The bottleneck in mining exports could not be resolved in the first quarter and persisted in the second quarter. Export remains locked up even at the end of April. The three key export minerals, namely coal, iron ore, and copper concentrate, still have excess inventory since 2021.

The government expects to collect about MNT 1.8 trillion from the exports of copper concentrates this year.

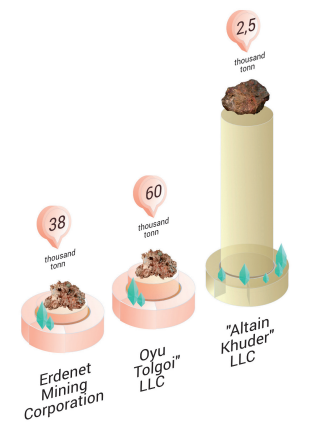

Roughly 458,600 tonnes of copper concentrate were exported in the first four months of this year. This is about 18.5 percent growth compared to the same period of last year. As of April 30, 2022, there are more than 60,000 tonnes of copper concentrate packed at the copper concentrate exporter Oyu Tolgoi LLC’s mine site.

At the current market price of about USD 10,200 per tonne, about USD 150 million worth of minerals is ready for export. A year ago, about 100 trucks delivered copper concentrates from “Oyu Tolgoi” per day, which has fallen to 48 now. Each truck carries 36 tonnes, or specifically, 18 bags of concentrate packed with 2 tonnes each. In early April, when the Mongolian Economic Forum was organized, about 80,000 tonnes of export-ready products were stockpiled at Oyu Tolgoi. The export bottleneck did not stop with just “Oyu Tolgoi” as “Erdenet Mining Corporation” is facing a similar situation. Over 38,000 tonnes of exportready products were stockpiled at the mine as of April 30.

The amount of copper concentrate at EMC hiked near 100,000 tonnes during the closure of the southern border. Since the opening of the border, the company delivered 100 wagons of products per day, greatly reducing the stockpile size to 38,000 tonnes. Ulaanbaatar Railway JV is currently providing only 30 units of freight wagons daily to EMC. While the two biggest exporters of copper concentrate are facing similar challenges, their “misfortune” also emerged in coal and iron ore exporters. Especially for coal exporters, the “misfortune” was felt earlier than the rest as it began disrupting the sector at the beginning of this year.

Coal exports have largely stopped and the big companies, such as “Erdenes Tavan Tolgoi”, “Energy Resource”, and “Tavan Tolgoi”, are only delivering pre-sold coal. About 700- 800 coal trucks daily entered the Gashuunsukhait port, but due to strict monitoring in line with the Covid-19 pandemic, the number of trucks entering the border dropped to about 250.

According to the Mongolian Government, a negotiation was made with China to increase exports and double capacity. 4.6 million tonnes of coal are currently stockpiled at the Tsagaan Khad border control zone. This year’s state budget estimate coal exports at 36.7 million tonnes. The expected revenue to the budget from coal is MNT 1.5 trillion. The Shiveekhuren-Sekhee port, the second-largest coal export gateway, has been closed since October 2021 due to the pandemic. 7 million tonnes of coal have been piled up at the port.

To stabilize the port operations back to normal, the Mongolian side has been trying to enforce the strict infection control measures of China, establishing two new PCR testing laboratories, and completing the necessary preparatory works for coal exports. Nyambaatar.Kh, Minister of Justice and Home Affairs, and the Chairman of the Working Group in charge of improving the situation at the Gashuunsukhait and Shiveekhuren ports and taking prompt measures, has announced to open the Shiveekhuren-Sekhee port, proceed with coal export by April and reduce the stockpile in a short period. The third biggest export mineral is iron ore. Since the beginning of the year, a total of 992,500 tonnes of iron ore and concentrate have been exported nationwide.

Most of the iron ore transported by rail is accounted for by Boldtumur Yeruu Gol LLC exports. The company said the landslide had disrupted mining operations, causing delays. However, exports have continued unabated. The accumulated ore concentrate in the customs zone of “Altain Khuder” LLC has reached 2.5 million tonnes and the mine has temporarily suspended its operations. The company did not export anything since September 2021. The spread of coronavirus, which is widely forgotten in Mongolia, is still considered high risk for our southern neighbor, and the strict control measures and curfews are currently effective. This situation directly affects Mongolia’s exports to China as uncertainty persists. The southern neighbor is not easing its zeroinfection policy this year, but instead, tightening it. China is the last major power in the world with a zero-infection policy. This year’s major events, such as the National People’s Congress and the Communist Party Congress, are taking place to discuss the “destiny” of the southern neighbor for the next 10 years, as well as to maintain state power. These are potentially factoring in on why China will not open its borders in 2022.