We present a special edition of “Mining Week 2022” this month. It is the first-ever event in Mongolia that attracted all stakeholders in the mining industry to discuss the future development and current problems of the mineral industry for five days. “Mining Week 2022” has been a great experience. Furthermore, what position will Mongolia take in the future mineral network and what policies and strategies will it implement will largely depend on the current steps and vision of the Ministry of Mining and Heavy Industry and how well the government can understand the process.

We present a special edition of “Mining Week 2022” this month. It is the first-ever event in Mongolia that attracted all stakeholders in the mining industry to discuss the future development and current problems of the mineral industry for five days. “Mining Week 2022” has been a great experience. Furthermore, what position will Mongolia take in the future mineral network and what policies and strategies will it implement will largely depend on the current steps and vision of the Ministry of Mining and Heavy Industry and how well the government can understand the process. E.ODJARGAL

od@mininginsight.mnThe time for Mongolia to review the past 100- year development of the mining sector and set out its future policies coincides with the beginning of the world's most important metals era. The country’s objective to keep pace with future mineral trends is a matter of concern for everyone. At the beginning of the new century of mining, Mongolia is focusing on the development of metals that are in demand in the transition to clean energy.

MINING, A 12 USD BILLION INDUSTRY

The cost of transportation in landlocked countries is 60 percent higher than in other countries. Internationally, 1 ton/km of cargo is transported by air for 1 US dollar, by road for 10 cents, by railway for 4 cents, by electric car for 3 cents, and by water for 1 cent. Our main export raw materials are copper concentrate, iron ore, and coal, which are transported in large quantities and are therefore very expensive. M.Dagwa, CEO of "QMC" LLC, guided the discussion with the idea that developing the production of critical minerals in small quantities may compensate for the weakness of the country's transportation.

Damian Brett, a Senior Mining Analyst at the World Bank, is optimistic that Mongolia's mining industry will become a USD 12 billion revenue industry with critical minerals. He reminded us that Mongolia’s copper production will develop by leaps and bounds until 2030 considering China's rapidly growing demand. He believes that copper production can offset the decline in Mongolia's coal export revenue in the future.

B.Uyanga, head of the Department of Geological Policy of the Ministry of Mining and Heavy Industry (MMHI), shared the CRU's forecast that the world's level of copper production will fall short to cover 7.5 million tonnes of demand by 2035 even with both the operating mines and upcoming projects. With the production of electric cars, the raw materials of batteries will be in high demand in China, Europe, the United States, and other countries. In the next 30 years, the IEA estimates that from critical minerals, the use of rare earth elements and lithium will surge 42 times. O.Batnairamdal, the Deputy Minister of Mining and Heavy Industry, considers it necessary to enter industries that will provide above-average returns, such as important minerals, led by copper, and rare earth elements. Our country has accumulated 40 years of experience in the copper industry. Assuming that the Oyu Tolgoi underground mine is at full capacity, the Erdenet copper concentrate processing plant is operational, and Tsagaansuvarga is put into operation, Mongolia has the potential to be among the world’s top five copper producers by 2030. This is only the currently available data.

There is more potential in other critical metals other than copper in Mongolia. The Minerals Professional Council has approved 297 projects as deposits since 2019. On top of that, the country is seeking cooperation in 26 active exploration projects, 14 projects for non-metals, such as coal fluorspar, six critical mineral projects, and 19 metal projects. Mongolia is located in a mineral-rich part of Central Asia, in highly developed mining regions such as China, Russia, and Kazakhstan. In this sense, Mongolia is attractive from the point of view of the formation of various minerals. Last year, Mongolia was ranked above Kazakhstan in the ranking of mineral resources, compared to 84 countries. In the external environment, Mongolia is more appreciated for its mineral resources potential than Kazakhstan, which is currently attracting a lot of foreign investment and opportunely developing its mining sector. According to the latest geological studies of the world, two of the four largest deposits of critical minerals are located in China, led by Bayan Ovoo, with the other two in Vietnam and Afghanistan. The geological formation with the accumulation of rare earth elements, where these deposits were discovered, continues in Mongolia. The MMHI is developing a concept of a research based on this forecast. In the future, the MMHI is preparing to advance basic geological research using advanced technology with the experience of Australia, Canada, and the United States. It is a completely new and difficult task for Mongolia for the first time. This means carrying out geological studies, which previously progressed only 1-2 percent in a year, in a short time with a few billion MNT using advanced technology. In other words, we need to buy time for critical mineral research.

If successful, Mongolia will have significantly higher competitiveness. There are many promising long-term fields for Mongolia, such as gold and copper. B.Uyanga, Head of the Department of Geological Policy of the MMHI, emphasized that Mongolia has an opportune chance of being a major player of minerals and metals in the world if the results of the research can be thoroughly studied and put to use. He said, "Geological exploration is risky and should be done with private investment. For this, the country needs to offer attractive options to investors. The speed of this work depends on the opening of the exploration. A fast and transparent platform for exploration licenses is already operational. After sorting out the issues of valid licenses, we are preparing to start issuing them very soon." It was reported that the National Geological Service is actively working to digitize access to our basic geological information, which is poorly evaluated in most studies of the investment environment. In the conclusion of the survey conducted by the MMHI among foreign investors in 2017 and 2021, it was mentioned that Mongolia's advantage is still its geological potential. In the last five years, the political situation has stabilized, the workforce has increased, trade barriers have decreased, and the quality of infrastructure has improved. While enforcement of current rules and regulations, legal system, tax environment, access to geological information, environmental regulations, socio-economic agreements, and dispute resolution indicators have fallen. Today, out of 70 minerals commonly mined and supplied to the market, Mongolia exports eight products: coal, gold, fluorspar, copper, iron ore, oil, zinc, and molybdenum. The country is not among the top ten in the world in terms of mineral extraction. Taking coal as an example, our annual export volume does not even reach one percent of the consumption of its key consumer China. Mongolia's main advantage has always been the mineral sector. Foreign investment and mining are two sides of the same coin.

The researchers agreed that the reason behind the "explosion" of exploration and mining in Mongolia was that it attracted the attention of the world as an unexplored country where new deposits are likely to be discovered. There is an expectation that investors will be interested in Mongolia if exploration licenses become available and basic research data are transparent. On the other hand, many countries are looking to tap into this "young" market of critical minerals. G.Erdenetuya, Executive Director of the Mongolian National Mining Association (MNMA), said that countries are competing with policies and tax environments to attract investments in the face of growing changes in the global commodity market and geopolitics. Peru is internationally promoting the terms of VAT exemption for the first five years of new copper production to attract USD 59 billion in the coming years. Saudi Arabia will exempt foreign investors in critical mineral extraction from royalties for five years. However, the mining sector in our country, which accounts for one-quarter of the GDP, is often excluded from any legal and tax benefits. In addition, the industry is worried that the deposit and mining projects may stall due to high taxes. The benchmark price of coal made it even more difficult for companies as the foreign trade of coal should follow the market principle. Now fluorspar and soon iron ore, royalty problems will arise one after the other. Experts warn that the government is missing an opportunity for attractive investment that is requiring a bold step to make meaningful changes in the tax environment.

Since it is a mineral exporting country, it cannot escape foreign markets and global trends. Three major transitions are expected in the future. Urbanization, geopolitics, and clean energy will completely change the world. By 2050, the "Big 7" countries will be replaced by the "Next 7". In terms of population and economy, China, India, Brazil, Indonesia, Russia, Mexico, and Turkey will dominate. In urbanization and energy evolution, minerals such as copper, coking coal, iron ore, rare earth elements, fluorspar, lithium, and cobalt are most in demand. From here, it is clear what Mongolia's mining industry needs to pay attention to in the next 30 years. At the same time, the advantage of attracting foreign investment in Mongolia is still the mining sector. If it improves its competitiveness in the world market and becomes a producer of critical minerals, it will become a truly global player, not a regional one, supplying raw materials to the third market.

DRY PORT: DIRECT EXPORTING ABILITY

Mining will play an important role in the realization of the long- and medium-term development goals of "Vision 2050" and "New Recovery Policy". The MMHI is pursuing a "geological exploration-mining-processing-selling-distribution" system to further develop the sector. O.Batnairamdal, Deputy Minister of Mining and Heavy Industry, emphasized that the next 30 years will be the time for progress in the development stage. Today, as much as our country exports oil to China, it imports gasoline and diesel fuel from Russia. USD 1.5 billion are exported annually to meet domestic consumption. According to Ch.Khishigdalai, Head of the Oil Policy Department of the MMHI, domestic consumption is expected to reach 2.2 million tonnes next year. Also, the most expensive imported product for the construction of our country is steel. Therefore, within the framework of "Industrial Recovery", complex factories for copper processing, coal concentration, oil distillation, and metallurgy will be established. Preparations are being made to create a legal framework for the "sale-distribution" system, including the Mining Exchange Law, which will allow open and transparent trading of state-owned enterprises.

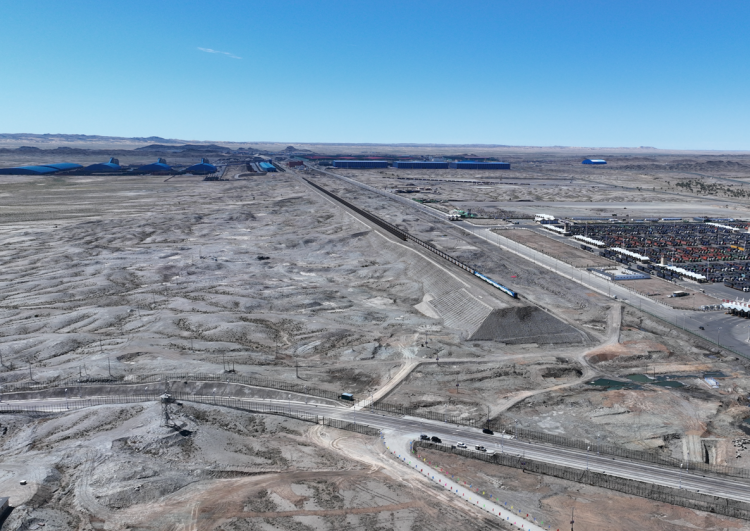

Also, the bill on the National Wealth Fund will be submitted to the Parliament soon. According to the expected results of the "Port Recovery Policy", the total export capacity of Mongolia will reach 165 million tonnes. The key ports for export and import will be identified. Some ports will be upgraded to international standards and will be in line with the port policy and plans of neighboring countries. In particular, the Ministry of Economy and Development is focusing on dry port development in Mongolia. In 2016, the United Nations Economic and Social Commission for Asia and the Pacific (UN-ESCAP) approved the Intergovernmental Agreement on Dry Ports of Member States. It is an international arrangement that facilitates commercial transport in landlocked countries. It has identified about 270 dry ports in 27 countries and started inter-shipping. The country's infrastructure benefits from being integrated into the Trans-Asian Railway and the Asian Highway network. The road connecting Zamyn-Uud and Altanbulag ports has joined the international AN3 network and the road from Bulgan port to Tashant belongs to the international AN4 network, and test transportation will start this year.

According to the government's decree, Zamyn-Uud, Sainshand, Ulaanbaatar, and Altanbulag ports are selected as key dry ports. Dornod province, Bulgan, and Bichigt ports have been identified as possible locations for new dry ports. According to Kh.Erdenebulgan, head of the Border Port Development and Free Zone Policy Department of the Ministry of Economy and Development, the dry port is an integrated and comprehensive service of inter-state border customs and transport logistics. It is important for Mongolia's export and import cargoes to pass through customs without hindrance, deliver deeper into the country, and export directly from that location. The main feature of a dry port is that the port does not need to be located on the border of the country and can be in the depths of the country. By fully using the railway network connecting neighboring countries, Mongolia will become a transit country.

Mining Insight Magazine, October 2022, special edition of “Mining Week 2022”