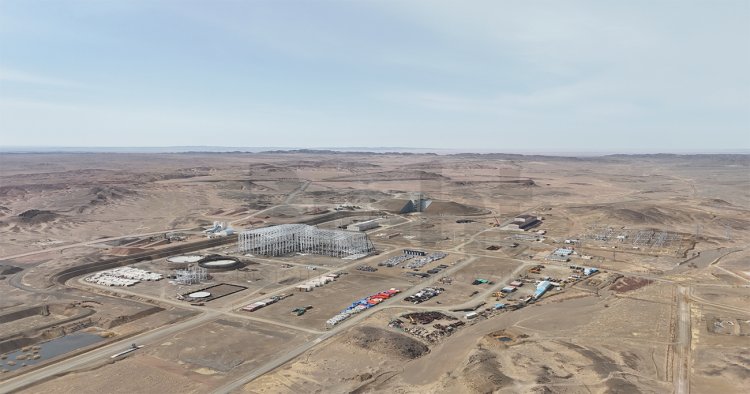

At the Tsagaansuvarga project construction site, the apex is marked by the primary crusher facility, situated alongside the openpit mine, reaching an elevation of approximately 80 meters. From this vantage point, one commands a panoramic view of the entire factory construction. To the right lies a mound of sand and gravel, where a sifting machine intermittently stirs up dust. Beyond stretches the Cathode factory, accessible via a striped road. Trucks sporadically traverse the area, as preparations for construction continue in the mine. In the background, the distant hum of an excavator redistributing soil adds to the ambient soundscape.

The stark gray facade of the concentrator building catches the eye, its metallic sheen appearing somewhat unfamiliar. Prior to the factory's closure, the equipment remained in this state for an extended period, awaiting the installation of largescale machinery that cannot pass through the entrance. It's imperative to install and seal the equipment before the onset of cold weather. Engineers at Tsagaansuvarga have indicated that work within the concentrator will be finalized during the winter following its closure. Next to the concentrator stands the newly finished orange edifice of the Concentrator Maintenance Center, mirroring the characteristic hue of Tsagaansuvarga's mine structures, reminiscent of the surrounding natural landscape's orangeyellow tones. A road delineates on the left side of the concentrator, bifurcating to lead one path to the Staff Building and the other to the Technical Repair Center. Despite its comparatively smaller resource deposit when compared to Erdenet and Oyu Tolgoi, Tsagaansuvarga is poised to emerge as Mongolia's third copper beneficiation production facility. Construction on the project was proceeding at a rapid pace for some time before coming to a halt due to politicization, leaving the project site deserted and silent for several years. However, as of last year, construction activities have resumed, with representatives from the contracting companies now regularly visiting the project site from its inception. Mine stripping had commenced but was abruptly halted. Plans entail opening a mine spanning 1,900 meters in length and 800 meters in width. Essential heavy equipment for mining tasks is largely prepared and awaiting deployment. One of the primary challenges encountered when initiating a new mining venture is often the resistance from the local community. When queried about this issue, Mungunjoloo. B, head of mining, remarked, "Our deposit resides within the bounds of Dornogovi province. The commencement of construction activities has been met with enthusiasm by both the local populace and administrative authorities. They frequently inquire about our progress." Recognizing the substantial influence that the establishment of large factories and mines can have on not only national development but also the local community, residents appear to be increasingly supportive of the endeavor. After completing his duties overseeing the construction of the Shiveekhuren terminal, Mungunjoloo was tasked with leading the construction efforts at Tsagaansuvarga. With over a decade of experience at Mongolyn Alt (MAK) LLC, he stands as one of the seasoned engineers within the organization. His commitment to the Tsagaansuvarga factory remained unwavering. "Ore extraction will encompass high, medium, and lowgrade varieties. However, the plant requires ore of 0.59 grade. Thus, the initial years will see a blend of lowgrade ore with higher grade counterparts. Our facility employs two primary methods: flotation and sulfuric acid leaching,” he emphasized the significance of this process, highlighting its importance akin to handling precious materials. The appearance of the concentrator, crusher, and ongoing construction bears a striking resemblance to the early stages of the Oyu Tolgoi mine. It's almost like a scaleddown version of Oyu Tolgoi.

Yet, an unconventional approach is underway to address a portion of the energy requirements through solar power installations.

It appears that prominent mines worldwide, particularly copper mines, are trending towards integrating renewable energy solutions to mitigate their energy consumption. This initiative stems from a grand aspiration to produce and distribute pure copper, vital for the technology of a sustainable future, and to achieve zero carbon emissions from inception. It seems that MAK LLC is equally invested in this endeavor. On the flip side, ensuring dependable energy consumption remains a pressing priority. An additional 65 MW of energy is imperative to sustain the mine's regular operations. Presently, a 156 km long, 220 kW twocircuit overhead transmission line has been installed, originating from the Tavan Tolgoi site. Energy supply emerges as a foremost challenge upon the inauguration of new factories and industrial complexes, not solely in remote areas but also within Mongolia. "Next year, with the inauguration of the Tsagaansuvarga concentrator plant, we anticipate the production of 138,000 tonnes of copper concentrate," revealed Ganbaatar. J, the Minister of Mining and Heavy Industry, during a discussion with international buyers on the topic "Trading Copper Concentrate through the Exchange." Consequently, the trio of Mongolian copper producers is poised to collectively yield an average of 2.1 million tonnes of copper concentrate annually, thereby contributing to the energy transition supply chain.

TSAGAANSUVARGA’S DELAY AND KAMOA KAKULA'S ADVANCE

The commencement of the Tsagaansuvarga construction is indeed a positive development. Nevertheless, MAK LLC has yet to disclose the extent of time lost and property damage incurred during its delay. However, the emphasis remains on expediting the project with precision and quality. This significant endeavor is anticipated to yield a profound impact on the nation's economy, underscoring the urgency of its timely completion. There's a prevailing notion that any project exceeding USD 1 billion in investment qualifies as a mega project. With Oyu Tolgoi (OT) as a prime example, Mongolians have gained profound insights into the substantial economic impact such mega projects wield. However, considering this criterion, no mega project of comparable scale has materialized in Mongolian mining since OT. Economists have long cautioned that amidst the OT underground production from project to operational stages, other sizable investment ventures should be pursued to leverage this pivotal phase of development. Especially over the past two years, the Mongolian government appears to have overlooked the crucial support required for domestic businesses, instead prioritizing the stimulation of the economy through a sudden surge in coal exports, foreign investment attraction, and the execution of mega projects. However, it's essential to acknowledge the inevitable fluctuation in coal prices and the potential reduction in demand from China, our primary market. History has shown such occurrences in the past, underscoring the need for Mongolia to diversify its revenue sources and be prepared for such eventualities. In the event of a significant disruption to foreign exchange income and tax revenue, there's a risk of a rise in the exchange rate of USD, budget revenue interruption, and consequent economic downturn. Therefore, it's imperative for the government to consistently address the question of how to substitute the income derived from coal exports and proactively prepare for such scenarios. At such a time, the importance and benefit of the mega project implemented in the country is the most important.

Presently, the most prepared project in the mining industry is Tsagaansuvarga, a mega project boasting an investment exceeding USD 1 billion.

While it may not rival OT in scale, the implementation of the Tsagaansuvarga project is poised to yield significant positive impacts on Mongolia's economy. As highlighted earlier, the construction phase alone is anticipated to generate thousands of new jobs, providing employment opportunities and income for hundreds of companies. According to project data, approximately 1,300 direct jobs will be created, with an additional 5,0007,500 jobs indirectly. Moreover, it's projected that at least 100150 companies will participate in the project's development. Beyond these numbers, the focus will be on fostering stable and highquality employment opportunities for Mongolian companies and youth. Furthermore, based on the feasibility study, it's projected that the state will receive an average of over USD 230 million in annual tax revenue. A significant portion of these funds will flow through the recently legalized Wealth Fund, ultimately benefiting the entire population. Another notable aspect of Tsagaansuvarga is its status as a Mongolian national company, ensuring that all foreign exchange earnings are processed through Mongolian banks. With an average annual export income of approximately USD 770 million, this signifies that FX can circulate through Mongolian banks and remain within the country. Tsagaansuvarga aims to avoid the long standing criticism directed at OT regarding the necessity to channel income through domestic banks. Thus, the positive economic impacts of mega projects can be exemplified solely through the case of Tsagaansuvarga. However, it appears that our nation has become overly reliant on the sudden influx of coal revenue, exhibiting indifference towards the prospect of new mega projects on the horizon. Moreover, Tsagaansuvarga holds immense significance for Mongolia's positioning within the newly evolving global raw material supply chain. As nations worldwide race to identify coal as a primary contributor to greenhouse gas emissions and strive to transition towards a cleaner, greener future, the importance of investments in clean and sustainable technologies becomes pramount. Countries that curtail coal consumption and emerge as producers of raw materials and technologies crucial for this green transition gain prestige, with their leaders and companies regarded favorably. Consequently, a novel concept has emerged: the raw material and technology supply chain, pivotal for nurturing a green future. Nations endowed with abundant reserves of critical raw materials like copper and lithium are diligently working to secure their position, if not ascend as major players within this burgeoning supply chain landscape. Nonetheless, Mongolia's economy remains heavily reliant on coal, and solely focusing on it poses a significant risk of falling behind in the race to secure a position within the evolving global supply chain. Presently, Mongolia appears entrenched in coal centric pursuits, resembling a child fixated on a single toy. However, the introduction of new projects geared towards extracting and supplying copper and other raw materials essential for a sustainable future will inject diversity into the economic landscape. Subsequent projects following this trajectory have the potential to alter Mongolia's backwardfacing stance, diversifying its economic outlook.

With the Tsagaansuvarga project in operation, an average of 320 tonnes of copper concentrate will be annually produced and supplied globally. When combined with the production from Erdenet and OT, Mongolia's copper concentrate output is expected to peak at around 3,000 tonnes, resulting in a supply of over 1 million tonnes of pure copper. This copper holds immense significance in the context of a green and clean world, positioning Mongolia prominently within its supply chain and offering an opportunity to solidify its standing. By being a major supplier of green raw materials rather than one tainted by coal, Mongolia stands to bolster its economy and society significantly. These copper suppliers comprise foreign invested firms, stateowned enterprises, and domestic private companies, each with varying levels of equity participation and investor involvement, akin to the model observed in Chile. Interestingly, the Kamoa Kakula deposit in the Democratic Republic of Congo, whose reserves were discovered after those of Tsagaansuvarga, yielded 400,000 tonnes of copper last year alone. Within the span of two years, it is projected to produce 650,000 tonnes of copper—surpassing Mongolia's current production levels. Developed by Robert Friedland, an individual with longstanding ties to Mongolia, the Kamoa Kakula project has been implemented at an impressive pace over the past 14 years. While the Kamoa Kakula deposit was initially unearthed in 2008, the feasibility study for Tsagaansuvarga was approved in 2009, with subsequent registration of reserves.

The table below illustrates the progression and development of two deposits poised to spearhead an economic revolution in the near future. By 2015, Kamoa Kakula had inked its initial investment contracts, and over the subsequent four years, development surged forward at a rapid pace, nearing completion. Apart from concentrators, the construction of highcapacity hydroelectric plants is underway to furnish energy for their operations. They promote themselves as green businesses, shining brightly in the global copper industry. However, the Tsagaansuvarga project encountered a complete halt in 2015 due to political populism. After a prolonged hiatus of 8 years, construction finally recommenced last year. It is slated for operation in 2025, with the production of the first concentrate anticipated by year's end. During the 9year hiatus of Tsagaansuvarga, Democratic Republic of the Congo, a prominent player in the world of copper, ascended to third place globally in terms of copper production. It achieved this milestone by producing approximately 2.5 million tonnes of copper last year. By the following year, it is poised to surpass Peru and claim the title of the world's second largest copper producer. In 2015, when the Tsagaansuvarga project was halted, the Democratic Republic of the Congo produced 900,000 tonnes of copper. However, within 7 years, it has remarkably increased its production by 2.5 times. Concurrently, the country's gross domestic product has nearly tripled, soaring from USD 25 billion in 2011 to USD 70 billion last year. Formerly one of the poorest countries in Africa, it is poised to emerge as a major player in the copper supply chain over the next decade, a consensus among analysts in the international mineral market. Consequently, the country is witnessing a surge in investor interest.

Mining Insight Magazine 2024, №4 (029)