BOLD-ERDENE.S

BOLD-ERDENE.SMiners would need their own trains to export minerals as demands grow further.

“Erdenes Tavan Tolgoi” is in a difficult situation, entering a barter deal to supply over USD 1 billion worth of coal in the next 2-3 years and repay MNT 2 trillion in bond obligation. Although these are based on a positive assumption of USD 7 billion worth of profits in the next 5 years driven by the implementation of infrastructure projects, however, unprecedented risks, such as border closure and commodity price drops, are already obstructing expectations. On the other hand, recent events show that China’s major state-owned companies remain interested in Tavan Tolgoi residual deposits. This time, it is Norinco Group and not Shenhua. The well-known agreement on coal supply with China’s state-owned “Chalco” Ltd has been extended by 5 years. The extension was discussed and agreed upon at a cabinet meeting in April. When the deal was struck in 2011, the Mongolian side became obliged to supply coal for the next 5 years with a possibility of a 5-year extension once the advance payment is transacted. When the transaction was completed in 2017, the deal was extended by 5 years and by another 5 years this year. The terms of the deal remain unknown and the only certain fact is that an advance payment of USD 280 million has been transacted to the Bank of Mongolia.

Besides this, the information regarding price index, supply amount, terms and conditions, and interest on advance payment is still unclear. At the current market price, the initial payment equals about 2 million tonnes of coking coal. “Erdenes Tavan Tolgoi” spent years under pressure due to the USD 350 million worth of advance payment 11 years ago. The deal that came close to dragging down several directors and ministers has been extended with another advance payment of USD 280 million as if to show that time is against “Erdenes Tavan Tolgoi”. Under pressure from the government, which is facing FX and investment shortages, ETT is “bartering” to finance two major projects. “Erdenes Tavan Tolgoi” made a bidding announcement in August for a blueprint development and construction of the coal concentrator. Four Chinese companies, including “Norinco International Cooperation”, participated in the first bidding and none of them were selected. In the second selection, “Power Construction Corporation of China” and “Norinco” sent their offers and were rejected again. Then in the third bidding, “Norinco” participated alone and won the tender with an MNT 955.9 billion offer.

About USD 335.6 million worth of contracts were signed according to ETT. “Erdenes Tavan Tolgoi” is planning to establish a coal concentrator with a capacity of processing 30 million tonnes of coal and the initial module capable of processing 10 million tonnes will be operational soon. The special terms of Norinko’s selection are that the company has agreed to self-finance the project to purchase coal in an amount equal to their investment. The second deal with “Norinco International Cooperation” is the construction of an oil transmission pipeline. The company won open bidding of the Mongolian Ministry of Mining and Heavy Industry which is claimed to be international. The total cost of the 530 km long pipeline is estimated to be USD 388 million. This is also financed by “Erdenes Tavan Tolgoi” with a “barter” deal to supply coal. According to information on “Mongolian Oil Refinery” LLC’s website, an initial investment worth USD 250 million was required at first. However, the construction cost has increased since then and the loan from India fell short of completing the project. Therefore, the Mongolian Government agreed to construct the transmission pipeline and the financing became a burden for “Erdenes Tavan Tolgoi”. ETT negotiated to take 30 percent profit of the pipeline.

Who is “Norinco International Cooperation”? The question of whether the company is capable of executing projects of this size will surely be brought up. “Norinco International Cooperation” is a Shenzhen Stock Exchange-listed Chinese company with a market capitalization of over USD 1.1 billion.

Aside from real estate, the company engages in the construction of infrastructures, including roads, railroads, powerplants, mines, and heavy industry establishments. It is of the key implementers of the Chinese Government’s “Belt and Road” initiative. The company is currently carrying out sizable projects in African and South Asian countries.

They have been active in the coal trade and transportation in Mongolia for years. Through its subsidiary “TTC & T” LLC, the company has been transporting coal from Tavan Tolgoi and engaging in the improved dirt road establishment in the Tavantolgoi-Khangi route. In brief, it is a company that knows full well of Tavan Tolgoi deposits with business relations with “Erdenes Tavan Tolgoi”. That could also be the reason why the company is entering a barter deal. Their parent company is a Chinese state-owned enterprise “Norinco Group”. It is well known as a leading supplier arms dealer for the Chinese army. That’s why there are rumors that a Chinese arms manufacturer is doing business in Mongolia. Among the companies that were highly interested in “Erdenes Tavan Tolgoi” JSC and the “Tavan Tolgoi” project about a decade ago, there were two Chinese giants, namely “Chinalco” and “Shenhua”. “Chalco”, a subsidiary of “Chinalco”, keeps its deal as of today, while “Shenhua” left Mongolia and in its place arrived “Norinco Group”. “Chinalco” was ranked 198th in the Fortune 500 list last year with USD 53 billion in revenue and over 152,000 employees. “Shenhua Group” was ranked 101st on the list as China’s biggest company with a gross income of USD 80 billion and 323,000 employees. The newcomer on the list “Norinco Group” was 127th with a gross income of USD 71 billion and 230,000 employees. Compared to the other two, the company is an arms manufacturer. “Norinco Group” is China’s sole armament manufacturing venture. The company has over 100 branches and representative offices in over 10 countries. It plays a significant role in China’s Belt and Road initiative. Through its subsidiaries, the company engages in oil field exploitation and has experience in developing a petrochemical industry cluster. Heavy industry is also their field of activity as they manufacture railroad and engineering equipment and materials. When the US-China trade war was stimulating in 2020, former U.S President Donald Trump forbade U.S investors from owning the shares of certain Chinese companies. Norinco Group was one of them.

Regardless, “Erdenes Tavan Tolgoi” is continuing to cooperate with two Chinese state-owned giants. The company will be supplying USD 1 billion worth of coal to China under this cooperation.

The question of whether the deal will have a positive or negative impact will become clear with the detailed terms of the agreement. The price index and conditions of supplying coal will decide whether the payment can be made in a short time or not. It took 6 years for Mongolia to repay the advance payment from “Chalco”, which was USD 350 million with 3-7 percent interest. ETT had to export over 25 million tonnes of coal until 2017 to fulfill the debt obligations to “Chalco”. This time, the value is three times higher. At the current price, this can be covered by about 10 million tonnes of coal. If the price drops, the amount of coal supplied will increase, which will negatively affect the company’s revenue and lead to operational failures. And the fall in price is simply a matter of time. On the other hand, the above-mentioned contracts will create an opportunity for “Erdenes Tavan Tolgoi” to maintain profitability. China limited its coal imports, drastically affecting Mongolia’s coal exports.

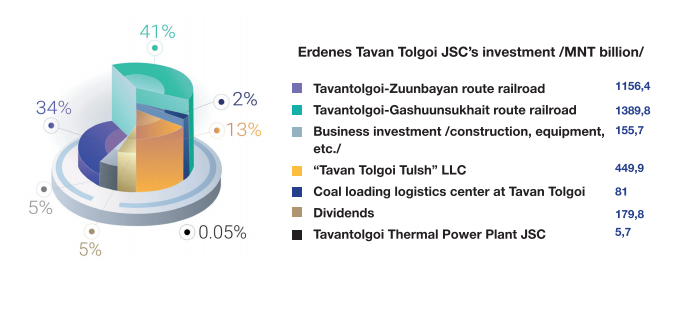

Therefore, Mongolia must increase its coal export through all channels. That is also why we are repeatedly pointing to the two Chinese state-owned giants. It is easier for ETT to let Chinese companies handle the customs issues at the Chinese border. The point is to not repeat the mistakes of the previous contract. At this time of high coal prices, Erdenes Tavan Tolgoi’s main goal should be to supply and export coal as quickly as possible. When the price fell in 2014-2015, “Chalco” almost “bailed” on Mongolia due to the prices being too high. As a result, ETT stopped supplying coal and faced losses incurred by interest, delaying the completion of the contract. This could happen again. Lastly, the current government is making full use of “Erdenes Tavan Tolgoi”. It may resemble a feeble dog collecting bones or a submissive camel that is easier to exploit. Regardless, “Erdenes Tavan Tolgoi” made an investment worth MNT 3.4 trillion, of which MNT 3 trillion was spent on railroads, briquettes, and power plants. An oil transmission pipeline will now be added. ETT is looking into every nook and cranny to finance these projects. For instance, they are planning to raise about USD 300 million through the third bond tranche. On the other hand, it is no secret that the company’s planned exports and revenues are declining. ETT had a plan to export 21 million tonnes of coal last year and earn USD 2.7 billion, but the plan failed. It is almost certain for ETT to fall short of reaching this year’s goal of earning USD 4.6 billion by exporting 28 million tonnes of coal. The only way for ETT to survive the next 2-3 years is to turn to its saviors, the Chinese companies and coal transport at the border, which remains at the hands of the Chinese government.