Miners would need their own trains to export minerals as demands grow further.

Construction of the Zuunbayan-Khangi railway, which will open a new export gateway and a new source of income, will begin this month and to be completed within just six months. Since the necessary conditions are all met and the implementation solutions are cleared out, the country decided on the shortest possible time, which if succeeded will be the fastest development in the history of Mongolia’s railway sector. A political decision has been made, there is no dispute over the gauges, and the border point has been agreed with the Chinese side at the government level. On the other hand, a domestic private company with experience in building railways and able to finance itself has been awarded a concession. With the commissioning of this railway, about USD 2 billion will be generated in revenue from the export of minerals at the Khangi port. The annual freight transportation will increase by around 20 million tonnes.

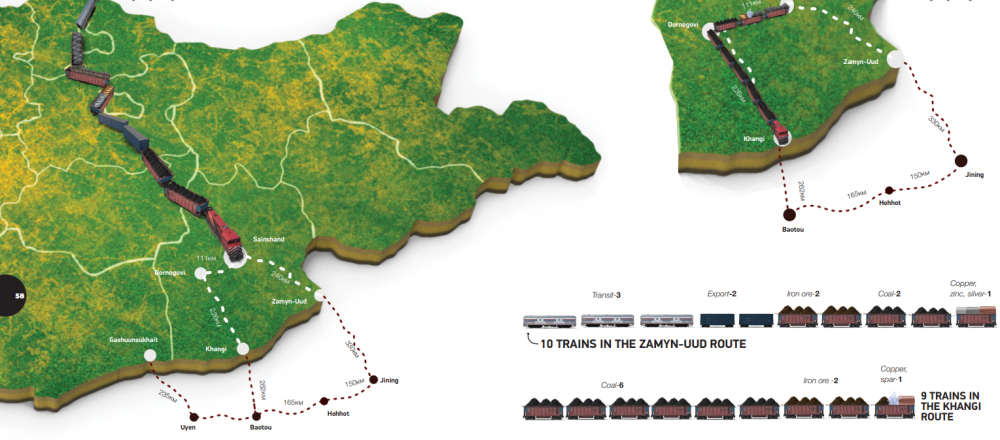

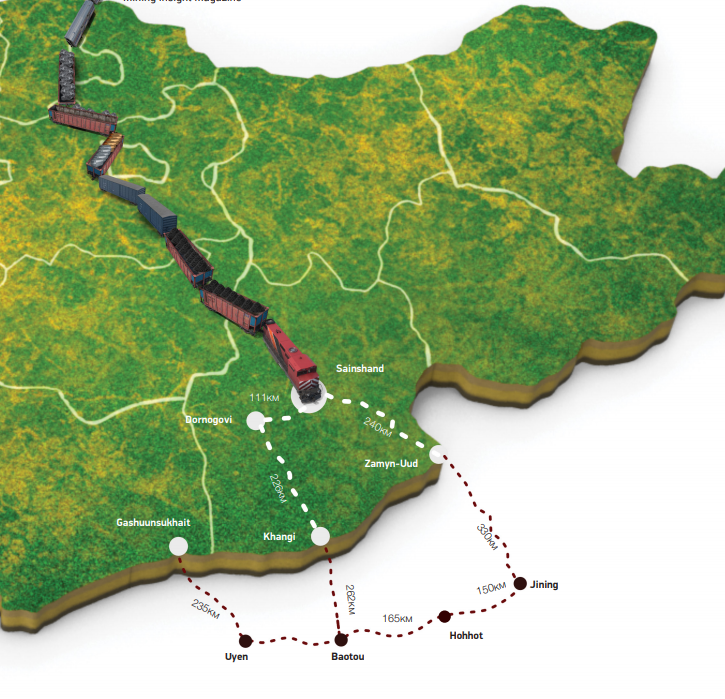

This includes Tavan Tolgoi coal, Oyu Tolgoi and Tsagaansuvarga copper, iron ore from the Darkhan-Selenge region, and other minerals from licensed mines along the route. In other words, Mongolia’s minerals export will expand by this amount. In 2018, when the Parliament amended the “State Policy on Railway Transportation”, two additional directions were included, one of which was Zuunbayan-Khangi. An estimate at the time showed reduced costs derived from 318 km shorter travel distance from Sainshand to Baotou by connecting 281 km railway from UBTZ’s Zuunbayan station to Khangi port. The situation is a little different now. The railway to Khangi port will branch from the 111th km of the main horizontal axis railway. This will be the first tri-route railway network in Khalzan Tsav, Dornogovi province. The Zuunbayan-Khangi railway will then be connected to the TavatTolgoi-Zuunbayan route in the direction of Tavan Tolgoi and with the Ulaanbaatar railway to the east. The decision was aimed at preventing the potential congestion at the Zamyn-Uud port. On the other hand, the construction cost is being reduced by moving the Khangi route to the west instead of the Zuunbayan station, thus shortening the traveling distance.

It also has the advantage of being closer to licensed mines, creating the necessary infrastructure for exporting its products to foreign markets. Since there will be no further connection from the Zuunbayan station, the involvement of the Russian side, which owns an equal amount of shares of UBTZ as the Mongolian Government, will be unnecessary on the Khangi line. The Russians have long been interested in the Zuunbayan-Khangi route and have expressed a clear position. During a high-level meeting between the heads of state of Mongolia, Russia, and China in Bishkek, Russian President Vladimir Putin highlighted the Zuunbayan-Khangi railway project. Russia believes that it is possible to transport transit and bulk cargo to the northern market of China through the port of Khangi. Although a daily capacity of eight freight trains is needed, the current capacity of Mongolia’s railway system can only allow four trains. China has always been ready to import raw materials through the port of Mandal. The country’s fiveyear plan included the construction of a railway from Baotou to the port of Mandal, which lies 10 km from the port. Therefore, China is ready to import minerals from Mongolia both by rail and highway. The Zuunbayan-Khangi railway will open the shortest route for Mongolia’s mineral exports to the target market in China.

Tavan Tolgoi coal, for example, can be delivered directly to metallurgical clusters and large consumers in the vicinity of Baotou by rail. China is developing trade, economy, and industry in its far northeastern region in line with the “Belt and Road” strategy. Baotou plays an important part in this strate gy. It is the main region that meets most of the country’s machinery, electricity, and steel needs. The heavy machinery assembly plant in Baotou supplies equipment to Oyu Tolgoi, Erdenes Tavan Tolgoi, Tavan Tolgoi, and Baganuur mines. The Bayan Ovoo deposit is located in the region, which alone supplies 90 percent of China’s rare earth elements, which sets the global production amount and prices. The Chinese Government supports the coal, non-ferrous metals, rare earth elements, chemical, and electronics industries through policies in Baotou. Needless to say, they need raw materials. Baotou is the leading region in terms of the scale and strength of its mineral-based heavy industry, and that is not not only in China but in the whole world. It is also known as the “City of Steel” and the Center for Rare Earth Elements. As Australian coking coal supplied from the South China Sea shrinks, Chinese traders are becoming more interested in increasing the supply from Gantsmod and Mandal. It is estimated that 50 million tonnes of coal (coking and thermal) can be imported through Gantsmod, 30 million through Sekhe, 30 million through Mandal, and 15 million through Ereen.

However, the capacity of the nearest port Khangi is currently less than 700,000 tonnes. The Baotou Metallurgical Plant smelts 17 million tonnes of steel per year. The plant produces over 400 products, including high-speed railways, subway rails of all sizes, as well as concrete slabs. The Baotou plant, which supplies 60 percent of China’s high-speed rail, said at the time that it could cooperate with the Zuunbayan-Khangi railway project by supplying broad and narrow gauge rails and concrete slabs. The plant annually consumes 5 million tonnes of coking coal and 6 million tonnes of iron ore. They have three blast furnaces with a capacity of burning 8-10 million tonnes of iron ore each, however, only one of them is operational at the moment. Once the blast furnace starts, it can’t be stopped for 30 years. If Mongolia can increase its supply of commodities and ensure a stable supply, it will be possible to start more stoves.

Mongolia exports 8 million tonnes of iron ore a year. Along with the steel industry, the production of rare metals and critical minerals and related technologies is growing rapidly in the Baotou region.

Bayan-Ovoo, which determines China’s influence on the world’s supply of critical minerals, is the world’s largest producer of rare earth elements and metals. Smartphones, spare parts, and chip assembly plants are constructed around it. Today, as part of a green policy, large Chinese metallurgical plants are relocating from the coast to the northeast.

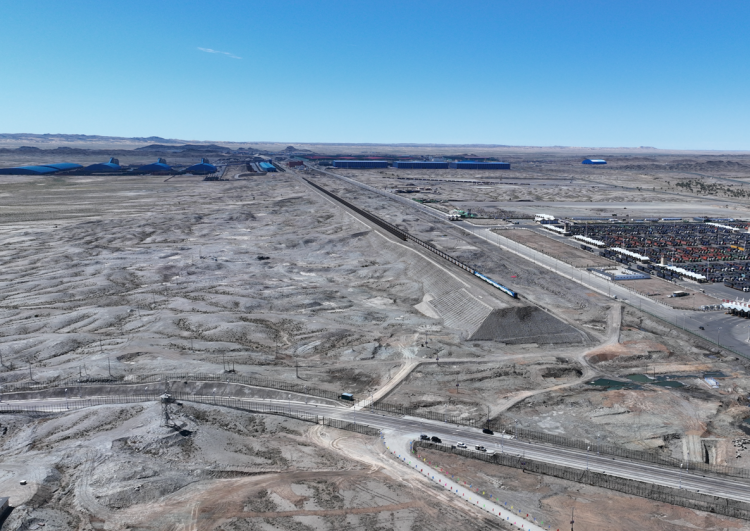

As a result, large industrial clusters, international quality transport, and trade and logistics networks are moving closer to Mongolia. Mongolia’s supply of commodities is too small in the face of huge demand from this giant market. As of 2021, a total of USD 300 million worth of goods were exported through the Khangi port. “Ikh Gobi Energy”, “Ailbayan”, “Sor Gobi” LLCs are exploiting coal, “Elstei” and “Mon Laa” are exporting iron ore by road. With the construction of the Zuunbayan-Khangi railway, the export revenue of the Khangi port is expected to increase by 6 times. The Government of Mongolia has identified the Khangi, Bichigt, and Tsagaandel ports as new export destinations, and commenced railroad connections from the Zuunbayan-Khangi route. Currently, the main exporting ports are Zamyn-Uud, Gashuunsukhait, and Shiveekhuren. Today, Zamyn-Uud, the largest foreign trade port with railways, is facing a real risk of overcrowding. According to a bilateral agreement between Mongolia and China, 14 trains will pass through Zamyn-Uud-Ereen port per day. Although the pandemic-related border restrictions are still effective, about 10 trains are entering the border per day. Specifically, there are 4 transit cargo trains, 2 export containers, 2 iron ore, 1 open-top, and 1 train for copper and zinc concentrates.

The future of the government and the duty of the Minister of Finance depends mainly on the situation at Zamyn-Uud. With the opening of a new Khangi railway export gateway, the supply of construction machinery, electrical goods, and other consumer goods, from mining machinery to Zamyn-Uud, will easily be transported without delays, and the shortest route to China will be more accessible. Therefore, the Zuunbayan-Khangi route is necessary not only for miners, but for travelers, traders, and SMEs. In addition to the port’s capacity and railways, one of the reasons for the congestion at Zamyn-Uud is the container train. Due to the lack of locomotives, container cargos arriving from China have to be unloaded directly.

One of the problems that will arise after the railroad connection of ports will be the availability of locomotives. Mining companies will need to have their own trains to export raw materials.

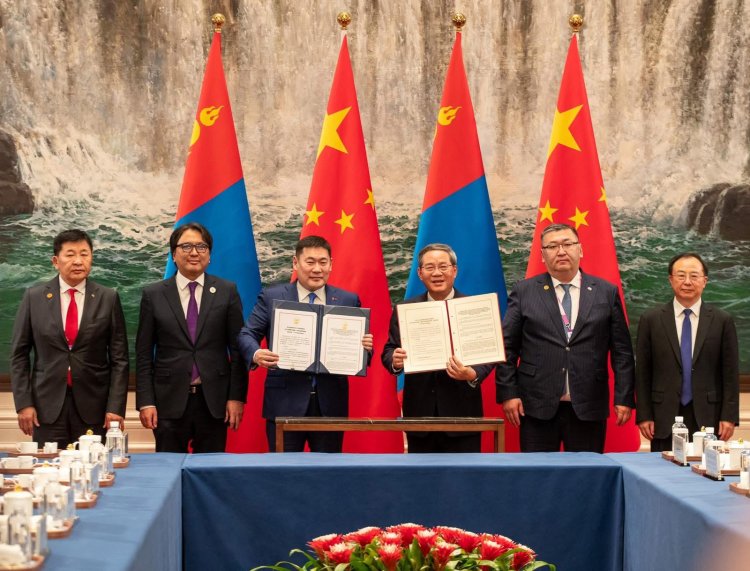

The first example is Boldtumur Yeruu Gol. They self-funded the railway and built a rolling stock depot with 3003 freight cars. Mining companies are starting to purchase their own trains. If there are not enough trains for export transportation, Erdenes Tavan Tolgoi will also need to buy a train to extract its coal, or MTZ will have to increase its fleet of locomotives to supply export transportation. By next year, our country’s railway network will be extended by 870 km. The 267 km-long railway of Tavantolgoi-Gashuunsukhait, 416 km of Tavantolgoi-Zuunbayan, and 226 km of Zuunbayan-Khangi will be commissioned. “... an agreement has been reached with the Chinese side on the construction of the railway, which has been stalled for 12 years.

So the construction will be carried out without any obstacles. Deliberately or unintentionally, we have lost over a decade and limited our opportunities. There were political and financial reasons. As a result, we have lost the trust of our southern neighbor. In other words, they are annoyed. Reconciliation talks between the two countries are progressing,” said Finance Minister Javkhlan.B, and highlighted that now is a “window period” that the country cannot afford to lose. On the upside, it is important that the country understands the need for low-cost and fast export of mining products at all levels. The government led by Oyun-Erdene. L is prioritizing boosting the revenue from commodities, such as coal, copper, and iron ore. Therefore, all attention is focused on ports and export railways. As part of the “Border Crossing Reform” alone, 44 projects have been proposed to attract USD 8 billion worth of foreign and domestic investment. Expansion of border crossings is expected to grow foreign trade turnover to USD 24.8 billion over the next two years. The government will not compete with what the private sector can do and will only focus on its duties. The investment opportunity is limited for the government. Therefore, the government will support and cooperate with investors. The government has promised to support all projects that will not be financed from the state budget. The government continues to imply that it will support public-private partnerships.

Mining Insight Magazine №03(004), March 2022