bold@mininginsight.mn

The entire society, political arena, and mining industry of Mongolia are focusing on the “Coal Theft” scandal. The massive manipulation of information caused everyone to stray away from the truth. Authorities remain frustrated as public unrest gains momentum. In a rush, law enforcers announced the names of 17 people who claimed to be involved in the scandal, which involved bribery worth MNT 5.4 billion and 12 government officials. Although nobody knows how it will turn out in the end, the internal dispute of the ruling party will mostly decide the outcome of the “Coal Theft” case similar to previous scandals. The whole “Coal Theft” issue only came to light recently, however, such rumors were around for years among the mining sector players. A key issue is that the coal sales of state-owned “Erdenes Tavan Tolgoi” (ETT) alone are now valued at MNT 2.1 trillion, therefore, the profitability of sub-contractors and coal transportation businesses have greatly increased, attracting more competition and political interest. The scope of the scandal is too large. All stakeholders, including ETT and “Tavan Tolgoi” JSC to sub-contractors, suppliers, transport companies, transport C permits, and customs control, are trying to crack the issue at every step from coal mining to exporting across the border. Therefore, let’s highlight some of the open data and take a comprehensive look at the coal business in general.

MNT 2.1 TRILLION WORTH OF MARKET GENERATED BY ETT

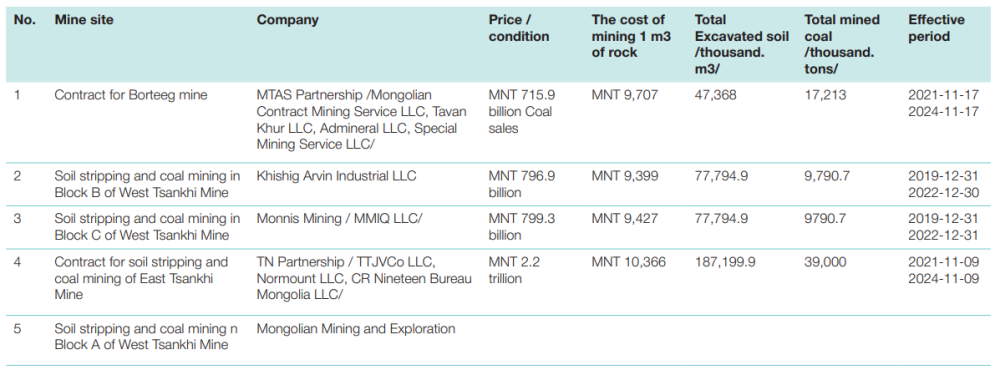

The only benefit of the ongoing scandal is that almost all information about ETT became public and transparent. Especially, the list of companies involved in the exploitation and purchase agreements has been announced, allowing the public to review and understand its operations. Between 2017 and 2021, ETT stripped a total of 292.1 million tonnes of soil, produced 58.8 million tonnes of coal, and sold 55.3 million tonnes of coal. About MNT 3.3 trillion was spent on production within these five years. The long and short-haul transportation of coal costs about CNY 100 per tonne, totaling MNT 7 trillion. On an annual basis, the soil stripping amounts to 60 million tonnes, from which 11 million tonnes of coal is produced and exported. Therefore, about MNT 2.1 trillion is annually circulated by estimating a cubic meter of dirt stockpile at MNT 9,400 and transportation cost between CNY 87.8-188.9 as set by ETT’s bid value.

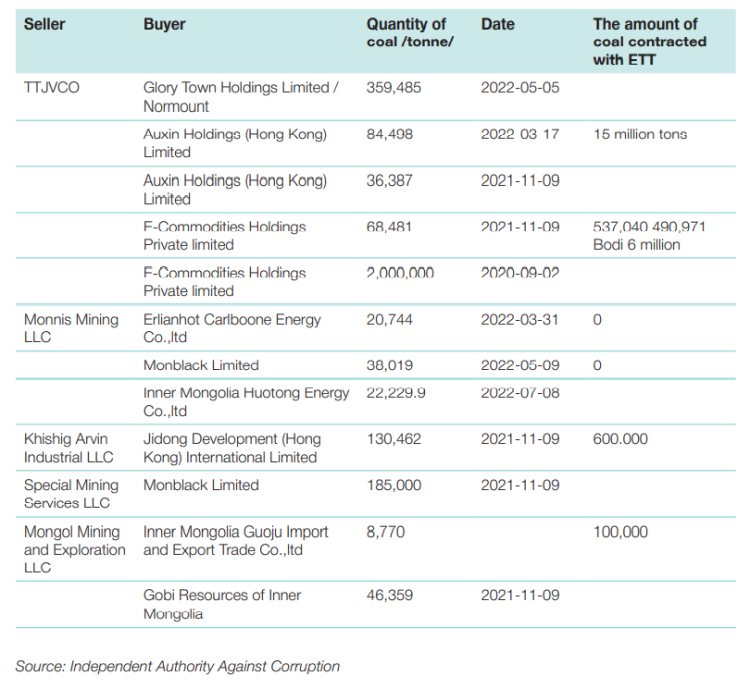

The cost of transportation alone is three times higher than the cost of mining, which clearly shows where the problem lies in this industry. Former Executive Director of ETT B.Gankhuyag was investigated for corruption and was imprisoned later on. He was accused of taking bribes from contract miner “Khishig Arvin Industrial” LLC in constructing housing estates. This is another potential problem for ETT’s contract miners. The company works with a total of five contractors, whose contracts are now publicly accessible. Contracts were signed with two companies at the West Tsangkhi mine, and with one more company for the Borteeg mine. The contracts of West Tsangkhi contract miners are expiring. However, nothing was found for “Mongolian Mining and Exploration” LLC, the contractor for Western Tsangkhi Group A. The site Tender.gov.mn says the company has not been selected, but its name is among the procurement contracts of ETT. In addition, TTJVCo LLC is at the East Tsankhi Mine as a contractor. It is also interesting to note that TTJVCo’s cost per unit is over 10 percent higher than other miners. There was an anticipation that TTJVCo’s contract, which has been effective for over 10 years, would be terminated, but the contract was renewed a year ago. This time, a joint venture contract was signed with “Normount” LLC and “CR Nineteen Bureau” LLC. “Normount” is related to Norinco Cooperation. It was registered in Mongolia in 2020 and took part in the open bidding by leasing equipment from “Chu Development” LLC. All of ETT’s contract miners receive a certain amount of payment in coal. There is a provision in the contract that the bartering coal will be valued at the market price. TTJVCo has signed the largest amount of coal contracts compared to other contractors. It can be seen from the table that the company signed a contract with ETT’s main buyer Norinco, Glory Town Holdings, and E-Commodities to supply large quantities of coal. E-Commodities Holdings has been one of the main buyers of Mongolia’s coal in the past, not just to ETT. Contractual mining companies only sell the paid coal to ETT’s buyers, which is not beneficial to ETT. By 2022, 781,000 tonnes of coal will be supplied at a discounted price of 7-10 percent for contract miners. Out of this, MNT 31.1 billion was lost by ETT, according to Government Secretary J.Ganbat, and he has promised that ETT will not pay any fees for coal in the future.

OFFTAKE CONTRACTORS WILL NOT BE LEFT BEHIND

“Erdenes Tavan Tolgoi” protects the interests of its key customers. In particular, high-value barter agreements, and offtake contracts were signed with two large Chinese state-owned companies and with two large private companies. Let us remind you that the Minister of Economy and Development Ch.Khurelbaatar criticized ETT for exporting coal without foreign exchange payments due to its offtake contracts, which has led to the “coal theft” scandal. ETT has signed two barter agreements with Norinco International for a total of USD 683 million.

Norinco has agreed to build a coal concentration plant and an oil pipeline for 6 million tonnes of coal in return. In addition, E-Commodities Holdings and Jiayou International Logistics signed an agreement to purchase 15 million tonnes of coal each and received an advance payment last year. In addition, an offtake deal worth USD 280 million will be added from Chalco Trading Company, which was established last May. The above-mentioned five companies are the biggest buyers of ETT coal. There has been strong discussion on the possibility of stopping the supply of coal to these Chinese buyers over the offtake agreement issues. The conversation caused outrage among buyers, including Norinco. It is said that discussions were held at the highest levels of governments of the two countries, blaming ETT for proposing an offer to conclude a contract, taking advance payment, and backing off on supplying coal, which will have a bad effect on long-term cooperation. As if to confirm this, the chart shows that the chart shows that ETT’s coal production accelerated after appointment of a Plenipotentiary Representative (PRE). Before the appointment of a resident representative, the above five companies accounted for 38.8 percent, or 2.3 million tonnes, out of 6 million tonnes of coal sold by ETT. This rose to 57.5 percent, about 5.2 million tonnes, within two months since the appointment of a PRE. Xianghui Energy is the company that has purchased the highest amount of coal since the appointment of the representative. 49 percent of the company is owned by E-Commodities. The two companies signed an agreement with ETT to purchase 15 million tonnes of coal in 2021 and 1.5 million tonnes in August 2022. Jasn International, a subsidiary of Jiayou International Holdings, bought 844,000 tonnes of coal. Also, the contract for 15 million tonnes of coal in 2021 and 1.5 million tonnes in September 2022 was signed with ETT. As a side note, 22 percent of Jiayou International Holdings is owned by “Zijin Mining”, a new partner of Mongolia. The company is listed on the Shanghai Stock Exchange and has a market capitalization of USD 1.6 billion. The company operates interstate transportation, logistics services, and smart warehousing business. The Gants Mod Port is a key location for its business. In short, it is a coal transportation, storage, and trading company, not the end user. It buys coal from ETT through its subsidiary Jasn International established in Singapore in 2018. In any case, after the appointment of the resident representative, the coal was supplied to the companies that signed the offtake agreement without leaving any of them out. The above-mentioned four companies that signed barter and offtake agreements together bought 48 percent of coal from “Erdenes Tavan Tolgoi” in 2022, and 45 percent of the total coal in the last three years.

NEW REGULATION ON THEFT PREVENTION

Starting 2023, not only Erdenes Tavan Tolgoi but also the whole coal industry will see big changes and new rules. Coal exporting companies have been banned from selling coal at the mine, and transport permits have been transferred to the mining companies. In other words, Government Resolution No. 362 issued last October will take effect. In the resolution, a provision states, “The legal entity holding a special license for mineral extraction shall stop signing new contracts for the sale of minerals at the mine, and take measures to transfer the right to buy and sell at the border price and C-type travel permits for permanent cargo transports crossing the border to be issued to enterprises engaged in mining activities.

The Minister of Mining and Heavy Industry J.Ganbaatar and the Minister of Road and Transport Development S.Byambatsogt shall overlook the implementation of this resolution.” The new regulation is one of the most important measures being taken against coal theft. This is to organize the transportation issue as over 30 officials of the State Transport and Logistics Agency is being transferred to the court over corruption surrounding the C permit of the transport companies, and many vehicles registered as empty vehicles crossing the border. But the decision has set the entire industry in motion, including coal companies, shipping companies, and buyers. It is too early to tell what the results will be. In the case of mines, mandatory cross-border sales and selftransportation are having different effects. There is also a group of people who believe that it is inappropriate to make a decision involving all coal companies to regulate an issue involving only stateowned companies. National transporters, on the other hand, are openly opposing the decision. They claim that the price ceiling will lead to losses, allowing Chinese shippers to transport at low prices, reducing the competitiveness of small national companies, and ultimately leading them to go bankrupt.

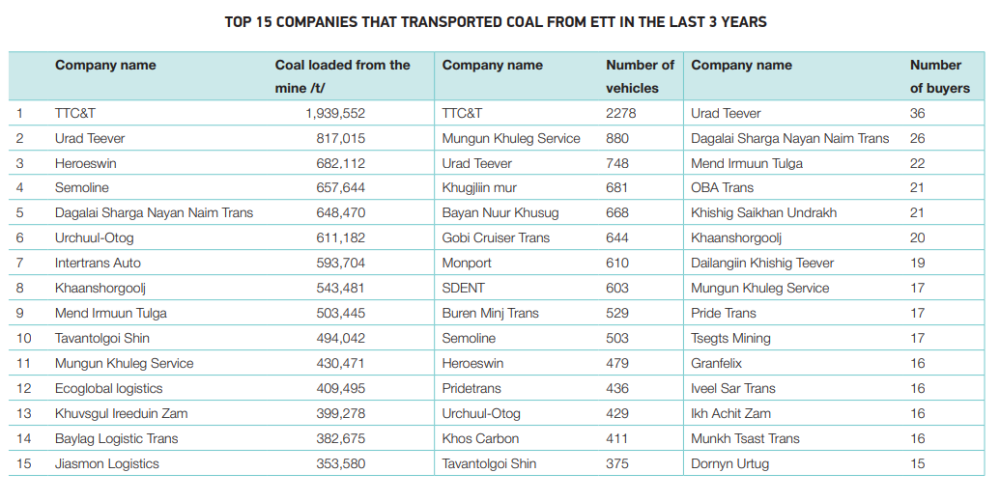

For example, the transportation between Tsagaan Khad and Gants Mod reached CNY 2,000 per tonne at its peak last year. But in the first 10 days of December, the price announced by ETT fell to CNY 88 when the price per tonne was CNY 370- 390. A significant part of the companies involved in ETT’s coal transportation is owned by the buyers. For example, Jasn International or Jiayou International Logistics Company transported 20% of the 1.6 million tonnes of coal purchased in the last three years through its subsidiary “Jiasmon Logistics”. Jiasmon has sent 64 coal trucks for transportation. Glory Town Holdings, a subsidiary of Norinco, transported 80 percent of the 2.1 million tonnes of coal it bought in the last three years through its affiliate company, TTC&T. “TTC&T” is the largest transport company with over 2200 vehicles. Even one of the largest buyers, E-Commodities, has started its operations in Mongolia by establishing its own transport company. E-Commodities Mongolia Intelligent Logistics LLC claims to provide shorthaul transportation services, but this year it transported 35,000 tonnes of coal from the mine. They also own “Eco Global Logistics” LLC. In recent years, it has become increasingly clear that Chinese coal buyers are establishing their own transport companies, or outsourcing transport with added interest. Since the buyer bears the cost of transportation, it is obvious that they should try to involve their own companies as much as possible. Considering the example mentioned above, it means that Chinese companies spend over MNT 1.4 trillion for coal transportation. In this sense, it can be said that a certain part of the revenue from China remains in Mongolian transport companies. But on the other hand, ETT stated that if they transport the coal themselves and sell it at the border, they can earn twice as much as selling it at the mine. Profit from the coal sold at the mine is worth USD 4.9 billion. Representative J.Ganbat stated that if it was sold under border terms, it would have amounted to USD 9.2 billion, or about USD 4.2 billion higher than the reported value.

WHO WAS THE REAL COAL THIEVES IN THE END?

The government and law enforcement agencies announced the names of 17 people involved in the “Coal Theft” case. The public is left thinking these “escape goats” were thrown to quell the social unrest so that the real thieves could go into hiding. President Khurelsukh Ukhnaa, during his term as a Prime Minister, called out MP and former Chief of Cabinet Secretariat J.Munkhbat as a coal thief at a Parliament session. MP Sh.Radnaased also claimed Minister of Labor and Social Protection and MP T.Ayursaikhan had a role to play in appointing B.Gankhuyag as the CEO of ETT. Whether these highranking politicians are related to the case or not will be clear over time. However, judging from the information provided by law enforcers and ministers, the scope of the “Coal Theft” scandal is as follows: A group of politicians from Umnugovi province surrounding the locally-owned “Tavantolgoi” JSC, a group of politicians who allegedly “intruded” on “Erdenes Tavan Tolgoi”, a group covering Tavan Tolgoi coal transportation, and finally, following the Tavantolgoi-Gashuunsuhait railway, “Bodi International”. In other words, there are four main groups involved in the scandal. It is clear that the leaders of the People’s Party and the Democratic Party of Umnugovi province, headed by MP D.BatErdene, are connected to “Tavantolgoi” JSC. 51 percent of the company is owned by the Citizens’ Representative Council (CRC) of Umnugovi province, while the next largest shareholder is the MP D.Bat-Erdene. Tavantolgoi JSC started exporting coal in 2004. If it is found that the coal trucks have been leaving the border empty since 10 years ago, the company’s managers and shareholders will be directly at fault. Also, the company was found to have stolen about 340,000 tonnes of coal from the field of ETT. The case was reopened, and shortly after, he paid about MNT 50 billion for the stolen coal. But it is not clear whether the guilty party remains uncovered. In addition, D.Bat-Erden’s “Tavantolgoi Trans” LLC, which used to buy coal from “Tavantolgoi” JSC at a low price straight from the mine to export at a higher price. The company’s CEO Dagvadorj was also investigated and detained in connection with the case. Judging from the fact that the government has imposed a special regime on “Tavantolgoi” JSC, it is clear that the coal issue surrounding the company will concern the authorities of the Umnugovi province. D.Bat-Erdene of “Ajnai” LLC implemented a coal business scheme at “Tavantolgoi” JSC for several years, which was copied at ETT. In recent years, ETT has started selling its coal cheaper than the market price, mostly at the mine. The scheme is beneficial for coal traders and shippers. Except for “Chalco”, “Norinco”, and E-Commodity, most of the buyers of ETT’s coal are traders. In other words, the end users, specifically metallurgical plants and coal-washing plants, are buying coal from these traders. The difference between ETT’s price and the price paid by the end-users becomes the profits of intermediary traders and shippers. The higher the difference, the lower the tax revenue for Mongolia, and there is also a risk of laundering corruption money. The coal transportation cost may be three times higher than the production cost because of this. However, information from Chinese companies is required to find proof, and it is almost impossible to determine the actual amount by investigating only national companies. If ETT takes responsibility for transporting coal to the border and sells the coal under border conditions, this scheme can be dismantled. However, ETT does not have a transportation company. To keep its coal transport free from corruption, the company’s operation has to be transparent and carry out fair selection among national transporters. This would also serve as an opportunity to develop the coal transport sector as a whole. Let’s put aside the case of the politicians who allegedly profited from ETT. But what is more interesting is how former President Kh.Battulga and “Bodi International” LLC are named the biggest “thieves” involved in the scandal. The Minister of Justice and Home Affairs Kh.Nyambaatar and Minister of Economy and Development Ch.Khurelbaatar have accused Kh.Battulga over railway construction. He is accused of making the construction of the Tavantolgoi-Gashuunsukhait railway a state secret, signing a direct contract with “Bodi International” LLC, and squandering a large sum of money. Whether Kh.Battulga and his companies embezzled money from the construction of the railway are not proven yet. “Bodi” issued a self-defense statement. We will soon have accurate information on the USD 1 billion funds and its spending. But the only thing that has become clear is that the railway financing is being paid to “Bodi” with coal, putting pressure on ETT. “Bodi” has signed a contract to supply coal at a discounted price of 5-13 percent. It was discovered that “Bodi” is supplying coal to ETT buyers at the market price. By 2020, “Bodi” signed a contract to supply 6 million tonnes of coal with E-Commodities, 1.45 million tonnes with Jasn International, and 500,000 tonnes with Inner Mongolia Zi Tuo International. E-Commodities and Jasn International are the biggest buyers of ETT. However, it is not clear how much of it was from ETT. Also, Inner Mongolia Zi Tuo International signed a contract to purchase about 1.4 million tonnes of coal from ETT in 2018-2019, but since then, it has started buying coal from “Bodi” instead of ETT. Basically, “Bodi” has been “gifted” MNT 174 billion from the difference in prices of discounted coal. This equals the last threeyear profit of Golomt Bank, which is also a main shareholder of the company. The same has happened in the coal supply agreement related to the financing of Bogdkhan Railway. As such, the railway financing of “Bodi International” will undoubtedly continue to surface. Just 7 months ago, Mining Insight published an article “May the Chinese skies bless ETT”. The article was about how these high-value barter agreements and offtake deals with the Chinese state-owned enterprises would soon drag ETT into bankruptcy. However, Mongolian politics is breaking apart ETT before China. Everyone can see that ETT has been robbed of billions of US Dollars in payment for not being a publicly owned company.

Mining Insight Magazine №12 (013), December 2022

1 Comments