ODJARGAL.E

ODJARGAL.E“Erdenes Tavan Tolgoi” JSC announces taking full responsibility for the export and transportation of mining products on the Tavantolgoi-Zuunbayan railway (April 26, 2022). The statement clarified that Mongolian Railways JV can’t enter into any contracts or agreements for the transportation of the railway.

The statement noted that the railway was financed by “Erdenes Tavan Tolgoi” and owned exclusively by “Zuunbayan Railway” LLC, which holds a government resolution-backed construction license. This is the first sign that the next “major obstacle” may occur along railroads. Mongolia, which had the Ulaanbaatar Railway JV since the socialist era, started seeing new corporate structures in the railway sector, such as joint ventures and private and public partnerships, in the last 10 years. Aside from the Ulaanbaatar Railway JV, two companies run comprehensive railway operations. These are the “Mongolian Railway” SOE and “Mongolian Trans Logistic” LLC (Boldtumur Eruu Gol). Starting next year, the country’s railroad network will be extended by 870 km. Each new railroad has different owners. There are many uncertainties, such as infrastructure ownership, traffic coordination, regulation, and tariff of usage.

Furthermore, more issues are bound to follow, such as the accessibility of rolling stock, wagons owned by mineral exporters, the capacity of ports, and coordination of rail transportation Established under the intergovernmental agreement between the People’s Republic of Mongolia and the Soviet Union of 1949 and with 50:50 investment from both sides, “Ulaanbaatar Railway” JV owns a total of 1,805 km long network, including the SukhbaatarZamyn-Uud route, which connects Mongolia’s northern and southern border, Ereentsav-Choibalsan route, which connects to the far eastern part of Mongolia, and other branches. Not only does Ulaanbaatar Railway JV, which has been single-handedly operating railroad transportation nationwide, owns the infrastructure, but the company also manages its operations. However, the owner and operator of the infrastructure should not be one according to the current Law on Railway Transport. Considering this act as a monopoly, the legal requirement was approved in 2007. “Ulaanbaatar Railway” JV is exempt from certain taxes under an agreement made more than 70 years ago, and its operations are regulated by government resolutions and special regulations. For instance, rolling stock of other parties is not allowed on “Ulaanbaatar Railway” JV’s railroads. This is why there is both a transparent and non-transparent public criticism towards the company that condemns their “excessive” rights.

ETT can recoup its investment in the railway and use the revenue to finance other projects. Then, these railways are likely to be used for Erdenes Tavan Tolgoi’s coal transportation rather than Mongolia’s mineral exports.

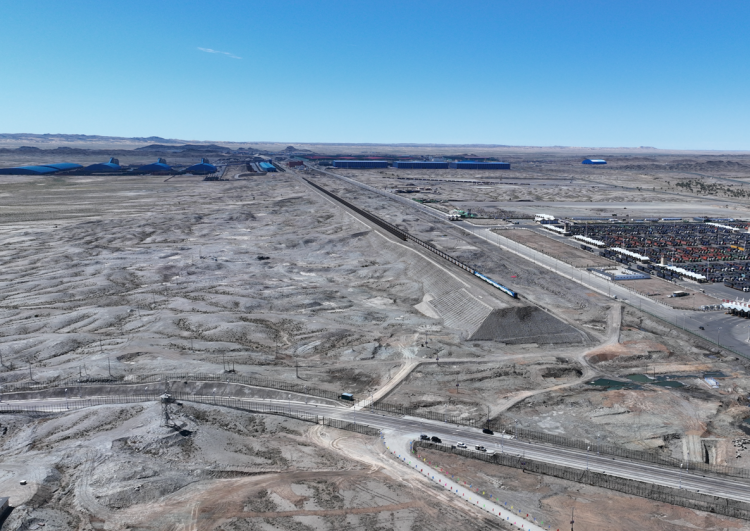

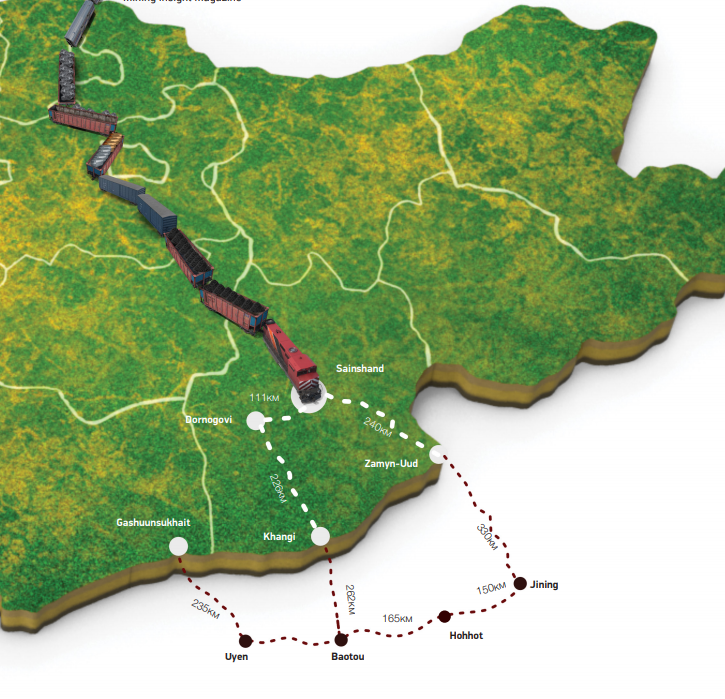

Under the concept of developing the national railway network, the “Mongolian Railway” SOE (MTZ) was established in 2008. Accordingly, the government is holding a policy to transfer the rights and ownership of new railway projects to MTZ and, in doing so, give them under state ownership. After over 10 years of dispute, the construction of a 267 km long railroad in the Tavantolgoi-Gashuunsukhait route is finally entering its completion phase and the 416 km-long horizontal railroads in the Tavantolgoi-Zuunbayan route are now running test delivery. Construction of the 223 kmlong railroads in the Zuunbayan-Khangi route, which will open the second export gateway, has also started. The Government approved a resolution (March 16, 2022) that allows the agreement under the terms “build-use-transfer” for the construction of 426.6 km long railroad in the Choibalsan-Khuut and Khuut-Bichigt routes and 1,255 km long rail in the Arts Suuri-Shivee Khuren-Nariin Sukhait route.

“Erdenes Tavan Tolgoi” JSC owns 66 percent of both “Tavantolgoi Railway” and “Zuunbayan Railway” LLCs that are building railroads in the Govi region, specifically in the “Tavantolgoi-Gashuunsukhait” and “Tavantolgoi-Zuunbayan” routes. This creates the first uncertainty within the sector. The announcement from the company said, “Erdenes Tavan Tolgoi finances the project on comprehensively developing the Tavan Tolgoi mine. Our company is responsible for the financing of the Tavantolgoi-Zuunbayan route railway and the construction license is solely owned by ‘Zuunbayan Railway” LLC. Under resolution no.117 of the Mongolian Government, ‘Erdenes Tavan Tolgoi” JSC owns 66 percent of the company and the remaining 34 percent is owned by ‘Mongolian Railway’ SOE respectively. Under this resolution, ‘Mongolian Railway’ SOE’s license on implementing the construction of core infrastructure has been annulled and transferred to ‘Zuunbayan Railway’ SOE for a three-year duration. Thus, ‘Mongolian Railway’ JSC cannot enter any agreement or deal on freight transportation related to the Tavantolgoi-Zuunbayan route railway project.” Banzragch.D, the CEO of “Zuunbayan Railway” LLC, said in an interview that the shareholders’ agreement also clearly states that the infrastructure will be owned and operated by “Zuunbayan Railway” LLC. Similar to this project, a government decree granted a five-year license to “Tavantolgoi Railway” LLC in 2018 to build the infrastructure of the Tavantolgoi-Gashuunsukhait railway. B.Gankhuyag, CEO of Erdenes Tavan Tolgoi JSC, explained that it would be right to give the railway to one side and transfer the state ownership to MTZ free of charge after a certain period or after recouping the initial investment. Erdenes Tavan Tolgoi has indeed decided to finance the construction of these railways. It is natural to control railway transportation as an investor. Erdenes Tavan Tolgoi has a long-term goal to increase its annual coal exports to 50 million tonnes. With a combined capacity of 40-45 million tonnes, the two railways will strive to export coal to both Gashuunsukhait and Khangi. That way, the company can recoup its investment in the railway and use the revenue to finance other projects.

Then, these railways are likely to be used for Erdenes Tavan Tolgoi’s coal transportation rather than Mongolia’s mineral exports. Is this the government’s policy and initial estimation? The government has set a goal to put the mineral deposits along the new railway route into economic use. On the other hand, other mining companies want to export their products as much as possible for profit. Companies that are “craving” export railways have enough cargo or commodities to ensure uninterrupted transportation. They will even try exporting thermal coal. In addition, the demand for a large number of wagons will inevitably increase, as most of Mongolia’s ex ports are light cargo. UBTZ has a capacity of deploying 11,500 wagons per day. As of today, the company has over 6,000 wagons, including rental ones. But these are not even enough for domestic freight transport. Of these, 3,000 are owned by the Ulaanbaatar Railway. The rest are wagons of private companies. Companies have already noticed the lack of wagons. That’s why export and transportation companies, not just mining, have been buying wagons from the beginning. Boldtumur Eruu Gol, the first private company to build the railway infrastructure with its funds, now has its fleet of 3,000 wagons, locomotives, and maintenance depots.

After that, Mongol Alt, Big Mogul Coal and Energy, Monpolymet, Energy Resource Rail, and Bodi International have their wagons, and some will set up subsidiaries and prepare to participate in railway transportation. Erdenes Tavan Tolgoi, the world’s largest coal company, also plans to have wagons. How much does it cost to have a rolling stock? One wagon costs USD 80,000-90,000 and locomotive - USD 5 million. It will cost at least USD 14 million to buy at least 100 wagons and one locomotive. The locomotive and wagon will have a rolling stock and will need an operator. There will be regular maintenance costs. Rail experts say that idle time is more expensive than transportation. In Mongolia, the right to have a rolling stock and establish an operating subsidiary is open by law. However, if all of them have wagons, problems will inevitably arise on the Gashuunsukhait road, such as licensed and illegal vehicles “fighting” to get through the port. What if UBTZ refuses to allow other people’s rolling stock on its path? If the ports do not have enough capacity, it is difficult to imagine how many companies will be stuck on the new railway, which is less than 1000 km long. Now the concept of a railway monopoly is disappearing. Amid export rail competition, companies with fewer wagons may be left behind. Due to the limited capacity of our ports, Erdenet, Oyu Tolgoi copper, Tavan Tolgoi coal, Darkhan-Selenge iron ore, and transit freights are leading in export transportation. Companies with less than 100 wagons may have to wait several months for goods to be exported. It is estimated that a fleet of 8,000 wagons will be required to transport a total of 40 million tonnes of freight by rail through Gashuunsukhait and Khangi ports. This is more than the total number of freight wagons currently transported nationwide.

So, every mining company has a space to have its wagon. It depends only on the capacity of the port and whether there will be congestion or not.

At the same time, Russia, which has been sanctioned by the United States, the European Union, and some other countries, has begun to focus more on the Asian market. In doing so, they will seek to increase freight transportation to China by transiting through the shortest route in Mongolia. UBTZ has a capacity of delivering 25 million tonnes of goods per year, but last year, the company transported more than 30 million tonnes. If Russia tries to make full use of UBTZ’s capacity, it is doubtful that Erdenet copper concentrate, Darkhan-Selenge iron ore, coal, zinc, and fluorspar mining products from the Gobi region, as well as imported cargo, will find a channel in our northern region. To pass not only through Zamyn-Uud but also through the Khang port, Russian transit cargo will have to travel on the main UBTZ route, via the MTZ’s Tavan Tolgoi-Zuunbayan, and on the private Zuunbayan-Khangi. This means that transportation will be provided on three different routes. Article 19.1.2 of the Law on Railway Transportation states that “fee of infrastructure use and service charges shall apply”. This means that the infrastructure owner will set the road use tariff. The companies expect to recoup the cost of the railway in the short term. Different tariffs apply to each railway. It is likely to be more expensive than UBTZ’s tariffs.

Thus, there is a need for a new legal environment for further competition, responsive regulations, and free competition in the railway sector.

The era of Ulaanbaatar Railway’s monopoly is over. The revision to the 2007 Law on Railway Transport provides an opportunity to regulate various forms of property relations, ensure equal competition, create a fair business environment, and liberalize the sector. The revision was submitted to Parliament by the cabinet in 2019. It is unique in that it is a law that is being updated at a time when various forms of private and public ownership are taking place. Some members of parliament believe that the law should improve the technology, infrastructure, and ownership of rolling stock, and raise the level of professionalism. MP Bat-Erdene.J expressed, “Mongolian Railway SOE was established to create the first-ever national railway company that could compete with UBTZ. Therefore, ownership of other railways, such as Tavan Tolgoi-Gashuunsukhait, Tavan Tolgoi-Zuunbayan, and Khuut-Bichigt are transferred to MTZ. All this should be the property of Mongolia. Therefore, the upcoming legal reform determines the fate of the Mongolian Railway.’ “Mongolia is the only country in the world that exports coal by truck. Railways are considered the “locomotive” of a country’s development. Today, however, our country’s railways have become a stumbling block. This law should be a reform of the railway sector, ”said MP Enkh-Amgalan.L. Minister of Road and Transport Development Khaltar.L explained, “Mongolia has been asking Russia to amend the 1949 agreement on the Ulaanbaatar Railway since 1992. We will continue to do so. Under the upcoming bill, railway companies will have their tariff policies for infrastructure use.

It also outlines the authority of UBTZ and regulates other companies’ rolling stock on UBTZ’s network, and in turn, UBTZ’s rolling stock on other companies’ infrastructure. The Mongolian Railway will operate the railways to the Gobi region. Currently, it is responsible for the operation of a 20 km long railway at the Tumurtei deposit. Compared to before, it has its roads, locomotives, and rolling stock now.” Today, MTZ, the nation’s most ambitious railway company, has only 20 km of railways and owns 34 percent shares in two railways from Tavan Tolgoi de - posits with no decision-making power, lacking as - sets, and rolling stocks. A total of 245 freight cars and 9 locomotives are rented for profit. What is the role of MTZ now that Erdenes Tavan Tolgoi and other mining companies have a fleet of wagons and all of them will be able to transport? If the parliament and the cabinet are planning to expand MTZ into a national railway company that can compete with UBTZ, then the question arises as to why the mining company, not MTZ, owns the preferred share of its strategically important railways.

If all these conditions are not taken into account from now on, and the reform of the Law on Railway Transport is not approved, the next major “obstacle” may arise on the railway. The narrow and wide-gauge railway dispute has delayed the development of Mongolia for over a de - cade. A bigger problem could arise on export rail - ways. But this is only an internal issue of the country. However, when the country hasn’t reached a decision internally, representatives of the Russian Railways have started visiting Mongolia more often. Russian Railways representatives have a “habit” of asserting their interests and opinions when they start visiting. This time, they are asking for answers to many ques - tions, such as whether to change the 1949 agree - ment between the two countries, and whether the transit freight and other transportation tariffs for UBTZ are agreed upon or not. In any case, a very interesting time has come for the Mongolian railway industry.