MISHEEL.E

misheel@mininginsight.mn

Technologically developed nations have been actively seeking efficient and sustainable ways to utilize electricity, particularly since the 1800s. The rapid growth of industrialization has led to widespread daily consumption of coal, oil, and natural gas, resulting in a significant increase in atmospheric carbon dioxide levels. As these levels surpass the acceptable threshold, it has become crucial for humanity to prioritize the concept of greenhouse gases and take appropriate measures.

The Earth's surface temperature is influenced by changes in the composition of gases in the atmosphere. To mitigate this impact, one solution is the adoption of hydrogen as an alternative fuel source. One method to achieve this is through the production of hydrogen fuel from coal. In 2017, Japan, a renowned technological powerhouse, unveiled the world's first comprehensive national hydrogen strategic plan. Mongolia has been actively involved in a collaborative initiative within this plan.

During the National Conference on Industrialization held on May 26, 2023, the Chairman of the Coal Deep Processing Sub-Committee of the National Industrialization Committee and Chairman of the Policy Council of Mongolyn Alt LLC Nyamtaishir. B delivered a speech titled "Factors Influencing the Revival of Industrialization." In his speech, he covered the following solutions:

▶ Energy sources, transmission lines, and networks;

▶ Water supply solutions;

▶ Steel production and supply;

▶ Development of the building materials industry;

▶ Legal environment;

▶ Supply of workforce and human resources;

▶ Products that meet high international standards;

▶ Funding sources.

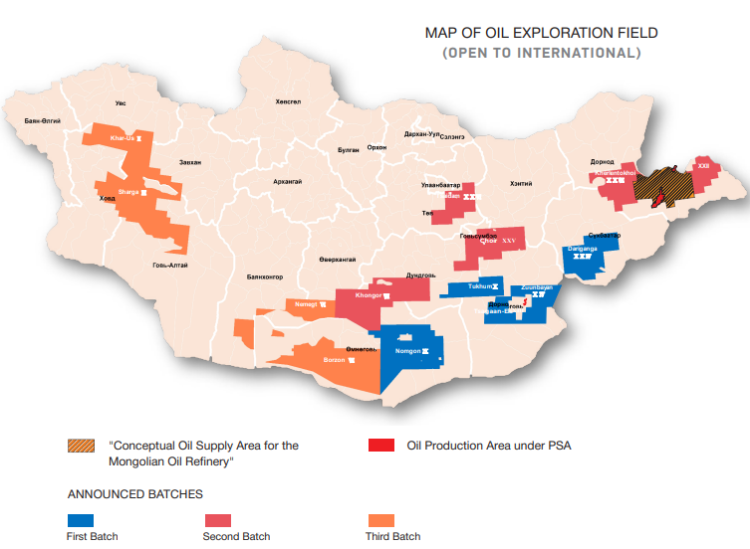

It is important to highlight that Mongolia possesses significant potential for the deep processing of coal within the heavy industry sector, which can be further developed soon. In September 2022, the Office of the President of Mongolia formed a Working Group on the Hydrogen production and it is derivatives project. The group comprised deputy ministers from various ministries, state secretaries, and coal-chemical scientists. Significant progress has been made in this area, and it is worth mentioning some of the accomplishments. Developed nations worldwide view hydrogen production as a key energy trend for the future. While some countries produce hydrogen from natural gas, Mongolia, with its abundant coal reserves, has the opportunity to develop hydrogen production through coal gasification. In October of the previous year, a research team composed of our Working Group and international research companies, including Mitsui and Unico International, was established. The initial research focused on identifying suitable regions in Mongolia for hydrocarbon extraction with minimal carbon dioxide emissions during processing. It was determined that the eastern part of Mongolia, particularly near Choibalsan in Dornod Province, holds approximately 1.7 billion tonnes of lignite reserves, deemed suitable for further development. Water plays a crucial role in the development of the coal-chemical industry.

The Kherlen River, which flows into China, provides ample water potential. In terms of workforce, Choibalsan boasts a skilled labor pool. The region also benefits from well-developed infrastructure, and the construction of the Choibalsan-Khuut-Bichigt railway line is set to commence soon. It is important to note that this railway line will be built with a narrow gauge of 1435 mm. This choice is made to facilitate the transportation of chemical products over an 800 km rail journey from the Bichigt port to the Jinzhou seaport in China without the need for transshipment. The Japanese side considers this option to be the most feasible and practical. Following the completion of the feasibility study, a pilot gas plant will be constructed. Given the limited infrastructure and utilization options, dimethyl ether is the preliminary intermediate product for hydrogen production. The cooling and liquefaction of this gas are cost-effective and allow for easy conversion back into a gaseous state. Consequently, the heat requirements of Ulaanbaatar city can be met by transferring it to gas boilers and utilizing coal combustion. This plan also includes the possibility of incorporating a gas turbine for electricity generation. Furthermore, the production of methanol from A92 gasoline will lay the foundation for the chemical industry's expansion into various sectors such as synthetic materials, paints, varnishes, linoleum additives, paint thinners, and raw materials for plastics.

The construction of this pilot plant is being urgently carried out in collaboration with the Japanese side. Upon successful implementation, the possibility arises for establishing a hydrogen plant for export to the Eastern region, along with a power plant utilizing the coal reserves in Shivee-Ovoo, Tavantolgoi, and Altanshiree, located in Choir. Additionally, a plant will be developed to serve as the foundation for various chemical plants mentioned earlier. Through these initiatives, we aim to effectively utilize coal resources, promote economic circulation, and generate valueadded products. Nyamtaishir.B is spearheading the efforts as the head of the working group in partnership with Japan to establish the hydrogen plant. Now, let's delve into the consumption, production, infrastructure, and transportation aspects of hydrogen derived from coal.

HOW IS THE SITUATION IN JAPAN?

Japan has taken the lead among developed nations in the transition to hydrogen by implementing the world's first national hydrogen strategy. Hydrogen fuel holds immense potential for a diverse range of applications, including steel, chemicals, the oil industry, shipping, air transport, automobiles, heavyduty vehicles, buses, locomotives, home heating, and energy extraction. Notably, the International Energy Agency (IEA) highlights the significance of hydrogen as a clean energy source, as it produces water as a byproduct after use. Despite being developed for car power two centuries ago, the widespread adoption of hydrogen fuel for everyday use has been limited due to challenges such as high production costs, distribution infrastructure, and availability. To address these inefficiencies, Japan introduced its National Hydrogen Strategy in 2017. The strategy aims to increase hydrogen consumption to three million tonnes by 2030 and 20 million tonnes by 2050 while reducing costs by one-third compared to 2017 levels. Additionally, by 2030, the plan targets 800,000 hydrogen-fueled cars and the construction of 900 hydrogen-fuel stations. This Japanese initiative is a continuation of the New Energy and Industrial Technology Organization's 1993 plan to establish an international hydrogen energy network.

AUTOMAKERS IN THE HYDROGEN FUEL INDUSTRY

Japanese automakers have actively participated in the ambitious endeavor of creating a hydrogenpowered "society." In 1992, Toyota Corporation, one of the world's largest car manufacturers, initiated the development of a hydrogen-fueled vehicle. This led to the introduction of the hydrogen-powered Mirai electric car in 2014, which has sold 21,475 units as of November 2022. Additionally, Honda, a global top-ten automotive company in terms of sales revenue, announced in February of last year its plans to introduce a new hydrogen-fueled vehicle next year. Before this, Honda had already launched the Clarity model as part of its commitment to hydrogen-powered transportation. Hyundai, a prominent automobile manufacturer from South Korea, is another key player in the production of hydrogen-powered cars. Since its introduction in 2018, Hyundai's Nexo model has sold over 30,000 units, with the domestic market accounting for more than 90 percent of the sales. Currently, both Toyota and Hyundai focus exclusively on producing and marketing hydrogen-powered vehicles. According to a report by the IEA, there were approximately 72,000 hydrogen fuel cell vehicles (FCVs) globally last year. Additionally, a late 2022 study by Information Trends revealed that there are over 1,000 fueling stations worldwide to support these vehicles' fueling requirements.

HYDROGEN TRANSPORTATION

o overcome the challenges posed by the lower density of hydrogen, it can be converted into denser forms such as ammonia and methanol. These denser forms enable transportation in smaller quantities through pipelines and trucks. Transportation presents one of the major challenges in the widespread adoption of hydrogen. To address this issue, Japan has conducted significant experiments in sea transport. Last year marked a milestone as hydrogen was transported in liquefied form for the first time from Australia. Kawasaki Heavy Industries, with the support of the Japanese and Australian governments, constructed the Suiso Frontier, a vessel with a capacity of 1,250 m3 or approximately 416 tonnes of liquefied hydrogen, specifically designed for this type of transportation. The pioneering liquefied hydrogen transport took place from the port of Hastings in southeastern Australia to the port of Kobe in southern Japan, covering a distance of 10,203 km. The successful delivery to the port of Kobe was made possible due to the establishment of the world's first liquefied hydrogen terminal by Kawasaki Heavy Industries in 2020, with support from both governments. The Kobe LH2 terminal is the largest of its kind in Japan, featuring a 2,500 m3, 19-meterhigh spherical storage tank capable of storing liquefied hydrogen at -235 degrees Celsius for extended periods. Despite Japan's possession of 37 LNG terminals, the construction of new facilities is challenging due to the high costs associated with converting existing storage facilities. The disparity in storage temperatures necessitates significant investment in additional insulation, which often incurs costs comparable to those of new construction projects.

OTHER HYDROGEN PROBLEMS

Hydrogen is widely recognized as a 100% sustainable energy source. Its appeal stems from the fact that it enables the potential for zero greenhouse gas emissions and can be generated from a diverse range of resources. This versatility and ability to produce hydrogen sustainably contribute to its classification as a sustainable energy option. The global demand for hydrogen reached 120 million tonnes last year. Primarily, hydrogen finds extensive use in the fertilizer and oil refining industries. However, the demand is expanding to encompass sectors like transportation, including vehicles, and residential applications. To support the growing adoption of hydrogen-powered vehicles, the establishment of fueling stations becomes crucial. In terms of hydrogen fuel distribution stations, China currently leads with 250 stations, followed by South Korea with 213, Japan with 161, and both the European Union and the United States with around 100 each. Notably, the majority of hydrogen filling stations in the US are concentrated in California, where the purchase of Japanese Mirai cars surpasses the domestic market. This trend aligns with the province's dedicated efforts to combat greenhouse emissions.

As part of the US hydrogen strategy, there are plans to construct 5,000 hydrogen fuel stations by 2032. Considering the average range of 500 km for the Mirai model on approximately 5 kg of hydrogen fuel, Japan's projected fleet of 800,000 FCVs would require approximately 4 million tonnes of hydrogen fuel at any given time. In terms of household use, hydrogen can be utilized to generate electricity and heat through a process similar to FCVs. One notable advantage is that this reaction does not produce any unpleasant odors or leave behind dirty waste. Currently, countries that have formulated strategic plans are actively conducting research in this area. Since Japan introduced its initial national hydrogen strategy in 2017, a total of 30 countries have followed suit by launching and developing their national hydrogen strategies. Notably, the United States has recently announced plans to invest a substantial amount of USD 470 billion in its hydrogen strategic plan. This comprehensive strategy aims to achieve the production of 50 million tonnes of hydrogen by the year 2050. According to the IEA, in 2021, 47 percent of the world's hydrogen production originated from natural gas, 27 percent from coal, 22 percent from oil byproducts, and 4 percent from electrolysis. Notably, the leading importers of hydrogen include the United States, Netherlands, Singapore, Germany, France, and Mexico. On the other hand, the leading exporters are Belgium, Canada, the Netherlands, the United States, Germany, and Malaysia. Of significance, the United States holds the position of both the largest importer and exporter of hydrogen. This is attributed to its focus on supplying hydrogen to the European Union and Japan, leveraging the relatively low production costs associated with natural gas. Belgium and the Netherlands, on the other hand, engage in both exporting and importing hydrogen due to price differentials in the market. The global efforts towards making hydrogen a commonplace energy source are evident from the strategic plans implemented by various countries.

Japan, in particular, carries the responsibility of leading this transition. Given its geographical location, Japan aims to meet its domestic hydrogen demand by transporting hydrogen in a diluted form. This approach allows them to effectively address their internal requirements and ensure a reliable supply of hydrogen. The growing interest in extracting hydrogen from coal is evident through collaborative research efforts with Mongolia. Given Mongolia's abundant coal reserves, it is crucial to translate this potential into practical applications. As part of the National Industrialization Committee, four sub-committees have been established, including the Coal Deep Processing Sub-Committee. Led by Nyamtaishir. B, Chairman of the Policy Council of Mongolyn Alt LLC, who possesses over 10 years of experience in coal deep processing research, the industry perceives this appointment as a valuable opportunity to advance practical implementation in this field.