od@mininginsight.mn

The outlook for Mongolia's geological sector appears discouraging. Currently, research and exploration of mineral resources, which should ideally precede mining, are almost at a standstill. The number of exploration licenses issued has declined, and investments in the sector have decreased. Moreover, the resources of the state mineral fund have dwindled, and there is a shortage of qualified personnel.

Given the circumstances, critics cast doubts on the effectiveness of our country's development policy which is heavily dependent on mining. As outlined in 4.2.24 of Mongolia's long-term development policy, "Vision 2050," the goal of intensifying geological research to increase mineral resources for longterm economic growth was proposed. Similarly, the Government's New Recovery Policy in section 3.1, "Recovery of Industrialization," emphasizes increasing investment by fully digitizing the issuance of mining licenses, boosting the production of value-added mining products, and enriching the guaranteed reserves of mineral resources.

Over the past decade, Mongolia's economy has significantly expanded to reach USD 10 billion. The development of Oyutolgoi and Tavantolgoi, two major projects, has played a crucial role in this rapid growth. The Oyutolgoi deposit was initially discovered in 1982, and after a 20-year-long geological survey, the mining of deep mines began only this year, which will bring about a full economic cycle. Similarly, it took 40 years to put the Tavantolgoi deposit into operation, underscoring how geological research and exploration typically precede mining by 20-30 years. The mineral resources sector's contribution to the state budget has been increasing annually, with around MNT 4.4 trillion collected from the sector in taxes in 2022. However, less than 1 percent of this amount is allocated each year to exploration.

Last year, only MNT 27.7 billion was spent on geological exploration, and this year's budget for exploration includes MNT 6 billion for general exploration of 1:50,000 scale geological mapping, MNT 7.9 billion for thematic research, and MNT 9 billion for exploration and evaluation, out of the total budget of MNT 23.5 billion. Currently, 76 percent of Mongolia's total territory is covered by forests, areas with special state protection, and zones designated for local use and border areas. These areas are subject to laws prohibiting mining and geological exploration activities. However, if mineral prospects are identified, geological exploration work will be conducted with state budget funds. To promote the exploration and mining of economically important minerals such as gold, copper, and hightech raw materials, the "New Recovery Policy" includes provisions for state-owned companies to carry out such activities.

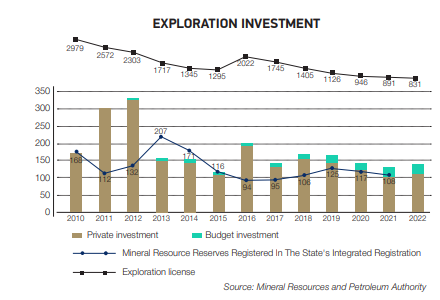

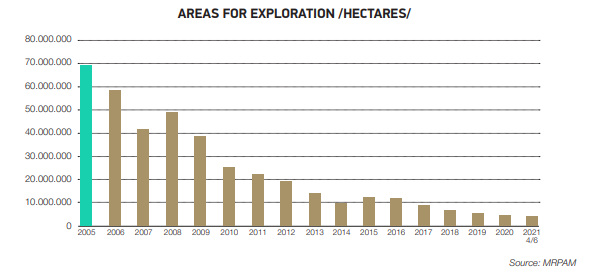

Nonetheless, only 50 percent of Mongolia's territory is currently covered by 1:50,000 scale geological maps, meaning that complete subsoil information is not yet available. To increase the scope and funding for geological research and mapping, and to produce high-quality results, the state budget should allocate more funds. This will create geological information that can attract foreign investors. Mongolia's advantage in attracting foreign investors is its status as a country with vast unexplored mineral resources. Policymakers have been actively promoting the exploration sector to foreigners and advertising the possibility of discovering the next Oyutolgoi and Tavantolgoi deposits. Geological exploration is generally considered a risky business that requires significant funding and does not immediately recoup its costs. Therefore, it is a sector that can attract foreign investment instead of relying solely on state budget funding. Since the 1997 revision of the Law on Minerals, exploration work has been conducted with a total of MNT 3 trillion in foreign and domestic private investment, resulting in the enrichment of Mongolia's mineral reserves. Prior to 2005, the number of exploration licenses issued in Mongolia was close to 5,000, covering over 40% of the country's area. This led to the discovery of several deposits, including Bayan Khundii, Khan Altai, Zuuvch Oovo (uranium), Dulaan Uul, Kharmagtai (copper), and Khalzan Burgegtei (rare earth elements). However, the passing of a law that restricted foreign investment caused exploration investment, which had reached MNT 326 billion, to sharply drop and halve. Since then, exploration investment has not reached its previous peak and has been steadily decreasing, except for a slight increase in 2016.

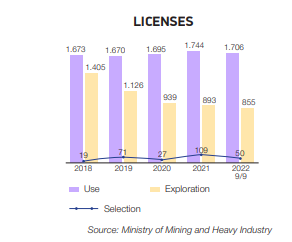

Currently, there are only 870 valid special exploration licenses, covering 2.6% of Mongolia's territory. Industry experts warn that if these permits expire in the next 3-4 years, the concept of mineral exploration in Mongolia will vanish. Exploration licenses were previously banned outright but were later granted through a selection process, application, or a combination of both, leading to ten years of experimentation. Recently, the selection process for granting exploration licenses has been conducted online. During the "Geological State Conference 2023", the Minister of Mining and Heavy Industry J.Ganbaatar acknowledged the declining trend in the geological exploration sector, which is essential for providing the country with reliable mineral resources in the long term. He attributed the decline to a decrease in investment and the inadequate level of exploration and research work due to the instability of the legal environment for attracting investment.

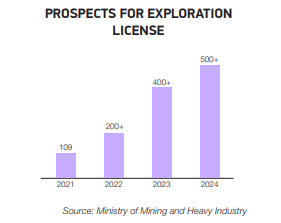

The minister also presented a plan to increase the number of exploration licenses by 400 this year and 500 next year due to the transfer to electronic processing.

Geology is a scientific field that studies the subsoil and its various components, with many specialized areas of focus. One such area is exploration, which involves identifying and assessing mineral resources. Geologists generally view the Law on Subsoil as the primary legal framework for their field, but they criticize the fact that the legal framework for the geological sector has become too fragmented. The sector is now governed by separate laws regulating minerals, water, oil, nuclear energy, and widely distributed minerals. Consulting geologist O. Chuluun said, "It's time to revise the legal framework of the geological exploration sector.

It is biased if the mineral law is understood to include the entire field of geology. In this law, there is very little regulation that affects the interests of the industry and geologists. Geologists are not included in the Working Group on the Minerals Bill. It is explained that it is "a secret for now". The people of this industry do not understand what is behind the implementation of the law. "There are many geologists who are dissatisfied with this draft law, which is being debated against time." The experience of countries such as Canada, Australia, Russia, China, and Kazakhstan, where water, oil, all kinds of minerals, and exploration activities are regulated by a single subsoil law, is discussed in Mongolia. Then, in the revised draft of the Law on Minerals, a comparison with the Subsoil Law of Kazakhstan was made and inspired. B.Uyanga, head of the Geological Policy Department of the Ministry of Agriculture, explained that the country's law is similar to the Australian mineral law. According to his information, regulations for the selection and application of exploration licenses, development of mine closure plans and approval by competent authorities before issuing exploration licenses in accordance with international best practice have been included in the revised bill on Minerals. Geologists do not support the establishment of a mining research and development center, which is included in the draft law. "Mining Development Center has been included in the bill to establish a new organization. It does not specify the status of state, NGO, or state-owned legal entity, but it does legalize the source of funding. It was arranged to be financed from the income of the report of the results of geological exploration, working as an expert in the feasibility study, and making a review. It should be noted that the interests of thousands of geologists and prospectors working in the field may be affected to some extent," said geologist S.Baatartsog during the "Mongolian geological exploration ROUNDUP" conference. As for geologists, they agreed that before submitting the revised draft of the Law on Minerals, it is necessary to consider the Subsoil and other laws step by step. Mongolia's geological sector faces several challenges.

The legal framework is unclear, information is scarce, and there is a shortage of attractive exploration areas for investors. Moreover, the number of special exploration licenses has been decreasing annually. The industry acknowledges that there has been an increase in non-professional work due to job availability, while the number of students pursuing natural sciences has significantly declined. At the National University of Mongolia, only 101 students are studying geology and geophysics, and the National University of Science and Technology has fewer than 80 students across four classes. The data from the last 15 years indicates that the number of specialists trained in the field of geology has decreased by threefold. The geological exploration industry serves as the foundation of the mining and industrial sectors in Mongolia, but it is currently facing significant challenges. The Ministry of Agriculture has adopted a policy of exploration-extraction-processing-sale, which cannot be fully realized without prioritizing the first phase of geological exploration.

The continued decline in the exploration sector will have a ripple effect on future personnel and employment opportunities, as well as on macroeconomic indicators such as fiscal and export revenues and foreign exchange reserves. Attracting foreign investment is unlikely under these circumstances. Geologists believe that opening new deposits like Oyutolgoi and Tavantolgoi is impossible without significant investment in geological exploration. The industry is fundamental for ensuring stability in mining investments and financing, but it has been shrinking for many years due to a prolonged decline in key indicators.

1 Comments