Rare earth elements are not as rare as you might think, general information about the market, elements, their value, and efficiency is “rare” in society. As it is widely used in high technologies, in today’s age of technology, the demand for rare earth elements is increasing by the day instead of by the year. At the same time, the necessity for rare earth elements (REEs), which are essential for renewable energy and “green” technologies to reduce the blue planet’s carbon dioxide emissions drastically, is increasing rapidly. With this trend, there is a strong interest in the economic circulation of unexploited and unexplored deposits worldwide. However, there is occasional research on REE deposits in other countries. Why rare earth elements are the most important...

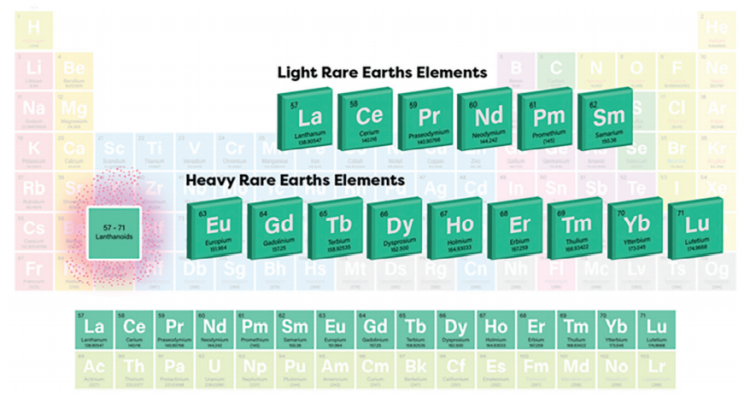

The elements of this group are divided into “heavy” and “light” categories based on their atomic weight. Usually, heavy and light elements predominate together. Demand for heavy elements is high. However, the range of applications for light elements is also not limited. Examples of light elements include neodymium and praseodymium, which are used in magnets. With the boom in the production of electric cars, the demand has increased, and it has become the focus of attention. Light elements used in steel production, such as alloys and industrial catalysts, are relatively cheaper than other metals due to their good supply of cerium and lanthanum. In terms of value, yttrium is the most affordable of the rare element group, while europium and terbium are precious metals.

MAKE IT WEALTH OR BECOME HARM?

According to a study released by the United States Geological Survey (USGS) in January 2023, 130 million tons of REE reserves have been identified worldwide. In the first five reserves list, our southern neighbor China leads, followed by Vietnam, our northern neighbor Russia, Brazil, and India. It is estimated that there are 3 million tons of reserves in the five deposits identified in Mongolia. Based on this study, our country can be named in the top 10, along with the United States and Greenland, in terms of potential for REE. However, REE cannot be evaluated by economic efficiency alone. In some deposits, other types of minerals and metals, such as uranium and thorium, exist as a mixture of rare elements. The process of separating them from ore is complicated and takes a long time. Mining REE deposits is challenging due to the need to separate each element from the complex oxides in the ore and the geological combination of radioactive and rare elements, which complicates both the extraction process and environmental concerns. However, methods for separating toxic impurities from the ore and environmentally friendly and safe extraction and processing are rapidly developing.

The Mongolian Khalzan Buregtei deposit is a clear example of such deposits characterized by geological settings. The Halzan Burgetei deposit, Mongolia’s most actively developed mining project, has an indicated reserve of 1.2 million tons. The main elements in mineralization are dysprosium (Dy), which is widely used as a magnet in high-tech motors and electrical appliances, neodymium (Nd), and Praseodymium( Pr), which are used to make strong magnets, terbium (Tb) used for lighting, and niobium (Nb) and tantalum (Ta), which are not REE but economically significant, are dominant. According to the project team’s notes, it is highlighted as a profitable project that can compete in the world due to its dysprosium reserves, which indicates the economic efficiency of the Khalzan Buregtei deposit. Of course, mixed concentrates of rare elements will cost less than separately processed concentrates. Therefore, the processing technology is the primary value of the feasibility study of projects preparing for the extraction of REE. The more innovative and realistic the ore extraction or beneficiation solution, the more valuable the project. For this reason, the development of technologies for the efficient and environmentally friendly use of REE is growing in direct correlation with the price of REE. In this sense, only a few countries in the world produce REE. But the everincreasing demand has yet to extinguish the desire of the aspirants to break away from China’s dependence. That is the main reason for creating intense competition in the market and innovation.

AMBITIONS OF MONOPOLY PLAYERS

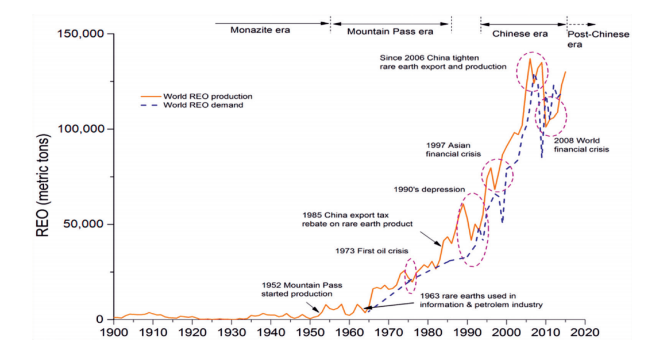

Different from familiar metals like gold and silver, it is not easy to understand the price and market of REE. Moreover, because there is no widely used stock market, it is impossible to predict the cost of each rare element in a mixed concentrate. As a result, only a few research organizations, such as Argus Rare Earths, conduct evaluations and monitoring based on data from market participants such as traders and consumers. Monopoly-holding countries determine the price outlook and future trends. China is the primary driver of the REE market as a whole. The Chinese era has already been announced in the global REE market. A story that confirms the authority that has strengthened its position in this sector is that in 2010-2011 when China reduced its exports, the price of REE increased sharply on the world market. This has fueled a boom in rare earth companies and mining projects worldwide, which have sought reliable sources outside of China. But when the price comes back down, there are painful experiences of many projects other than China failing at the mining stage. In 2014, the World Trade Organization decided to ban China’s REE export quota. Subsequently, in January 2015, the country lifted supply restrictions on REE and export tariffs, leading to lower prices. Therefore, Mongolians must study China’s REE industry to raise our flag in this field. As mentioned in the previous section, China is the absolute leader regarding REE reserves and potential, and six state-owned companies use four significant deposits. The Bayan-Ovoo REE-niobium-iron deposit, which is the world leader in production and reserves, as well as being located in China in terms of production and reserves, is located in Inner Mongolia, about 70 km south of the Mongolian border and has 40 million tons of reserves (a total of 48 million tons of indicated and inferred reserve). It is a complex deposit with a high content of lanthanum, cerium, and neodymium among the light REE minerals, and 15 types of REE minerals were identified. The Mianing deposit in Sichuan province was discovered in 1985-1986, and the production reserves of 3.7% of rare earth oxide have been determined to be 1 million tons. It is rich in light REE and contains europium and yttrium from heavy REE. The Weishan deposit in Shandong Province was first identified in 1958, and exploration work was completed in 1975, with an average grade of 3.13 percent and 2.5 million tons of reserves. It is also rich in light and rare elements. It should be noted that the so-called ion absorption type REE deposits, which were deposition processes related to weathered crust-elution, are unique deposits in the world and are the second largest in China in terms of heavy REE content. World-class ion absorption-type deposits with high grades of yttrium and heavy REE were identified in Jiangxi Province in 1969. In addition, heavy and light rare-element-rich deposits with two types of mineralization are also found in Hunan, Guangdong, Fujian, and Guangxi provinces.

Proven reserves are 1 million tons, and 85 percent of the world’s heavy REE reserves are contained in this deposit. Today, China is the world leader in extracting rare elements, providing more than 90% of the supply. China’s production of rare earth elements (REE) rose by 25% in 2021-2022 compared to 2021, reaching 210,000 tons from 168,000 tons. China’s REE production accounted for 70% of the world’s total production last year. It is expected that in 2023, China will continue to be the dominant leader in the critical metals sector, which includes rare elements. As a result, this sector is predicted to be the future battlefield for silent competition. One of the major economies that “compete” with China in terms of manufacturing is the United States. In February 2021, President Joe Biden signed an executive order to review gaps in domestic supplies and supply chains for medical devices, computer chips and other critical applications. A new initiative by the US Department of Energy has been proposed to allocate $30 million towards investigating and strengthening the country’s domestic supply chains for raw materials used in batteries, including cobalt and lithium. In addition, in September 2022, The Biden administration announced funding 156 million US dollars to construct “The first facility for the extraction and separation of REE and critical minerals from non-traditional sources”. MP Materials owns and operates the only facility in the United States focused on extracting and processing rare earth elements (REEs) in Mountain Pass, California. Rare earth oxides such as lanthanum, cerium, and neodymium- praseodymium separated by high reduction are produced here. This sentence means that the technology and industrial ambition of the United States are comparable to those of China in REE field. Both countries have similar aspirations when it comes to technological and industrial advancements. Australia is the leading producer of rare metals that has established itself independently of the Chinese monopoly. Lynas Rare Earths owns the Mount Weld mine in Western Australia, as well as a processing facility in Malaysia. Two years ago, Lynas Rare Earths received 30.4 million US dollars in funding from the Pentagon to build a light REE processing plant. In addition, another 120 million USD contract was signed to construct a heavy element separation facility.

REE’S ENDLESS DEMAND AND OPPORTUNITY

From the beginning of 2023, global mining companies and developed countries such as Canada and Australia have expressed their desire to support critical metal or high-tech mineral production projects and fill the emerging supply gap. For example, Canada’s Belmont Resources has announced its exploration plans for the Saskatchewan uranium-thorium project. The company plans to return to Uranium City to search for REE based on the results of the exploration work carried out in 2006-2008. For the European Union, 98% of its REE is supplied by China, and in January 2023, the Swedish stateowned LKAB company announced to the world the discovery of a deposit with 1 million tons of reserves, which raised hopes in the West to limit energy independence and China’s monopoly. According to analysts, this announcement will strengthen the transatlantic alliance and increase competitiveness with China, but Sweden alone cannot replace Chinese supply, and LKAB director Jan Mostrom said it would take 10-15 years for the REE concentrate to be on the market. Between 2021 and 2022, global production of rare earth elements (REEs) rose from 290,000 tons to 300,000 tons and is projected to continue its upward trajectory. The surge in demand for electric vehicles and green technologies has fueled this growth trend. Mongolia has initiated collaborative research with scientists from Germany, Finland, and Japan to study rare earth element (REE) deposits and enhance exploration projects. Furthermore, in 2022, Mongolia decided to establish a joint research center with South Korea to advance research and development in the field of REEs. Whether or not Mongolia can be a player in the supply gap for high-tech raw materials depends on the intensification of REE exploration projects in Mongolia. Therefore, the economicalization of our REE exploration projects by supporting operational stage developments is our crucial card to compete in the global market by securing our 3 million tons of reserves in this game of critical metals.

Mining Insight Magazine, February 2023