misheel@mininginsight.mn

In 2019, Mongolian geologists extracted oil from a depth of 2,834 meters. This event marked a significant moment in the 79-year history of Mongolian geology.

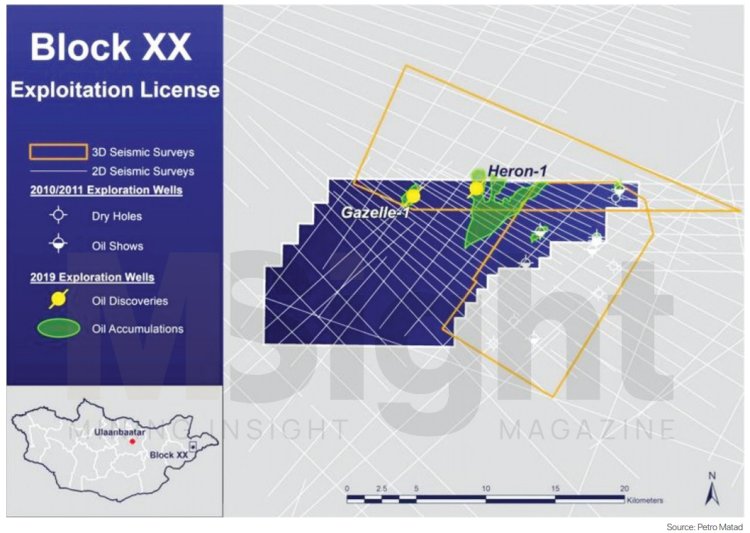

Now, five years later, Petro Matad LLC is on the brink of commencing its third round of oil production. According to the company, production equipment will be installed in August, and operations will begin once the equipment is connected to the well. Recent estimates suggest that the resource near the Heron-1 field in the Matad-XX block in Dornod Province holds around 100 million barrels of oil. The company expects initial production to be approximately 500 barrels per day, with a target of reaching 9,000 barrels per day within five years. This production volume would represent 67% of the total oil output in Mongolia from the previous year. The development of the Heron-1 field is particularly significant as Mongolia is in the process of establishing its first domestic oil refinery. The refinery will be supplied with oil through a 530 km pipeline extending from Matad soum to Altanshiree soum in Dornogovi Province. By August, around 100 km of the pipeline had been buried, and 400 km had been welded and tested. Construction is also underway for the reservoir, substation, control room, and pipeline foundations, with the second stage of the refinery’s development—including the Primary Process and Auxiliary Facilities (EPC-2) and the Thermal Power Plant (EPC-3)—already in progress. The nearing exploitation of this new oil field is particularly timely amid the ongoing industrial construction. Petroleum product consumption in Mongolia has been rising steadily since 2017.

Monthly consumption averaged 111,000 tonnes in 2017, increased to 143,000 tonnes in 2022, and reached 180,000 tonnes in 2023. Since the beginning of this year, consumption has surged to approximately 200,000 tonnes. This increase is attributed to higher coal production, rising exports, and the growing number of passenger cars, trucks, and heavy-duty vehicles.

Monthly consumption averaged 111,000 tonnes in 2017, increased to 143,000 tonnes in 2022, and reached 180,000 tonnes in 2023. Since the beginning of this year, consumption has surged to approximately 200,000 tonnes. This increase is attributed to higher coal production, rising exports, and the growing number of passenger cars, trucks, and heavy-duty vehicles.

OIL WILL DRIVE DEVELOPMENT TOO

Last year, Dornod Province ranked fifth out of 21 provinces on the development index, consistently demonstrating strong performance. The contributions of oil exploration and production companies to this development are significant. As of 2023, PetroChina Dachin Tamsag LLC, Donshen (Mongolia) Oil LLC, and Petro Matad LLC have invested USD 32 million in the province, according to the Mineral Resources and Petroleum Authority of Mongolia. This figure reflects only direct investments; the total contributions, including taxes, expenses, local support, and development, amount to USD 231 million. With full exploitation of the Khukh Heron-1 deposit, future investments and contributions are expected to rise, further boosting both national and local economies. However, oil extraction has faced public resistance. Mike Buck, CEO of Petro Matad LLC, cited the lack of coherence among government agencies and the absence of a robust legal framework for investor protection during the “Mining Week” event (July 10-16, 2023). He also raised these concerns in a meeting with Minister of Economy and Development Ch. Khurelbaatar early in the year. Despite these efforts, public protests against oil extraction have intensified, particularly on social media during the spring. Notably, many protesters were from outside the local area. In February, a month before the protests, Petro Matad LLC obtained a land use permit from the Citizens’ Representative Council of Matad soum in Dornod Province. Currently, Mongolia produces an average of 11,000 barrels of oil per day. If the Heron-1 field comes online, production could reach 20,000 barrels per day or approximately 7.3 million barrels per year, equating to about 950,000 tonnes of oil. To operate at full capacity, the oil industry will need around 1.5 million tonnes of products.

OTHER EXPECTATIONS

The government’s 2020-2024 action plan saw limited success in achieving its oil-related targets. However, the 2024-2028 National Development Plan introduces 14 major projects aimed at expanding the economy, including the “Oil Refining Complex” project. The term “complex” in this context suggests a broad scope, encompassing not only oil refineries and pipelines but also investments in the oil industry and government support for exploration. Eight companies with Production Sharing Agreements (PSAs) are involved in state-supported oil projects. These include Mongolyn Alt (MAK) LLC, Smart Oil Investment LLC, Capcorp Mongolia LLC, and Shunkhlai Energy LLC, all of which are actively investing. Last year, these companies invested USD 9.3 million in the oil sector. Additionally, Mongolian Oil Refinery SOE is seeking investment for its Davst-31 field in Matad.

Mining Insight Magazine, №07, 08 (032, 033)