Over the past years, Mongolia has been making efforts to enhance its exploration activities and attract foreign investment in its mineral sector. Therefore, it is crucial to hear from foreign-invested exploration companies that have been operating on a large scale in Mongolia. To that end, Ariuntuya.N from Mining Insight interviewed Sam Spring, the President and CEO of Kincora Copper, a company listed on the stock exchanges of Canada and Australia.

As a foreign-invested exploration company operating on a large scale in Mongolia, we are eager to learn more about the latest developments in "Kincora Copper". To start off the interview, could you please provide us with updates on your projects and activities in Mongolia?

Kincora Copper was formed to undertake, and has been, the most active western group for the last decade undertaking regional pophyry copper exploration in the Southern Gobi. We have applied the first modern district scale exploration in this region, lead by an industry leading technical team who have found multiple world-class copper-gold projects. This has resulted in the definition of a large maiden JORC resource, further large exploration targets and securing a mining license at our most advanced project, plus identifying three very large and prospective, but relatively underexplored, porphyry systems.

We have also undertaken active regional project generation across Mongolia, resulting in potentially the largest privately held western party proprietary geological database. The Company worked with government, business associations and IFI’s to proactive advocacate for and support efforts to improve Mongolia’s business environment, to attract capital and bring industry leading geoscience in-country.

In 2019, Kincora was forced to expand its focus outside of Mongolia due to a lack of exploration ground available, and, no new licenses being made available. After a review of jurisdictions for both geological potential and their support for exploration and project development Kincora pivoted its focus to Australia’s world-class porphyry district, in the central west of NSW. Since our entry in NSW we have drilled almost 30,000m, secured 4 new licenses under direct application from the government (securing all historical exploraiton data for free), secured over $600,000 in co-operative funding support from the government to support drilling. We have made the largest mineralised skarn discovery in NSW. In Mongolia, we have sought to bring in new investors to move our Mongolian assets forward - with a different strategy and skill set to Kincora’s. Serious players have looked at the development potential of our assets rather than a focus on broader based regional exploration. Despite the raw attractiveness of Mongolia’s resource sector it is hard for a company our size to do two jurisidictions justice and have two different business strategies.

We are interested to know the amount of investment your company has dedicated to exploring projects in Mongolia, and how the results have been thus far. Could you kindly share your insights with us on these matters?

Kincora has invested considerable time and capital in its Mongolian focussed project acquisition and exploration strategy in Mongolia - which has seen over C$60 million being written off to date. Since 2011, Kincora has completed three corporate transactions in Mongolia and drilled two further project generation opportunities under option as part of due diligence. A peak landholding of 13 licenses covering 1689 km2 has been systematically explored and refined to 3 licenses covering 321 km2. We have drilled 58,665 metres (147 holes) at six projects in the Southern Gobi. This effort has resulted in a maiden 194 Mt JORC resource and further 100-300 Mt exploration target at the Bronze Fox project. Drill targets and further field activities are warranted at a further two poprhyry complexes.

In 2021, a dispute arose due to the General Department of Taxation issuing a tax deed related to the transfer of the Mineral License to Kincora Copper. Could you please update our readers on the current status of this process, and share your company's position on this dispute?

Due to Kincora’s public market disclosure obligations, being listed on the ASX (in Australia) and TSXV (in Canada), a recent announcement was made on this (March 3rd). This was because of our application to the Supreme Court, which is a material development for our Company. Due to the ongoing judicial process it is not possible to say anything more than what is in those detailed releases. In summary, for over two years Kincora has been defending a reassessed tax notice from the General Deparment of Taxation for a retrospective assessment relating to a transaction that occurred in 2016. The reassessed tax demand was calculated based on historical invested capital for exploration licenses that had already been returned to the government and written down to zero. No profit or cash consideration was made, and will never be made on these licneses or the transaction that is the focus of the reassessment. A prior tax audit took place, and tax paid based on the transaction. This prior tax act was relied upon by the counterparties, Mongolian public sector entities and foreign regulators to close the transaction. It was also relied upon by investors (including the EBRD) and resulted in significant FDI and exploration in Mongolia. This is what Kincora is seeking to defend in the judicial system. The reassessed tax act was also received after the statute of limitation had passed and we have had conflicting rulings by different courts to date. This ongoing dispute has already curtailed a number of potential significant third neighbour investors seeking to partner with Kincora, to push development of Kincora’s remaining assets forward and to invest in other new opportunities.

While we are trying to protect our company’s shareholders interest in the courts I am also concerned that our tax dispute sets a wider precedent for Mongolia as an investment jurisdiction.

From conversations with interested investors in our projects, and other opportunities in Mongolia, including major mining companies, our case is viewed that way.

From an investor's perspective, how do you evaluate Mongolia's investment and tax environment? What are the advantages and disadvantages, and what issues do you think need to be improved or addressed?

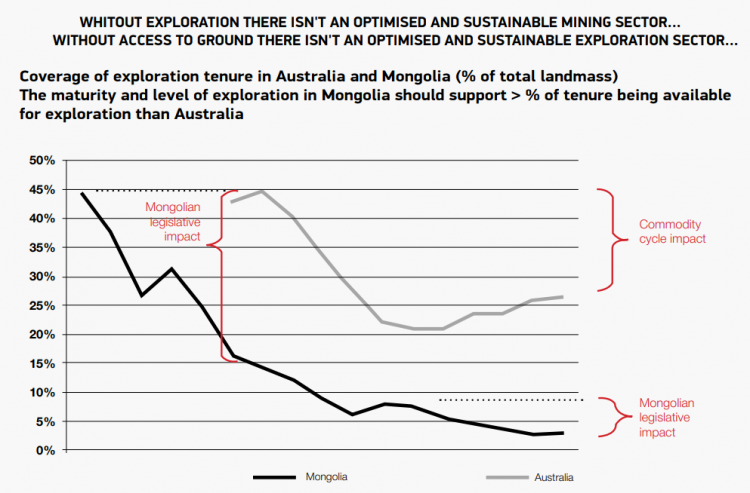

Mongolia is widely regarded has having very prospective geology and given the relatively unexplored nature of the country there is significant potential for new globally significant discoveries – this is a major advantage. But to understand and realise that undiscovered potential there needs to be significiant investment and over a sustained time period – eg Kincora writting off C$60m to date over a decade. To attract that capital and specialist knowledge a favourable, and globally competitive, investment and tax environment needs to be in place – this applies to all jurisdictions. Exploration licenses have often been treated like a speculative asset to be traded, not actually explored and invested in, and the tax and legislative environment has in the past supported this. As discussed, Kincora pivoted to NSW because of the inabilty to contiue to have a sustainable regional exploration business, due to lack of exploration ground available and no new licenses being made available – as per Chart 1. I know there is a draft Minerals Law under supporting framework to ensure competent groups are capable of supporting the very significiant investment and modern exploration techniques required to result in the next generation of mines.

According to recent evaluations, Mongolia's ability to attract investment is weak. What do you think are the main reasons for this, and how can this issue be addressed?

Oyu Tolgoi’s undergound development recommencing should see wider foreign investment significantly increase. However, serious new investors do country due diligence to see how existing investors are being treated - before investment flows. While the OT underground is moving forward, thier very significant tax dispute remains and other existing investors issues aren’t resolved, As mentioned, the various items the business associations have been raising are impacting investment, and many will be wanting to see positive and tangible actual action and change before investing. Our ongoing tax dispute is impacting our ability to bring investment to Mongolia and unfortunately is an example investors are paying attention too. On the bright side, it has the potential to be a legacy issue that we believe can be resolved by the courts, in-line with an original ruling that resulted in significant investment into the country and was supported by 4 independent legal opinions. Kincora is not OT but we believe resolution would be a major positive for Mongolia.

Following the amendment of the Constitution, the revision of the Minerals Law and changes in a number of laws related to the activities of the industry are being discussed. What problems do you think needs to be made more clear and understandable in the state regulations for improvements in the mining sector?

Increased transparency and consistency in any jurisdiction is a positive, particularly given the long term and significant capital commitments required in the exploration and mining sector.

Moves toward globally competitive benchmarks and tax regimes are also very important. Increased investor protection mechanisms are also a major positives in any jurisdiction. I trust the business associations are putting forward a comprehensive set of reforms, which are focussed significantly on attracting competent private sector groups and the required funding sources to back longterm investment.

Your company intends to actively seek and implement new exploration projects in Mongolia. However, areas with potential resources have already been relatively well explored. Is there still an opportunity for high-level exploration in Mongolia?

While Kincora’s focus for regional exploraiton is now in NSW, I very strongly believe there is excellent potential for the discovery of new globally significant and mid tier mines in Mongolia. It must be remembered that it took until hole 270 and the discovery of the Hugo mineralised system to transform Oyu Tolgoi to a world-class asset, almost a further 120 holes since the SW Oyu discovery hole. Ivanhoe Mines and Rio Tinto spent almost US$ 1 billion in direct expenditure (ex the multiplier effect amongst other sectors) before construction commenced, so the value of the exploration sector to national and regional development should not be underestimated. Erdene Resource’s disciplined ongoing exploration and discoveries in their Bayan Khundii project is turning a great high grade gold disovery into a new district. They have acheived this in a relatively quick time by industry standards, but it has still taken a decade. These are just two good examples, and remembering Chart 1 and the lack of exploration license coverage, and previous private sector exploration expenditure, in Mongolia.

What steps should be taken to intensify the development of the geological exploration sector?

This is a matter for government - politicians and the key ministries. Should they get the law and bureaucratic processes right then significant investment flows should follow. This is part of what is required to attract international capital. Globally this has been proven time and time again. Only government can provide the tax and business environment to enable the private sector to invest the significant time and capital required to exploit this sectors potential, but it should be the private sector doing the work and spending the money, the government setting the framework and recieving the resulting taxes and royalties that the private sector generate.

What changes and trends are occurring in the investment and exploration policies of the mining sector in many countries in relation to the global policy against climate change and green promises? What opportunities and risks will this bring to Mongolia?

The worlds move towards decarbonisation has huge implications to the resource sector and all individual countries.

Mongolia’s existing copper endownment, and wider copper and other critical minerals potenital, present huge opportunities. However, first getting the investment attractiveness settings right is needed.

A major risk to Mongolia’s economy is the global trend away from coal and carbon given the very significant contribution the coal industry currently makes to Mongolian GDP. A prudent medium term strategy would be to continue to exploit the coal sector in Mongolia, because there is a global competitive advantage for this sector, but diverisfy and grow more in other sectors.

The mining industry has played a significant role in Mongolia, but opinions on its impact on society and the economy are divided. Starting a new mining operation is increasingly complicated, and developing and maintaining sustainable long-term relationships between stakeholders continues to be a challenge. What is the international attitude on this issue?

Yes, a similar situation and trend is occuring all around the world – these circumstances and opinions are not just in Mongolia. Great ESG approaches are needed to gain and retain regional support for projects. Developers are up for these challenges but increasingly look at country level. Transparency and having a globally competitive tax and business environment, from the federal to community level. They look for the barriers that they feel may be insurmountable and where these are perceived they move quickly to review other jurisdictions.

Thank you for the interview.

Mining Insight Magazine, march 2023