bolderdene@mininginsight.mn

POLITICIANS REMAINED SAFE FROM "SCRUTINY”

The ad hoc review committee convened for two days (May 29-30, 2024) to address matters concerning the special mineral license. This marks the fifth Open Hearing convened since the implementation of the Law on Parliamentary Oversight and Inspection. Enkh-Amgalan. B, the member of parliament who chaired the hearing, highlighted the breadth of the topic under discussion, noting the constraint of limited time compared to previous hearings. Established by Parliament Resolution No. 25 on April 12, 2024, the Temporary Review Committee was tasked with overseeing activities related to land allocation, subsoil exploration permits, payment, taxation, and collection for mineral exploration and utilization. Members representing the Mongolian People's Party (MPP) included Sandag-Ochir. Ts, Tserenpuntsag. Ts, and Enkh-Amgalan. B, while Adshaa. Sh and Dorjkhand. T represented the minority. Despite Tserenpuntsag role as head of the temporary committee, EnkhAmgalan presided over the open hearing as assigned by the Speaker of Parliament, Zandanshatar. G. Discussions during the hearing encompassed not only licensing and taxation issues but also strategic deposit considerations. Anticipation was high for a thorough examination of the mining industry, major corporations, and influential political figures and government officials during the "Mineral Licensing Hearing." Past hearings have seen parliamentary members and ministers brought into focus, leading to resignations and legal consequences. However, it's evident that mineral licensing transcends mere mining concerns, serving as a nexus for both mining and political collaboration. However, the hearing remained relatively subdued. The reason is straightforward: due to the General Election Commission's failure to validate the regular parliamentary elections, no official or politician faced trial. It's imperative to avoid populism and refrain from disseminating false information in the public domain. Nonetheless, in his concluding remarks, the Hearing Chairman and Member of Parliament Enkh-Amgalan. B underscored that he provided the public with genuine information regarding the legal framework and the collaboration among government institutions serving the sector.

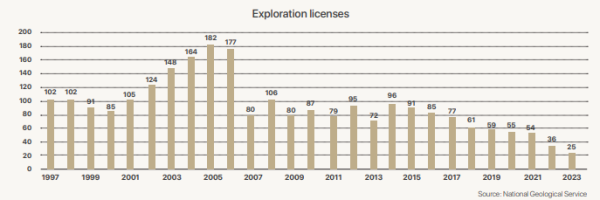

OUT OF 14,299 EXPLORATION LICENSES ISSUED, 2,126 DEPOSITS WERE BROUGHT INTO OPERATION

Let's recap some key points regarding the special licenses discussed during the hearing: According to data presented by the National Geological Service, Mongolia issued a total of 14,299 special exploration permits from 1997 to 2023. Notably, 2,053 special licenses were issued in 2004, with a hiatus in issuance during 2011-2013. Over this period, a total of 2,518 special use permits were granted. Initially, special use licenses were obtained through application. However, in 2006, amendments to the Law on Minerals facilitated the issuance of special exploitation licenses based on the resources delineated in the special exploration licenses.

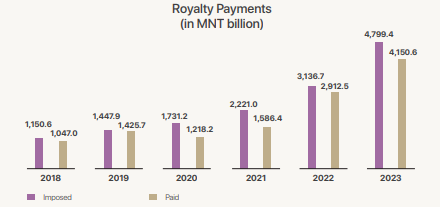

Of the aforementioned special permits, 2,126 deposits have been identified and registered in the state reserve fund, primarily comprising key minerals earmarked for export. Nevertheless, over 90% of last year's total mineral exports originated from deposits with special exploitation licenses issued between 1995 and 2006. In essence, our current export base relies heavily on deposits licensed two to three decades ago. This underscores the inadequacy of recent mining activities and the opening of new deposits. Without significant development in these areas, there is a risk of lacking sufficient deposit reserves to sustain exports in the next 10- 20 years. Furthermore, the majority of revenue from the mining sector is derived from mineral resource royalties. Over the past five years, royalty alone has contributed to 55% of the mining sector's revenue. In 2023, tax revenue from the mining sector accounted for 30% of the total budget revenue, with royalty contributing 17% on its own. This underscores the significant role of royalty in the national budget, marking a pinnacle in Mongolia's mineral income. However, as of today, 62% of special use permits have yet to be implemented. According to the latest data, Mongolia currently holds 1,731 valid special licenses. Excluding permits for minerals lacking resources and those with widespread distribution, the operational status of 1,076 special use licenses remains uncertain. Upon closer examination, 42% (456 permits) cite a lack of investment as the primary hindrance, while 241 permits state no specific reason. Merely 19 permits attribute non-operation to local and civil opposition movements.

Of the aforementioned special permits, 2,126 deposits have been identified and registered in the state reserve fund, primarily comprising key minerals earmarked for export. Nevertheless, over 90% of last year's total mineral exports originated from deposits with special exploitation licenses issued between 1995 and 2006. In essence, our current export base relies heavily on deposits licensed two to three decades ago. This underscores the inadequacy of recent mining activities and the opening of new deposits. Without significant development in these areas, there is a risk of lacking sufficient deposit reserves to sustain exports in the next 10- 20 years. Furthermore, the majority of revenue from the mining sector is derived from mineral resource royalties. Over the past five years, royalty alone has contributed to 55% of the mining sector's revenue. In 2023, tax revenue from the mining sector accounted for 30% of the total budget revenue, with royalty contributing 17% on its own. This underscores the significant role of royalty in the national budget, marking a pinnacle in Mongolia's mineral income. However, as of today, 62% of special use permits have yet to be implemented. According to the latest data, Mongolia currently holds 1,731 valid special licenses. Excluding permits for minerals lacking resources and those with widespread distribution, the operational status of 1,076 special use licenses remains uncertain. Upon closer examination, 42% (456 permits) cite a lack of investment as the primary hindrance, while 241 permits state no specific reason. Merely 19 permits attribute non-operation to local and civil opposition movements.

EXPLORATION LICENSING ISSUES

The hearing brought to light numerous issues surrounding the issuance of exploration licenses, with the most egregious being instances of illegal mining occurring in areas prior to the granting of special exploration licenses, as well as the establishment of access points for smallscale mining operations. In Mongolia, since 2017, special permits for mineral exploration have been allocated through a competitive selection process. A total of 310 special licenses were awarded to 351 companies. Moreover, starting from October 2022, the selection process was conducted online, resulting in the issuance of 274 special exploration permits out of 523 announced areas, generating MNT 86.3 billion for the state budget.

One notable advantage of awarding special exploration licenses through a competitive selection process is the concentration of significant revenue into the state budget. Essentially, exploration areas are auctioned off, and the license is granted to the company offering the highest bid. However, inspectors and experts from the Temporary Committee raised concerns regarding potential illegal activities associated with this process. A notable observation is that several companies participate in the selection process but fail to remit the required funds and consequently do not obtain the special license. Historically, there have been 68 instances of candidates participating in the selection process and securing the highest number of votes. Furthermore, according to examples provided by auditors and experts, there have been documented cases of illegal mineral extraction in areas where the selection process was announced. Among the 68 cases scrutinized by analysts, four instances emerged where the highest vote-getters failed to secure the special license. One such case involved International Gem and Stone Trading LLC, which withdrew from bidding after offering MNT 25 billion MNT for the 712-hectare gold selection site named Bor Nuruu in the Bayangovi Soum of Bayankhongor Province, with a threshold value set at MNT 3.2 million. State inspectors from the Department of Industry Inspection of the Ministry of Mining and Heavy Industry (MMHI) investigated the situation in the Bor Nuruu area last April to ascertain why the company departed without acquiring a special license. Upon examination, it was discovered that in the Bor Nuruu area, three abandoned trenches and multiple pits along the veins indicated possible illegal mineral extraction activities. It is highly probable that the participating company conducted unauthorized mineral exploration activities before leaving the site without obtaining the requisite special exploration permit, or that other parties engaged in illicit mining operations in the area. Munkhdul. B, head of the MMHI's Department of Inspection, stated, "During my personal inspection of the Bor Nuruu site, I encountered a deep pit that had been excavated for at least 4-5 years. Five slopes had been dug in pursuit of exploration. We suspect that this was a tactic to buy time, potentially facilitating illegal mining activities in the interim. Therefore, we forwarded a report to the Administrative Police Council (APC) and the Criminal Police for further investigation. Given our findings, it's evident that the involvement of the local governor in illegal mining activities cannot be ruled out, thus necessitating intervention by legal authorities."

Furthermore, "World Copper Mining," which bid MNT 13.3 billion and MNT 9.5 billion for two promising coal fields named Sukhant Khudag and Khureltogoo respectively, as part of a selection process in the Bayan-Undur Soum area of Bayankhongor province, failed to secure a special license. It was also discovered that excavation had occurred between the aforementioned two fields. Azzaya. G, Executive Director of "World Copper Mining," explained, "The 2024 selection process in Bayankhongor province was canceled due to delayed funds from our partner company. The transfer was not completed within the short timeframe." Azzaya further stated, "We have requested an extension from Mineral Resources and Petroleum Authority of Mongolia (MRPAM), stating that with more time, we can fulfill the financial requirements and obtain the special permit without cancellation." Should companies withdraw from the selection process, there are no provisions for awarding the special license to the nextranked company. The MMHI indicated that it is preparing to amend regulations to hold companies accountable and prevent such occurrences in the future. There are suspicions that deliberate confusion and cancellations in the tender process may be linked to illegal mining activities. A similar issue concerns areas subjected to small-scale mining activities. According to the law, small-scale mining is permitted in areas abandoned after mineral extraction or in damaged areas. However, there have been instances where undamaged areas were intentionally damaged to justify mining activities. Subsequently, these areas were registered as damaged, enabling the issuance of permits for smallscale mining. Chairman of the hearing, Enkh-Amgalan. B, repeatedly stressed the potential involvement of local authorities, MRPAM, and officials from the Ministry of Environment and Tourism. One such incident occurred in Darvi Soum of GobiAltai Province.

Furthermore, "World Copper Mining," which bid MNT 13.3 billion and MNT 9.5 billion for two promising coal fields named Sukhant Khudag and Khureltogoo respectively, as part of a selection process in the Bayan-Undur Soum area of Bayankhongor province, failed to secure a special license. It was also discovered that excavation had occurred between the aforementioned two fields. Azzaya. G, Executive Director of "World Copper Mining," explained, "The 2024 selection process in Bayankhongor province was canceled due to delayed funds from our partner company. The transfer was not completed within the short timeframe." Azzaya further stated, "We have requested an extension from Mineral Resources and Petroleum Authority of Mongolia (MRPAM), stating that with more time, we can fulfill the financial requirements and obtain the special permit without cancellation." Should companies withdraw from the selection process, there are no provisions for awarding the special license to the nextranked company. The MMHI indicated that it is preparing to amend regulations to hold companies accountable and prevent such occurrences in the future. There are suspicions that deliberate confusion and cancellations in the tender process may be linked to illegal mining activities. A similar issue concerns areas subjected to small-scale mining activities. According to the law, small-scale mining is permitted in areas abandoned after mineral extraction or in damaged areas. However, there have been instances where undamaged areas were intentionally damaged to justify mining activities. Subsequently, these areas were registered as damaged, enabling the issuance of permits for smallscale mining. Chairman of the hearing, Enkh-Amgalan. B, repeatedly stressed the potential involvement of local authorities, MRPAM, and officials from the Ministry of Environment and Tourism. One such incident occurred in Darvi Soum of GobiAltai Province.

UNAUTHORIZED EXPORTERS AND ROYALTIES

The number of unlicensed exporters has surged significantly over the past three years. In the preceding year, 193 companies engaged in mineral exports without possessing a special license, compared to 133 companies with valid licenses. This marks the first instance of unlicensed exporters surpassing their licensed counterparts. Furthermore, 30 companies failed to report their mineral export activities, indicating a total of 223 companies exporting mineral resources without the requisite special licenses. This figure represents an increase of 186 companies from 2020 and 126 companies from 2022. Notably, among these unlicensed exporters, there were 30 enterprises that exported minerals without a special license while evading payment of royalties. This trend is particularly prevalent among fluorspar companies. Additionally, Customs data revealed instances of mineral exports by certain companies that failed to submit their reporting plans to MRPAM due to nonoperation. For instance, 31 holders of fluorspar usage licenses exported a cumulative total of 856,000 tonnes of fluorspar over the past three years. Notable exporters include Termenjonsh, which exported 92,000 tonnes, and Baylagjonsh, which exported 74,000 tonnes of fluorspar during the same period.

BY WHAT EXTENT IS THE LIST OF STRATEGIC DEPOSITS EXPECTED TO EXPAND?

With the enactment of the Law on National Resources Fund and amendments to the Law on Minerals, the issue of strategic deposits has once again come to the forefront. It is anticipated that the number of strategic deposits may see an increase, with the proposal to allocate 34 percent of the income from strategic deposits to the Sovereign Wealth Fund. Currently, as per the Law on Minerals approved in 2006 and Parliament Resolution No. 27 adopted in 2007, there are 16 deposits classified as strategic. Resolution No. 27 also mandates the government to assess the inclusion of 39 additional deposits as strategic, along with newly discovered deposits. The recent enactment of the Sovereign Wealth Fund Law has reignited discussions on the implementation of Resolution No. 27, issued 17 years ago. Clause 4 of Resolution No. 27 directs the government to establish state ownership over the Oyu Tolgoi, Tavan Tolgoi, Tsagaansuvarga, and Asgat deposits and to integrate them into economic activities. Subsequent parliamentary decisions have been made regarding the Oyu Tolgoi, Tavan Tolgoi, and Tsagaansuvarga deposits, with state ownership percentages determined. However, the Asgat silver deposit, despite being wholly owned by the Erdenes Mongol SOE or the state, faces challenges in commencing mining operations, as reported by the MMHI. Without additional exploration and resource expansion, it is estimated that utilizing the current resources may not be economically viable. During the final day of the hearing, deliberations focused on the implementation of Resolution No. 27 and the measures being taken. Representatives from companies owning strategic deposits actively participated in the discussions, offering their perspectives. Essentially, parliamentarians queried these company executives about their stance regarding the implementation of the Sovereign Wealth Fund Law. Representatives from Energy Resources LLC, operating in the Tavantolgoi deposit, and MAK LLC, operating in the Nariin Sukhait deposit, expressed their positions, indicating that they are currently assessing the implications of the law. However, Mendbayar. M, head of the MMHI Policy Department, provided comprehensive insights into the efforts being made to expand the list of strategic deposits in line with Resolution No. 27. In 2013, a joint working group comprising representatives the former Ministry of Minerals and Energy, and the Minerals Authority were established to conduct a study. Nineteen out of the 39 deposits listed in Annex 2 of Resolution No. 27 were proposed for inclusion in strategic deposits and submitted to the government. However, during the parliamentary session in May 2013, these proposals were not endorsed. Subsequently, in 2018, in addition to the initial 19 deposits, another 41 deposits were recommended for inclusion in strategic deposits. However, they were rejected due to the need for further evaluation. Since then, ongoing research and preparatory efforts have been underway. During the hearing, it became evident that there is an urgent requirement for a unified information system among government institutions to enhance coordination. This lack of coordination has been identified as the primary factor negatively impacting the industry's development and sustainable operations, leading to a tarnished industry reputation.

Mining Insight Magazine, №5 (030)