N. ARIUNTUYA

- ETT’s Market Capitalization Estimated at USD 9.5 Billion -

Erdenes Tavantolgoi (ETT) is one of Mongolia’s largest state-owned companies, achieving record sales and profits. In 2023, ETT generated MNT 9.5 trillion in revenue and earned a net profit of MNT 3.5 trillion, with dividends distributed to 2.5 million Mongolians just before the election. These figures represent a 2.7-fold increase in sales and profits compared to 2022 and are three times higher than in 2019, before COVID-19. By the first half of 2024, the company has already earned MNT 6.2 trillion and reported a net profit of MNT 3.2 trillion, positioning ETT to surpass its 2023 success.”

These figures are drawn from the report by Mongolian International Capital Corporation (MICC), an investment firm providing financial consulting services, titled “Equity Research - Erdenes Tavan Tolgoi JSC” (October 9, 2024). For ETT, these are records since its establishment in 2010, driven by several key factors. First, favourable market conditions and price growth have significantly boosted ETT’s performance, particularly due to China’s unexpected coal purchases. Despite declining steel production, China, the primary market, has been purchasing Mongolian coal at high prices through 2023 and will continue to do so in 2024. The reasons behind this trend remain unclear whether it’s a fortunate coincidence, a policy alignment between the two countries’ governments, or other strategic factors. Remarkably, even when inventories are high, China continues to buy at elevated prices, defying typical market trends. Second, the improvement of transport infrastructure has allowed Mongolia to meet China’s demand more effectively. In the past, limited infrastructure meant that rising demand and prices could not be fully capitalised on; long queues, sometimes spanning 130 km, were common on the only available road. However, the Port Recovery policy is now yielding positive results, with joint efforts from the government and private sector enhancing transport infrastructure. Increased transport capacity, including the use of the Tavan Tolgoi and Khangi roads and railways, has eased bottlenecks and allowed coal to be transported to the border more efficiently. Third, the implementation of a special regime and the appointment of a Government Plenipotentiary Representative (PRE) to ETT have contributed to this success.

These figures are drawn from the report by Mongolian International Capital Corporation (MICC), an investment firm providing financial consulting services, titled “Equity Research - Erdenes Tavan Tolgoi JSC” (October 9, 2024). For ETT, these are records since its establishment in 2010, driven by several key factors. First, favourable market conditions and price growth have significantly boosted ETT’s performance, particularly due to China’s unexpected coal purchases. Despite declining steel production, China, the primary market, has been purchasing Mongolian coal at high prices through 2023 and will continue to do so in 2024. The reasons behind this trend remain unclear whether it’s a fortunate coincidence, a policy alignment between the two countries’ governments, or other strategic factors. Remarkably, even when inventories are high, China continues to buy at elevated prices, defying typical market trends. Second, the improvement of transport infrastructure has allowed Mongolia to meet China’s demand more effectively. In the past, limited infrastructure meant that rising demand and prices could not be fully capitalised on; long queues, sometimes spanning 130 km, were common on the only available road. However, the Port Recovery policy is now yielding positive results, with joint efforts from the government and private sector enhancing transport infrastructure. Increased transport capacity, including the use of the Tavan Tolgoi and Khangi roads and railways, has eased bottlenecks and allowed coal to be transported to the border more efficiently. Third, the implementation of a special regime and the appointment of a Government Plenipotentiary Representative (PRE) to ETT have contributed to this success.

Under Resolution No. 385, issued by the Government of Mongolia on October 26, 2022, a six-month special regime was established for ETT JSC, alongside the appointment of an Extraordinary Plenipotentiary Representative to oversee operations, which has proven beneficial to the company’s remarkable performance. PRE has successfully achieved its objectives, as reflected in the increase in key financial indicators, particularly profit. By tracking the financial flows into ETT, PRE was able to curb the practice of ‘coal theft’-a term for undervaluing coal prices and inflating transportation costs. This effort led to the disclosure and subsequent cancellation of sales contracts suspected of undervaluing coal. Without these actions, a significant portion of revenue might have gone unaccounted for. While the issue of coal theft appears to have been addressed, questions remain as to whether it has been eliminated. Additionally, policy measures following the coal hearing have contributed positively. Since 2023, several regulations have reshaped the coal sector, including restrictions on companies exporting coal directly from mines and transferring transportation permits to mining companies. Open trading on the mining exchange has also commenced. Together, these initiatives have undoubtedly bolstered profitability. With ETT’s increased exports, revenue, and profit, both positive and negative aspects of its performance have emerged. The positive impact is seen in ETT’s significant contribution to the economy; in 2023, the company paid MNT 2.7 trillion in taxes and fees, accounting for 11.6% of Mongolia’s budget revenue.

Under Resolution No. 385, issued by the Government of Mongolia on October 26, 2022, a six-month special regime was established for ETT JSC, alongside the appointment of an Extraordinary Plenipotentiary Representative to oversee operations, which has proven beneficial to the company’s remarkable performance. PRE has successfully achieved its objectives, as reflected in the increase in key financial indicators, particularly profit. By tracking the financial flows into ETT, PRE was able to curb the practice of ‘coal theft’-a term for undervaluing coal prices and inflating transportation costs. This effort led to the disclosure and subsequent cancellation of sales contracts suspected of undervaluing coal. Without these actions, a significant portion of revenue might have gone unaccounted for. While the issue of coal theft appears to have been addressed, questions remain as to whether it has been eliminated. Additionally, policy measures following the coal hearing have contributed positively. Since 2023, several regulations have reshaped the coal sector, including restrictions on companies exporting coal directly from mines and transferring transportation permits to mining companies. Open trading on the mining exchange has also commenced. Together, these initiatives have undoubtedly bolstered profitability. With ETT’s increased exports, revenue, and profit, both positive and negative aspects of its performance have emerged. The positive impact is seen in ETT’s significant contribution to the economy; in 2023, the company paid MNT 2.7 trillion in taxes and fees, accounting for 11.6% of Mongolia’s budget revenue.

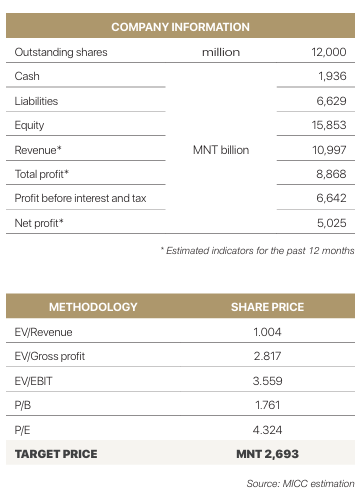

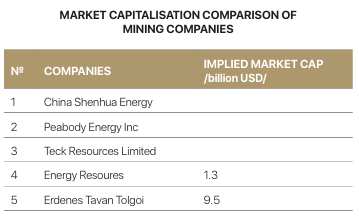

This year, it is expected that this contribution will exceed last year’s, though the precise percentage increase is yet to be determined.” Furthermore, this will serve as a clear example of the Sovereign Wealth Fund Law in action, a topic often discussed by authorities. Thanks to ETT’s successful operations, the government will be able to report tangible progress on the Sovereign Wealth Fund next year. ETT plays a critical role in contributing to the individual savings accounts set to be opened for every Mongolian citizen. Dividends from 34% of the government’s 73.51% ownership in ETT will be allocated to the Savings Fund. Currently, this fund holds dividends from only two state-owned companies, ETT and Erdenet, but will soon benefit Mongolia’s 3.4 million citizens, who will receive dividends from their shares, anticipated to surpass the 2023 payouts. On the downside, ETT’s high profitability has started to draw significant attention from politicians and government officials. This is particularly evident in amendments to the 2024 budget and the proposed 2025 budget. This heavy reliance on ETT’s financial performance presents a substantial risk, as it makes the national economy and state budget vulnerable due to dependency on a single company. ETT has also become a focal point for political interests. As revenues and profits from state owned mines have increased, so too have cases of misappropriation and exploitation. ETT now requires greater transparency and stricter oversight, with governance and accountability as immediate priorities. Another crucial aspect highlighted in the MICC report is the disclosure of ETT’s share price and market capitalisation. The report provides estimates of ETT’s cash, liabilities, shareholders’ equity, revenue, gross profit, profit before interest and tax, and net profit over the past 12 months.” Based on this assessment, MICC estimates ETT’s target share price at MNT 2,693, with a market capitalisation of MNT 32.3 trillion (USD 9.5 billion). This makes the market value of Energy Resources LLC, operating within the Tavantolgoi deposit, seven times higher than its current value of USD 1.3 billion as of October 25, 2024.

This year, it is expected that this contribution will exceed last year’s, though the precise percentage increase is yet to be determined.” Furthermore, this will serve as a clear example of the Sovereign Wealth Fund Law in action, a topic often discussed by authorities. Thanks to ETT’s successful operations, the government will be able to report tangible progress on the Sovereign Wealth Fund next year. ETT plays a critical role in contributing to the individual savings accounts set to be opened for every Mongolian citizen. Dividends from 34% of the government’s 73.51% ownership in ETT will be allocated to the Savings Fund. Currently, this fund holds dividends from only two state-owned companies, ETT and Erdenet, but will soon benefit Mongolia’s 3.4 million citizens, who will receive dividends from their shares, anticipated to surpass the 2023 payouts. On the downside, ETT’s high profitability has started to draw significant attention from politicians and government officials. This is particularly evident in amendments to the 2024 budget and the proposed 2025 budget. This heavy reliance on ETT’s financial performance presents a substantial risk, as it makes the national economy and state budget vulnerable due to dependency on a single company. ETT has also become a focal point for political interests. As revenues and profits from state owned mines have increased, so too have cases of misappropriation and exploitation. ETT now requires greater transparency and stricter oversight, with governance and accountability as immediate priorities. Another crucial aspect highlighted in the MICC report is the disclosure of ETT’s share price and market capitalisation. The report provides estimates of ETT’s cash, liabilities, shareholders’ equity, revenue, gross profit, profit before interest and tax, and net profit over the past 12 months.” Based on this assessment, MICC estimates ETT’s target share price at MNT 2,693, with a market capitalisation of MNT 32.3 trillion (USD 9.5 billion). This makes the market value of Energy Resources LLC, operating within the Tavantolgoi deposit, seven times higher than its current value of USD 1.3 billion as of October 25, 2024.

In comparison to similar coal companies in other countries, the following observations can be made. Overall, it appears that ETT is at the peak of its cycle perhaps at its historical high and maximum market value. Future growth is likely limited, with potential increases estimated at only two to three times the current value. Once the water issue is resolved and the concentrator reaches full capacity and stability, ETT may receive a slightly adjusted valuation. In this context, wise decision-making and sound management are more crucial than ever.

What actions are best in such a peak cycle? Perhaps now is the ideal time to revive ETT shares and consider an IPO.

Article 5.6 of the Law on Minerals states, “A person holding a license for the use of strategic mineral deposits must trade at least 10% of their shares on the Mongolian Stock Exchange.” This provision, which has remained unimplemented since its enactment, will now be put into effect by the government. This decision aligns with the interests of all Mongolians who own ETT shares, enabling them to benefit from a profitable company. Initially, the government valued 1,072 shares at MNT 1 million each. According to MICC calculations, this nominal price has now increased to approximately MNT 2.7 million. ETT shares were issued to citizens following the principles of the Minerals Law; however, trading on the stock exchange did not commence at that time. Now, the next step is to register these 1,072 shares on the Stock Exchange and initiate trading. Currently, Khan Bank holds the largest valuation on the Mongolian Stock Exchange, and a company larger than Khan Bank will further expand the market by listing its shares. Moreover, Minister N. Uchral has frequently emphasised that companies operating in strategic deposits should issue shares and trade at least 10% of them on the stock exchange. If such a policy is genuinely intended for implementation, it should start with ETT, as the company is currently at its peak—its historical high. This is the optimal time to transition to a joint-stock company. By doing so, governance and transparency will improve, alleviating concerns about potential theft.

Mining Insight Magazine, October 2024