bold@mininginsight.mn

While the “coal theft” scandal is attracting the attention of society and politics, allowing the government to take full control of the largest state-owned companies in the coal industry, there has been a important change in the ownership of another major company “Oyu Tolgoi” (OT). The main investor of the project, Rio Tinto Group, acquired 66 percent of Oyutolgoi after purchasing all shares of Turquoise Hill Resources. This is a significant event not only in the history of the OT project but also in the Mongolian mining industry. It took nine months of hard work for Rio Tinto to buy Turquoise Hill Resources (TRQ), the owner of 66 percent of Oyu Tolgoi. Rio Tinto, the owner of 50.8 percent of TRQ, and other small shareholders have had a conflict for some time. Small shareholders began to blame Rio Tinto for the delay in the construction of the OT project and the increase in costs, which became the main reason for the tension in relations. It can be said that, as a result of all this, the “Rio Tinto” group is increasing its ownership in OT by completely buying TRQ, kicking them out of the “game”. Two months after reaching an agreement with the government last January, Rio Tinto made its first offer to buy TRQ for USD 2.7 billion. The company’s board of directors did not approve, so the price was raised to USD 3.1 billion in August and USD 3.3 billion shortly thereafter.

“Rio Tinto” stated, “by fully purchasing TRQ, the governance and ownership structure of the OT project will be simpler and more effective. Pentwater Capital Management and Sailingstone were most unsatisfied with Rio Tinto’s proposal. The OT project’s underground mine development was nearing completion and production was close to reaching full capacity. The dispute between the largest and other shareholders caused quite a stir. In response to Rio’s decision to force a shareholder vote, small shareholders led by Pentwater increased their holdings by buying more shares on the stock exchange. They increased their voting rights and spent a hefty sum of money to oppose Rio’s proposal. Rio tried resolving the issue by entering into separate deals with Pentwater and Sailingstone but had to back away as it would have violated exchange regulatory rules. At the end of all this, on December 9, at the meeting of shareholders of TRQ, a decision was made to accept the offer of “Rio Tinto”, and “Rio Tinto” group bought 49% of TRQ for USD 3.3 billion. Thus, the year-long drama is now over. Rio is suddenly showing an increased interest in OT, and after overcoming many obstacles, it will soon own 66 percent of the project alone. Interestingly, Rio did not want more ownership in the project for 10 years before this. The company was first involved in the project in 2006. In October of the same year, “Rio Tinto” group signed a cooperation agreement with “Ivanhoe Mines Limited” (the current TRQ), the owner of the OT project.

By purchasing about 37.1 million shares of “Ivanhoe” for a total of USD 303 million, it acquired 9.95 percent. The OT Investment Agreement was signed in October 2009. Seven days later, the company bought an additional 46 million shares for USD 388 million, acquiring 19.7 percent of the company. Since then, “Rio Tinto” has continuously increased the number of shares, and by the end of 2011, it owned 49 percent of “Ivanhoe Mines”. However, ownership of 51 percent caused a lot of problems. Robert Friedland, the founder of Ivanhoe Mines, even turned to the Arbitration Court in order not to lose his company to Rio Tinto. However, the court’s decision was in favor of Rio, and in January 2012, the company bought 15.1 million shares of Ivanhoe at USD 19.7 per unit, acquiring a 51 percent stake. During this period, approximately USD 3.4 billion was spent on “Ivanhoe” in the form of various financial methods, and they finally owned 51 percent. Three months after acquiring 51 percent, the founder of Ivanhoe Robert Friedland, and his team members were released from the management team, and a month later, the company changed its name to “Turquoise Hill Resources”. Since then, Rio Tinto has not spoken about increasing its holdings in Oyu Tolgoi. It is safe to say that the decisions were related to the company’s asset portfolio and the policy of the CEO.

Tom Albanese, then CEO of Rio Tinto, was one of the key people who wanted to control the construction and operation of the OT project by owning 51 percent of Ivanhoe Mines. Before being appointed as the CEO in 2006, he was the head of Rio’s explo ration and copper sector, so he is said to have attached great importance to OT. But Sam Walsh, who succeeded him in 2013, during his 4-year tenure as CEO, was vocal about stopping the project, let alone increasing the company’s holdings in OT. Before being appointed as CEO, he managed the company’s iron ore division for 10 years and the aluminum division for four years. At that time, the main business of “Rio” was iron ore. Jean-Sebastien Jacques, who succeeded Sam Walsh, also once expressed his disinterest in increasing the company’s holdings in OT. As for him, while heading the Copper Group of Rio Tinto, he got the OT underground mine out of the jam, concluded the Dubai contract, and then was promoted to CEO. Copper is Rio Tinto’s main business for the future, and Oyutolgoi is often said to be a promising project for the company, but he considered 34% of the project to be sufficient enough. He may have seen a higher risk in Mongolia and difficulty in communication. However, with the dismissal of Jean-Sebastien Jacques and the restructuring of the entire management team of Rio Tinto, the new CEO Jakob Stausholm and the CEO of the Copper Group Bold Baatar completed their plan to fully buy TRQ within 9 months. The ownership of 66 percent of OT seems beneficial for Rio Tinto in several ways. First of all, they are now able to independently handle the remaining financing of underground mining. It means taking full responsibility for the mine. It will also contribute to the company’s reputation.

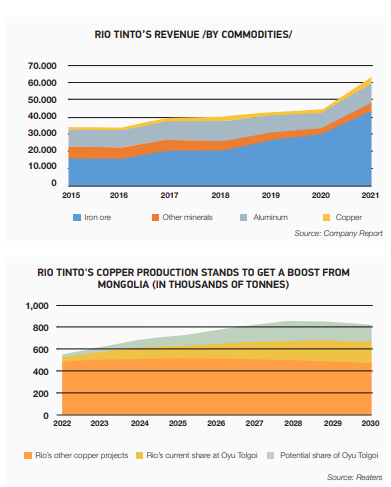

OT will be Rio’s frontrunner project if they can reach an understanding with the Mongolian government, because this time, there will be no complaints or opposition from small shareholders. In addition, “Rio Tinto” is diversifying its asset portfolio and paying great attention to mineral products that are dominant in energy transition and green development. Iron ore accounted for 59 percent of Rio Tinto’s total revenue last year. The company made about USD 40 billion from iron ore, which is five times higher than the revenue from copper. As a result, the share of iron ore in Rio Tinto’s total income has been increasing over the years. The 17 mines in the Pilbara region of Western Australia form the core of the industry, which is heavily dependent on its main buyer, China. However, the share of other minerals such as gold, uranium, diamonds, and titanium dioxide in the company’s income is shrinking.

At such a time, there is no doubt that they want to expand their asset portfolio and expand their income with minerals that are the basis of green development, such as copper and lithium, which are considered the key commodities of the future. However, Rio Tinto is not a big player in the copper industry at the moment. Currently, it owns 100 percent of the Kennecott and Bingham Canyon mines in the United States, and 300,000 tonnes of copper were extracted from these two mines last year. It also owns 30 percent of the Escondido mine, the second largest in the world. 280,000 tonnes of copper will be allocated to “Rio” from last year’s production. In addition, two new copper projects are being developed. Projects in the US and Australia will not be up and running as quickly. Once the Oyu Tolgoi underground mine achieves sustainable operation, the amount of copper extracted from the deposit will exceed 500,000 tonnes at its peak. Out of which, 330,000 tonnes belong to “Rio”. Last year, 54,000 tonnes of copper mined from OT went to “Rio”. This means that the amount will spike up by six times. In other words, by increasing its ownership by USD 3.3 billion, in just five years, half of the copper to be mined by “Rio” will be mined from Oyu Tolgoi. Therefore, the increase in ownership in OT is significant for “Rio”. In any case, the OT has been the center of attention for both Mongolia and Rio Tinto for the last two years.