability, the risk to independence, wealth nationalism, populist movements, and high levels of corruption were identified as the biggest weaknesses. The country also depends heavily on a very small number of mines. Artisanal mining investment is low.

Production costs are high. It is landlocked with a lack of infrastructure. There is a shortage of energy supply. Exports are slow due to logistical congestion at border crossings. The process from exploration to mining requires too much time. Lack of investment in research and development is a disadvantage. Looking at the current situation in Mongolia as a whole, policy and institutions are the main factors limiting the inward FDI. The government management of mining revenue is poor. Taxes, including the royalties, are too volatile. This is because the regulatory environment is constantly changing along with the government reshuffle. There is a lack of leading organizations to attract foreign investment in the mining sector, as well as a lack of capacity in investment agencies. The government has repeatedly started disputes with investors. There are fewer success stories and positive information.

The study’s participants noted that policies and institutions can be self-reliant, independent, and resolved internally. The country is working to address these issues at the government level, which are identified by the research to a certain extent. The Ministry of Justice and Home Affairs is drafting a revised version of the 1993 Investment Law. The Ministry of Mining and Heavy industry is also preparing to revise the Minerals Law. Both are scheduled to be discussed at the autumn session of the Parliament this year. Over 500 policy documents have been issued over the past 30 years, all of which are intended to be reflected in the long-term development policy “Vision 2050”. To create the basic conditions for its implementation and to address the limiting factors promptly, the first 10 years of the “New Recovery Policy” has been identified to solve six key economic constraints: trade ports, energy, industrialization, urban and rural development, green development, and efficient governance. For example, with the “Port Recovery” policy, Mongolia aims to connect to seaports by road, rail, and highway without delay, and develop the air transport sector to a new level as a landlocked country. In terms of infrastructure, the railways connecting the two border crossings are expected to be commissioned this year.

It also dismissed many separate investment agencies and established the Ministry of Economy and Development. A new Foreign Investment Agency is being established under the Ministry, which will provide all services to investors through a “single window policy” and will represent the Government of Mongolia in the event of any dispute.

Mining Insight Magazine №05(006), May 2022