ODJARGAL.E

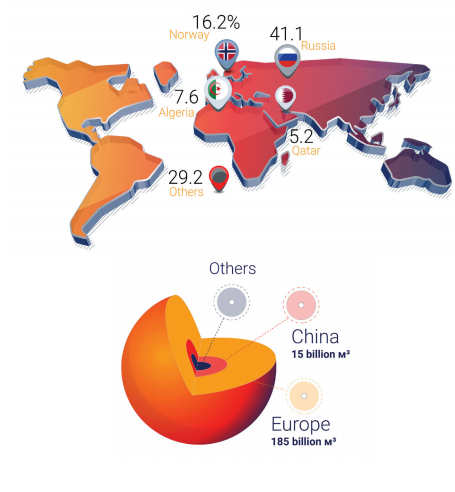

ODJARGAL.ERussia is the world’s largest exporter of natural gas. For Russia, natural gas could be a “stronger weapon” than even a nuclear weapon. One of the secrets to how Putin still has power over Europe and maintains good relations with China is natural gas. He’s been meaning to connect Russia’s western and eastern export infrastructure routes. This will grant the country the power to control natural gas trade in Europe and Asia at will. China’s growing demand for energy and natural gas will provide such an opportunity, or so he thought. However, as big as China’s demand might be, it’s still tiny compared to the demand in Europe. This is visible in last year’s statistics as Europe accounted for 91 percent of Russia’s natural gas exports while China amounted to less than 8 percent.

This will grant the country the power to control natural gas trade in Europe and Asia at will. China’s growing demand for energy and natural gas will provide such an opportunity, or so he thought. However, as big as China’s demand might be, it’s still tiny compared to the demand in Europe. This is visible in last year’s statistics as Europe accounted for 91 percent of Russia’s natural gas exports while China amounted to less than 8 precent. Russia is annually supplying 185 billion cubic meters of natural gas to the west. The country has the export infrastructure to Europe and its deposits are located close to the market. As for the eastern route, the country has a deal with China to annually supply 48 billion cubic meters of natural gas. But it has to be reminded that this is an ongoing discussion. There isn’t enough infrastructure capacity. The raw materials aren’t ready and the deposits are far from the market. Since the incident in Crimea in 2014, Russian President Vladimir Putin has been rushing the natural gas deal with China. But it is safe to say that the time is against him. il and natural gas exports made up 48 percent of Russia’s budget revenue last year. The country produced 762.3 billion cubic meters of natural gas in the same period. Gazprom, the state-owned monopoly of Russia’s natural gas (through the pipelines), exported a total of 202 billion cubic meters of gas, of which 185 cubic meters were delivered to the European market. In other words, Russia’s natural gas export is entirely dependent on Europe. Up until now, Russia has been supplying 40 percent of total natural gas demand in Europe.

However, the country’s market share dropped to 32 percent last year, and 20 percent of liquified gas. Within just a year, the country lost 10 percent of its market. It is bad for Europe to lose Russian gas, but even worse for Russia to lose the European market.Europe has been looking to reduce gas dependence from Russia, however, it hasn’t been effective yet. Therefore, some of the prominent European politicians have been open with their position of avoiding conflict with Russia and Putin. However, a strategy on shifting from natural gas to hydrogen is about to be presented at the upcoming high-level meeting of the European Union in December. The strategy will include the installation of hydrogen production capacity equal to 10 billion tonnes, or 34 billion cubic meters of natural gas by 2030. Europe sees renewables as an opportunity to address its energy problems. While acknowledging the need for nuclear power generation, natural gas will be used as a transition fuel. In doing so, natural gas will be slowly replaced by hydrogen. If Europe stands firm in this position and implements its new solutions, Russia’s gas influence will shrink in the medium term.Since the end of last year, Gazprom did not renegotiate the agreement every five years. Despite the actual delivery, Gazprom pays the capacity fee. Russia never hid its intention to shy away from using the pipeline in Ukraine, both in terms of geopolitics and economy. The heightened tension between Russia and Ukraine is making the matter more uncertain. Transit exports may not stop completely, however, Russia may keep a symbolic deal with Ukraine and cut annual supply by about 10-15 billion cubic meters.

Of course, this is not profitable for Ukraine. The day after Russian President Vladimir Putin signed a decree recognizing the independence of Donetsk and Luhansk, German Chancellor O. Scholz froze the approval process of the North Stream 2 pipeline. In response, the Deputy Chairman of Russia’s Security Council Dmitry Medvedev tweeted, “German Chancellor Olaf Scholz has issued an order to halt the process of certifying the Nord Stream 2 gas pipeline. Well. Welcome to the brave new world where Europeans are very soon going to pay 2.000 for 1.000 cubic meters of natural gas!”. This was a “shock” to Putin because Russia and Germany had very close relations up until now. Germany has a huge influence over the massive project that was built on the floor of the Baltic Sea. The project has been strongly supported by Germany since 2005 under Chancellor Gerhard Schrder. Sharing the same view as him, several German politicians support the Russian pipeline. He is currently a candidate for Gazprom’s Board of Directors. The project was also funded by shareholders in Germany’s Uniper and Wintershall. In addition, major European companies such as OMV of Austria, Engie of France, and Royal Dutch Shell of the United Kingdom have collectively raised half of the total investment of North Stream 2. That’s why Russia had high hopes for the pipeline, and Europe had high expectations. Without approval, Nord Stream 2 will never be operational. Because the Russian monopoly can’t use its full capacity to the west, the supply at storage tankers fell to a historic low in 2022. The demand is currently covered by liquified gas.

Within just two months, Europe’s biggest liquefied gas supplier became the U.S (56%). Some analysts are criticizing the U.S interest in Europe. The liquified natural gas exports of the U.S reached 99.2 billion cubic meters, surpassing Russia to become the third-biggest supplier in the world. Support from China, a strong competitor to the United States economically, is crucial for Russia. But the annual revenue from China equals just 25 days of revenue from the European market. The actual volume of gas supplied to the Chinese market in eastern Russia is 15 billion cubic meters. China imports 170 cubic meters of natural gas, importing half of its demand annually. The Siberian Power 1 pipeline was recently established at a great expense to reach the Chinese market. Despite supplying the blue fuel for over a year, they have not been able to meet the plans. It took 15 years to reach a deal for this pipeline. During the Winter Olympics in Beijing, China and Russia signed a new oil and gas agreement. This is the Siberian Power 3 project, which will supply an additional 10 billion cubic meters of gas via the Russian Far East. This confirms the agreement with China to sell a total of 48 billion cubic meters of gas at full capacity via the Siberian Power 1 and 3 pipelines. That’s a whopping 30 percent of China’s imports, but four times less than Russia’s exports to Europe. On the other hand, China’s interests are crucial. The idea is to supply gas from the Sakhalin-3 field in the Far East, to end-users in China. The project was automatically banned by the United States in 2015 due to the discovery of oil in addition to gas in the field. The only possible method is deep-sea mining. Four companies in the world provide equipment for such complexes. They are either owned by the United States or invested by them. Therefore, Gazprom’s ability to supply gas from Sakhalin is limited. Exploited deposits are also remote. To that extent, the cost of building Siberian Power 3 will be high. On the other hand, the European Union and the United States imposed sanctions on Russia and froze all Russian assets and foreign sources after the attack on Ukraine. The European market, which fill its storage tankers to Europe.

Natural gas prices jumped to USD 2,100 per 1,000 cubic meters in Europe during the coldest days of winter. Europe had to transport expensive liquefied natural gas by sea from afar. Due to the heightened price, the energy bills surged to USD 1 trillion. Europeans are consuming the most expensive energy of the last 10 years. Despite the quadrupled price, the Russian natural gas monopoly did not rush to increase its supply to Europe. Quite the opposite, they cut their supply to the region by 30 percent.Russia has completed the construction of the Nord Stream 2 pipeline, however, Germany put a hold on the project. If the pipeline becomes operational, natural gas supply to Europe will increase significantly and Russia may stop using the pipeline in Ukraine. The deal with Ukraine will end in 2024. Moscow and Kyiv renegotiate the agreement every five years. Despite the actual delivery, Gazprom pays the capacity fee. Russia never hid its intention to shy away from using the pipeline in Ukraine, both in terms of geopolitics and economy. The heightened tension between Russia and Ukraine is making the matter more uncertain. Transit exports may not stop completely, however, Russia may keep a symbolic deal with Ukraine and cut annual supply by about 10-15 billion cubic meters. Of course, this is not profitable for Ukraine. The day after Russian President Vladimir Putin signed a decree recognizing the independence of Donetsk and Luhansk, German Chancellor O. Scholz froze the approval process of the North Stream 2 pipeline. In response, the Deputy Chairman of Russia’s Security Council Dmitry Medvedev tweeted, “German Chancellor Olaf Scholz has issued an order to halt the process of certifying the Nord Stream 2 gas pipeline. Well. Welcome to the brave new world where Europeans are very soon going to pay 2.000 for 1.000 cubic meters of natural gas!”. This was a “shock” to Putin because Russia and Germany had very close relations up until now. Germany has a huge influence over the massive project that was built on the floor of the Baltic Sea. The project has been strongly supported by Germany since 2005 under Chancellor Gerhard Schrder. Sharing the same view as him, several German politicians support the Russian pipeline. He is currently a candidate for Gazprom’s Board of Directors.

The project was also funded by shareholders in Germany’s Uniper and Wintershall. In addition, major European companies such as OMV of Austria, Engie of France, and Royal Dutch Shell of the United Kingdom have collectively raised half of the total investment of North Stream 2. That’s why Russia had high hopes for the pipeline, and Europe had high expectations. Without approval, Nord Stream 2 will never be operational. Because the Russian monopoly can’t use its full capacity to the west, the supply at storage tankers fell to a historic low in 2022. The demand is currently covered by liquified gas. Within just two months, Europe’s biggest liquefied gas supplier became the U.S (56%). Some analysts are criticizing the U.S interest in Europe. The liquified natural gas exports of the U.S reached 99.2 billion cubic meters, surpassing Russia to become the third-biggest supplier in the world. Support from China, a strong competitor to the United States economically, is crucial for Russia. But the annual revenue from China equals just 25 days of revenue from the European market. The actual volume of gas supplied to the Chinese market in eastern Russia is 15 billion cubic meters. China imports 170 cubic meters of natural gas, importing half of its demand annually. The Siberian Power 1 pipeline was recently established at a great expense to reach the Chinese market. Despite supplying the blue fuel for over a year, they have not been able to meet the plans. It took 15 years to reach a deal for this pipeline. During the Winter Olympics in Beijing, China and Russia signed a new oil and gas agreement. This is the Siberian Power 3 project, which will supply an additional 10 billion cubic meters of gas via the Russian Far East. This confirms the agreement with China to sell a total of 48 billion cubic meters of gas at full capacity via the Siberian Power 1 and 3 pipelines. That’s a whopping 30 percent of China’s imports, but four times less than Russia’s exports to Europe. On the other hand, China’s interests are crucial. The idea is to supply gas from the Sakhalin-3 field in the Far East, to end-users in China. The project was automatically banned by the United States in 2015 due to the discovery of oil in addition to gas in the field. The only possible method is deep-sea mining. Four companies in the world provide equipment for such complexes.

They are either owned by the United States or invested by them. Therefore, Gazprom’s ability to supply gas from Sakhalin is limited. Exploited deposits are also remote. To that extent, the cost of building Siberian Power 3 will be high. On the other hand, the European Union and the United States imposed sanctions on Russia and froze all Russian assets and foreign sources after the attack on Ukraine. The European market, which is the main source of income for Russia, became unforeseeable, and the Russians do not have the resources to finance other large projects. Of course, it would be good for China if the Russians cover the project cost and supplied gas to them. China invests in projects that they see profitable. Recently, an agreement was reached with Turkmenistan to invest in the construction of the fourth natural gas pipeline. As Russia’s main hope for natural gas exports, China is committed to having a diversified source of all its raw materials, not just energy. China imports 34 billion cubic meters of natural gas via the Central Asia-China pipeline, which stretches for more than 6,000 km through Turkmenistan and Uzbekistan, and Kazakhstan. With the construction of the fourth section of the pipeline, China will import an additional 30 billion cubic meters of gas. As a result, gas supplies from Turkmenistan are projected to be 30 percent higher than Russia’s. 30 billion cubic meters is the equivalent of the capacity of the “Siberian Power 2” pipeline that is currently in talks to run through Mongolia.At a time when competition for gas in the western hemisphere is intensifying due to the energy crisis, it is “interesting” that Mongolian and Russian companies are signing an agreement to build a gas pipeline. Under the agreement, Russia will carry out engineering and geodetic surveys of the gas project to China through Mongolia in 2022-2023. In other words, we are seeing an increased interest in Russia in the “Siberian Power 2” pipeline. The transit section is Soyuz Vostok. This option was considered in 2000 at locations between Mongolia and Kazakhstan, and was originally called “Altai”. In terms of cost and affordability, it has the advantage of easy installation and closer proximity to China. Russia’s main goal in building the Siberian Power 2 pipeline is to increase gas supplies to the Chinese market.

However, the key buyer China has never officially commented on the project. China is closely monitoring the risks and vulnerabilities posed by gas transit from the Ukraine-Russia relations. Putin is alone on the global geopolitical stage. Since the 2014 Crimean uprising, Putin’s efforts to maximize the power of his weapons and maintain its key market have failed. The country has not been able to supply as much gas to China as it wanted due to many reasons. In the West, Europe, and even its key trading partner, Germany, has publicly announced that it will reduce its dependence on Russian gas and is “looking” to diversify its sources of import. It is interesting to know who will partner with Russia in overcoming the great crisis caused by isolation and sanctions imposed by all sides.