The GDP per capita of Mongolia has been “stuck” at the level of USD 4,000 for the last 8 years. During this period, one out of every two US dollars circulating in the economy was related to the Oyu Tolgoi project. When the construction of the project is completed and the underground mine production starts next year, there is no project ready to cover this amount of investment. Due to the new global situation and the green transition, there is a need to change the mining and investment policy for mineral exporting countries. The chairman of the board of directors of the American Chamber of Commerce in Mongolia, which led the main discussion of the investment conference, asked the following questions to the panelists.

The GDP per capita of Mongolia has been “stuck” at the level of USD 4,000 for the last 8 years. During this period, one out of every two US dollars circulating in the economy was related to the Oyu Tolgoi project. When the construction of the project is completed and the underground mine production starts next year, there is no project ready to cover this amount of investment. Due to the new global situation and the green transition, there is a need to change the mining and investment policy for mineral exporting countries. The chairman of the board of directors of the American Chamber of Commerce in Mongolia, which led the main discussion of the investment conference, asked the following questions to the panelists.• How can Mongolia attract more investment in the mineral sector?

• What should be learned from past successes and mistakes?

• Will the state manage the mineral sector or will the private sector be in charge? Can there be competition between the public and private sectors?

• Can the plans that are under discussion come to fruition?

• What exactly has changed in Mongolia? Why should investors invest in Mongolia now?

HOW CAN MONGOLIA ATTRACT MORE INVESTMENT IN THE MINERAL SECTOR?

As determined by the Ministry of Economy and Development, infrastructure, energy, and non-value-added commodity exports are the limiting factors to FDI. To eliminate these obstacles, 43 ports, 21 energy, and 16 industrial projects have been planned. With the implementation of infrastructure projects, it is expected that the capacity of road cargo transportation will increase by 21.5 million tonnes, the carrying capacity of railways will increase by 32.1 million tonnes, and the capacity of the border port cargo transfer terminal will increase by 25 million tonnes. If the power projects are activated, the current capacity will double and cover the electricity consumption of large projects. More than half of the 94 projects of the “New Recovery Policy” will be implemented within the framework of public-private partnerships.

27 laws will be revised in connection with the creation of a legal framework for attracting foreign and domestic investments and supporting public-private partnerships. These include the Minerals Exchange, National Wealth Fund, Minerals, and Heavy Industry, Laws. The revised draft of the Investment Law, which is being developed by the joint Working Group of the Ministry of Justice and Home Affairs and the Ministry of Economy and Development, is expected to be approved by the autumn session of the Parliament. The changes to the law will provide tax support in the form of investment-specific support, exemption from customs duties and VAT, and extension of the payment period.

Sectors that are subject to tax incentives will depend on the policy-supported priority list. This includes more value-added industries. A transparent system solution will be established to effectively protect investors’ interests. Investment contracts and stabilization certificates shall be determined differently depending on the sector and location of operations. To attract investment, the steps to legal approval will be eased starting in 2023 with an electronic platform for protecting investor rights and resolving complaints, providing incentives for customs duties and VAT for the import of equipment that cannot be supplied domestically and more support to obtaining licenses, highlighted B.Anar, the head of the Investment Policy Department of the Ministry of Economy and Development. O.Batnairamdal, the Deputy Minister of Mining and Heavy Industry, believes that the country’s economy will depend on how rational decisions are made in the boom cycle of metal prices that have been on the rise since 2020. The country will attract investment by monitoring global trends and raw material price fluctuations in advance, and aligning its mining policy. In the next 30 years, the world will see a transition to clean energy, especially in Asia, and there will be major urbanization. He said that non-ferrous and ferrous metals, critical minerals, coking coal, iron ore, and fluorspar are in the most demand, so these minerals will be the main focus of Mongolia’s future mining and heavy industry. He said that the government stability has improved in recent years, which will help increase investment. G.Erdenetuya, CEO of MNMA, believes that Mongolia needs to study what investor wants. She said that if the country do not make the right decisions based on the lessons of the past, we will not see anything positive soon considering the global geopolitical and post-epidemic difficulties.

WHAT SHOULD BE LEARNED FROM PAST SUCCESSES AND MISTAKES?

Since Mongolia transitioned to the free market, 72 percent out of the total of USD 37 billion FDI has been in the mining sector. Of this, USD 15.4 billion were for the Oyu Tolgoi project. Foreign investments based on mining, especially the implementation of mega projects, have been the impetus for the rapid development of the country’s economy, but have also been the cause of most problems.

In 1993, with the first approval of the Investment Law, the conditions for the actual entry of FDI were created. As a result, Mongolia’s real economic growth reached 17.5 percent. In the peak year of FDI, Mongolia was ranked 31st out of 96 countries by the Fraser Institute. However, in the year when FDI reached a record high of USD 5.7 million, the Foreign Investment Office was dissolved, a law was passed to restrict foreign investment, and the issuance of exploration licenses was restricted by law. As a result, it is now among the worst 10 countries in terms of foreign investment according to the Fraser Institute.

In Fraser’s study, the main reason for the decline in FDI in Mongolia was the “Long Named Law”, the law that restricted foreign investment, and many license terminations, as well as corruption. This created a “nightmare” for exploration companies with forced nationalization and disrupted transparency. James Liotta, Chairman of the Board of Directors of the American Chamber of Commerce in Mongolia, explained the lack of a legal framework to limit the encroachment of privately owned assets in the mineral resources sector to the inconsistency between laws. In recent years, Mongolia has been deeply af fected by corruption. He said that politicization, geopolitics, social inequality, and the government’s blind policy of socialization of natural resources have ruined the reputation of mining. G.Erdenetuya, CEO of MNMA said that the biggest factor in the decrease in investment was the legal inconsistency. “Our country has made a lot of legal reforms in the last 10 years. While Canada regulates issues related to the environment and restoration with only one law, Mongolia had 90 highly strict laws, 1,200 standards, over 90 government resolutions, and more than 20 ministerial orders that could be referred to under the name of responsible mining. There are enough laws in Mongolia, but the legal environment remains unstable.” Rio Tinto Group’s Country Director for Mongolia Kh.Amarjargal, said, “Mining is a sector that is most likely to attract investment, but it is not enough compared to other countries with natural resources. It failed to develop the sector and maintain steady growth. Also, there is a big difference between Western business culture and Mongolian methods. Everyone has made efforts for quite some time to eliminate it.” O.Amartuvshin, President of the MNCCI, said, “It is quite funny how we’re asking each other why investors have left the country after passing laws that restricted foreign investment and limited the issuance of mineral licenses. The government, local communities, and the public have been stringent on mining, which accounts for over 70% of FDI. The government does not pay attention to the implementation of the law. The link between laws is weak. When a decision is made at the top level, it is opposed by the middle and lower levels. Authorities and local authorities blame their inaction on people and companies who have received investments. Even the government colludes to basically “rob” investors”.

WILL THE STATE MANAGE THE MINERAL SECTOR OR WILL THE PRIVATE SECTOR BE IN CHARGE?

CAN THERE BE COMPETITION BETWEEN THE PUBLIC AND PRIVATE SECTORS?

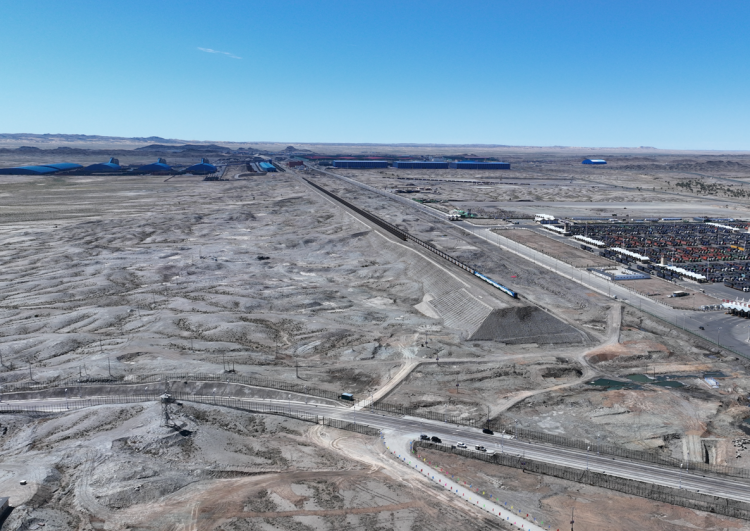

James Liotta shared his opinion on the stateowned enterprise “Erdenes Mongol”, which consolidated the licenses and deposits seized from several private entities after foreign-invested companies left their businesses, and concentrated significant resources of minerals. Tavan Tolgoi-Gashuunsukhait railway is an efficient project to cut the cost of road transport to a third of current costs. Previously, the feasibility study of the project costing USD 698 million with the same economic return was developed by a German company “Deutsche Bahn”, and the national company was supposed to finish the construction in 2010, but it was canceled due to a decision by the Ministry of Road and Transport Development. He reminded us that we missed the opportunity to benefit from the railways 12 years ago. Like the railway, the Tawantolgoi Power Plant project has been discussed for several years. Therefore, he clarified whether the mining industry should be managed by the state or the private sector.

Acting CEO of “Erdenes Mongol” O.Khulan said that USD 8.3 billion investment is required for 47 projects implemented by the joint venture, and presented the progress of uranium, natural gas pipeline, silver, coal, and energy projects. The projects to cooperate with investors are the coal-based synthetic natural gas and energy production projects in the Baganuur and Shivee-Ovoo mines, as well as the gold Dovjoot, Mukhar Khar Tolgoi, Khalzan, and silver Owoot Khyar and Ulziit Ovoo deposit projects. Rio Tinto Group’s Country Director for Mongolia Kh.Amarjargal, emphasized that small and medium-sized enterprises are developing and diversifying the economy of our country following large projects like Oyu Tolgoi. In 2030, Oyutolgoi mine will become the leading copper producer in the world. Vice President for Business Development of “Erdene Resources Development” A.Bilguun said that the company has explored 116 mineral licenses in Mongolia with an investment of about USD 50 million. As a result of exploration, 112 licenses were returned to the state, and discoveries were made in four license fields. “Bayankhundii” project, the pioneer of the new gold district, is one of the highest gold deposits in the world (3 g/tonne). 34% owned by the public and 29% owned by foreign investment funds, “Bayan Khundii” will be the first mine to use renewable energy in Mongolia. Also, “Khar Mori” and “Ulaan” deposits will be operational. “In today’s unstable global geopolitical situation, gold is an important strategic product for any country’s economic independence. Our neighbors are among the world’s leading countries in gold production. China produces 330 tonnes of gold and Russia produces 300 tonnes of gold per year. However, our country produces only 20 tonnes of gold annually despite its significant effort. Mongolia has the potential to produce 50-60, maybe 100 tonnes of gold per year. To manage such production, it is important to discover large reserves of hard-rock gold deposits. Australian TMK Energy Ltd’s Director of Planning and Development Dougal Ferguson mentioned that Mongolia can fully produce its energy needs from its resources. He expressed that a strong political policy is needed for the development of gas production for this. The company he manages is implementing the “Gurvantes-XXXV” coal bed methane gas project in Umnugovi province with the vision of building a gas plant in Mongolia and exporting it to foreign markets. The aim is to supply products to the Chinese market, where gas consumption has been continuously increasing for the past 20 years. The Chairman of the Board of the Mongolian Business Council, Ts.Tumentsog conveyed his proposal to implement the projects of the “New Recovery Policy” in collaboration with foreign and domestic investors through public-private partnerships. The total investment of “New Recovery Policy” projects is estimated at MNT 120 trillion. At today’s exchange rate, this is equivalent to the amount of FDI that entered our country in 30 years.

CAN THE PLANS THAT ARE UNDER DISCUSSION COME TO FRUITION?

In the last three years, not only exports but also imports of our country have been going through a very difficult period. Currently, import costs have increased by 20-25 percent, and the costs and funds originally estimated in the feasibility studies of the projects have far exceeded. The companies openly said that the government supports the processing industry, but the imported equipment is not exempted from taxes, and the tax incentives did not realize at all. In addition, problems common to companies, such as the 14/14 day roster and the standard rate of royalties, which were strictly stipulated by the reform of the Labor Law, were discussed. One of the first things investors look at is taxes. If you look at the current state, no one will invest in the coal industry, which pays 30 percent of sales revenue to royalties. It is no different in the copper industry. The companies are raising an issue that it is necessary to correct the regulations in which royalties would equal 5 percent when the copper price is USD 5,000 per tonne, and increase with tiers when it exceeds USD 5,001. Demand for critical minerals and copper is increasing dramatically with the global energy transition. However, starting from the Tsagaan Suvarga copper deposit, which is almost ready for use, new copper projects have been stuck for many years because of the pressure of royalties.

Also, our country is not able to issue exploration licenses, which have not been fully explored even though lithium, cobalt, and rare earth elements have been discovered. The industry is worried that Mongolia will fall behind the super cycle of commodity growth again if exploration falls behind.

It has been said that the government is initiating and developing new laws to improve the investment environment. Businessmen and investors should be heard and consulted before legal changes and reforms. The companies believe that the current plans cannot be implemented just by changing the law.

Mining Insight Magazine, October 2022, special edition of “Mining Week 2022”