MISHEEL.E

Mongolia is embarking on a groundbreaking initiative, establishing its inaugural plant for the transformation of crude oil resources into a diverse array of finished products to cater to domestic demands. In parallel with the oil processing endeavor, the groundwork for a petrochemical raw material production facility is also being laid. It hasn't been long since the decision to initiate the final phase of the four-stage factory construction was made. The construction of this facility is currently in progress, with active involvement from the "Mongolian Oil Refinery" SOE in collaboration with companies from India and China. In this regard, the head of the government has instructed the pertinent authorities to ensure the plant's operational readiness by the year 2027.

FIRST TASK

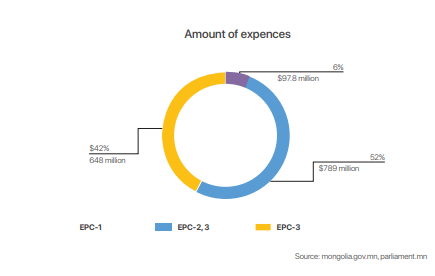

The construction of the plant, situated in Altanshiree soum within the Dornogovi province, is undergoing four distinct phases. The first phase of this endeavor is slated for completion and handover to the government by the year 2023, with both the EPC-2 and EPC-3 packages already in progress. Importantly, all stages of the factory are executed concurrently; there is no sequential approach where one phase finishes before the next commences. The project is being carried out holistically as a complex operation. In the context of the EPC-4 package, which encompasses seven key works employing state-ofthe-art technology, construction of the hydrocracking facility, sulfur separation facility, and hydrogen plant is scheduled to commence next year. In September, a decision was made to channel financing amounting to USD 236 million to the Export-Import Bank of India (Exim). Among the final batch of works, the three aforementioned facilities hold particular significance. The hydrocracking technology facility primarily focuses on the production of diesel and jet fuel, with the technology license to be obtained from "Honeywell UOP," a renowned American company with over a century of experience in technological development. The sulfur separation facilities serve to extract sulfur from various sulfur compounds, yielding elemental sulfur. The tender for the desulfurization license was won by the French company "Axens," specializing in enhancing oil efficiency. Additionally, numerous processes within the petroleum industry necessitate a hydrogen-rich environment, and the responsibility for the hydrogen production facility rests with the Italian firm "Kinetics Technology." "Kinetics Technology" boasts a global presence with branches in over 30 countries, making it a significant player in the industry.

LOANS

The Government of India has been flexible in terms of credit. Last August, a representative of the Indian "Exim" bank came and got acquainted with the process of the factory. Also, according to our proposal, the repayment schedule has been postponed, and the financing of EPC-02 and EPC-03 project loans has been extended for 7 years. In other words, starting in 2030, the loan of USD 789 million USD for the EPC-2 and EPC-3 package works will begin to be paid. Recently, the total funding of four sets of works has reached USD 1.534 billion. The amount of loans shows that India attaches great importance to the Mongolian Oil Refinery project. As of last year, India is implementing 162 projects worth USD 14 billion in five neighboring countries. An average of USD 88 million per project. In addition, one project in Africa is worth USD 39 million.

SECOND TASK

The essential raw materials required for the factory are sourced from the East. Construction of the raw material pipeline, undertaken by the contractor company "Norinco International Cooperation," commenced in June of the previous year. By early September, one-fifth of the pipeline had been successfully welded. Up to this point, a total of 110 kilometers of pipelines have been welded, with 71 kilometers undergoing radiographic testing. The completion of the pipeline work is a prerequisite for commissioning the plant. The Chinese stateowned company is on track to deliver the project by 2025, although the precise timeline depends on our ability to fulfill the offtake contract. "Erdenes Mongol" LLC, the parent company of Mongolian Oil Refinery SOE, bears the responsibility for financing the pipeline. Additionally, the involvement of the Ministry of Foreign Affairs, which played a crucial role in establishing the offtake agreement, is indispensable. The detailed design of the pipeline is being executed by the Canadian firm "Worley Parsons." Founded in 1971, this company boasts a wealth of experience in diverse industries, including oil, chemicals, sulfur technology, energy, minerals, and mining projects. With a presence in 46 countries, "Worley Parsons" is currently engaged in over 25,000 projects worldwide.

THE LAST TASK, THE OBSCURITY OF RAW MATERIALS

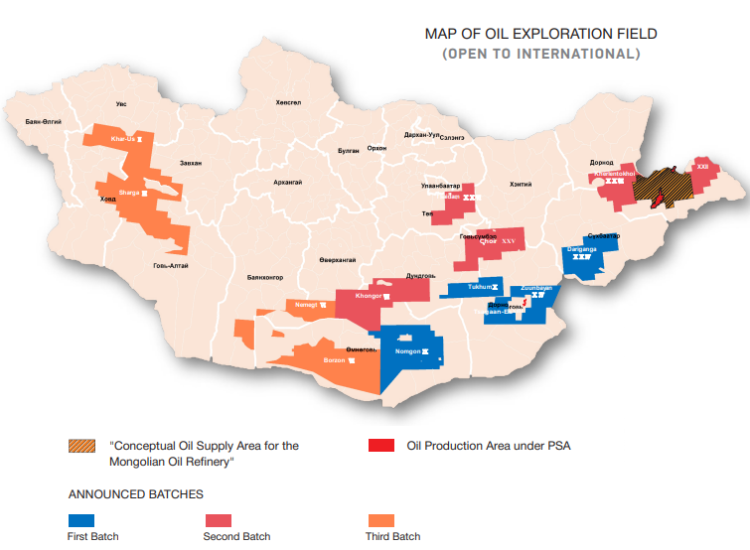

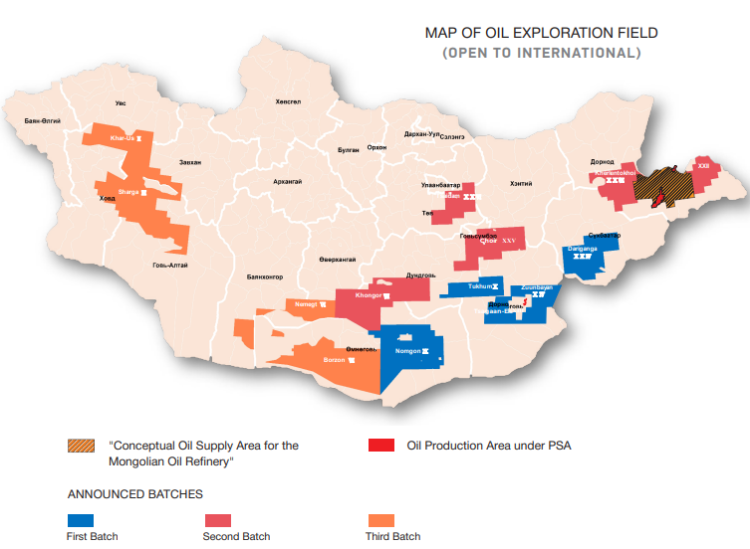

Presently, the plan for the oil supply required by the plant involves sourcing from three distinct locations. Preliminary estimations from China's "PetroChina Dachin Tamsag" LLC indicate an allocation of 47.5 percent of the oil from the Tamsag XXI and TosonUul XIX fields and a 5 percent contribution from the Zuunbayan field. There are also exploration intentions for the Davst XXXI field under the Refinery. Both of these Chinese companies export their products, and a smaller quantity will be extracted from the Zuunbayan deposit. Notably, exploration activities for the Davst XXXI field have not yet commenced. Last year, the two fields operated by "PetroChina Dachin Tamsag" LLC yielded 339,000 tonnes of oil. Consequently, when compared to last year's production, it is feasible to satisfy over 10% of the factory's oil requirements. Mongolia's Mineral Resources Fund currently registers oil reserves of 333 million tonnes, but the assured reserves available for utilization amount to 43 million tonnes. Over 90% of these resources are concentrated in the Tamsag XXI and Toson-Uul XIX fields. Therefore, the priority is to initiate exploration activities in the Davst XXXI field. Furthermore, it is essential to advance negotiations for the 15 open tenders, starting from November 2022, with five of them in the Production Sharing Contract (PSC) stage. On the international stage, oil field exploitation typically takes 5-10 years. In our country, the contract for the Toson-Uul deposit was signed in 1993, but the actual oil production boom didn't commence until 1996. Additionally, it's worth exploring the possibility of enhancing the capacity of the two deposits operating under PSC agreements. If such an enhancement is feasible, it would be prudent to initiate discussions at an early stage. In the previous year, the Toson-Uul field yielded 1,050 tonnes of oil per day from 491 wells, averaging 2.1 tonnes per well. Meanwhile, the Tamsa field produced 1,150 tonnes per day from 311 wells, with an average of 3.6 tonnes per well. However, it's important to note that monthly production figures can vary. For instance, in August 2022, Tamsag recorded its highest production at approximately 31.5 thousand tonnes, while production significantly decreased in April. When comparing the highest production month to the lowest, this translates to a potential annual production of 378,000 tonnes for Tamsag, extending its guaranteed service life to 53 years. As for Toson-Uul, annual production close to Tamsag's figures is achievable, with a guaranteed reserve similar in magnitude. Under the production sharing agreement, the two fields collectively produced around 355,000 tonnes of oil last year. Nonetheless, experts suggest that the likelihood of a natural gusher occurring at either deposit has decreased. It is worth noting that Mongolia produced over 1 million barrels of oil between 2014 and 2017, indicating the potential for further production. However, the approach—whether to rely on existing wells, explore new ones, or pursue a combination of both—remains a subject of speculation and uncertainty. Considering current progress, the crude oil pipeline construction is set to conclude in 2025, three sets of plant facilities will be completed in 2026, the first EPC-4 facilities will be commissioned, and the initial product will be manufactured by 2027. Nevertheless, the question of ensuring a dependable raw material supply remains a topic of ongoing consideration. Delays could result in increased loan-related expenses as time passes.

Mining Insight Magazine №09 (022)