Since May 23, the European Union's Critical Mineral Raw Materials Act has been officially enforced. This act, initially discussed at the end of 2022, was swiftly implemented—a notable achievement attributed to the association's 2011 list of critical minerals, subject to review every three years. When compiling the list of critical minerals, the European Union prioritized two main objectives: ensuring a stable supply of essential raw materials and facilitating the transition to clean energy—a focus shared by technologyproducing nations like the United States, South Korea, and Japan. Moreover, major mining nations maintain their own lists of critical minerals, with Australia and Canada leading the way. Their approaches differ from those of technology manufacturers. Australia's Critical Minerals strategy, for instance, emphasizes attracting investors among its six key elements. Conversely, Canada has expressed willingness to adjust its list based on the strategic importance of minerals to allies and partner nations.

Notably, the top five investors in Australia over the three years following 2019— namely, the United States, Great Britain, Belgium, Japan, and Singapore—rank among Canada's key trading partners and allies. The EIT RawMaterials meeting (May 14-16, 2024) took place in Brussels, Belgium's largest city, just seven days before the European Union act came into effect. Discussions during the meeting centered on expanding mining activities within the federal states' territories and engaging in critical mineral negotiations with third countries, aligning closely with the objectives of the Critical Commodities Act. Essentially, these two significant European mining events in May underscore the challenge facing domestic mining efforts: while there's a resumption of domestic mining operations and the exploitation of new deposits, it may not be sufficient to meet critical mineral demands. The European Union has set a target, outlined in the act, to limit imports of 34 critical minerals from third countries to no more than 65% of annual needs by 2030.

Among these third countries is China, a significant source of critical minerals, but the European Union aims to reduce dependency on it. It's anticipated that the act will aid in diversifying import sources, with a growing focus on increasing imports from Africa and the 11 ASEAN countries. Simultaneously, in Mongolia, the second seminar titled "Critical Minerals: Mongolian and Global Trends, Policies, and Practices" (May 22, 2024) was held.

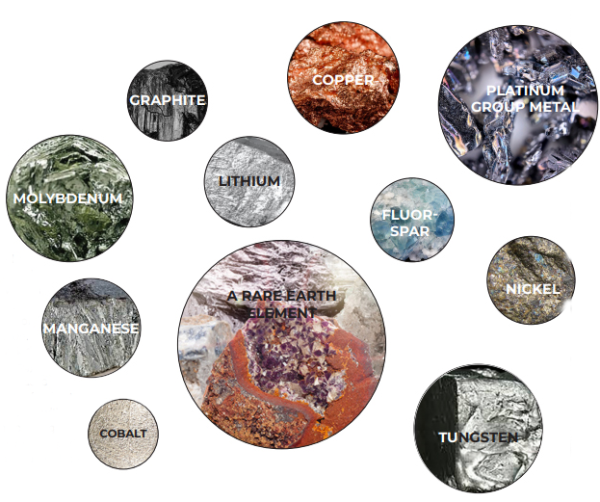

Organized by the Mongolian Important Minerals Association, the seminar unveiled Mongolia's first tentative list of critical minerals, comprising 11 minerals: molybdenum, manganese, nickel, copper, fluorspar, graphite, rare earth elements, cobalt, lithium, platinum group metals, and tungsten.

During the seminar, Dagva. M, president of the association, announced that these 11 minerals would be formally presented to relevant authorities starting from the upcoming fall. This initiative signals Mongolia's nascent steps toward establishing a framework for critical minerals. Presently, nine of the minerals identified by the association are encompassed within the European Union's strategic raw materials list. This alignment also extends to the critical minerals identified by the Republic of Korea and Great Britain, both of which are actively engaging in discussions concerning our country's critical minerals.

The convergence of critical mineral lists is largely due to their shared objective, albeit with distinct intentions: one aimed at selling and the other at commercials. Over the past 12 years, the European Union has consistently expanded its list of minerals through four evaluations. While aiming to domestically mine at least 10% of its needs by 2030, both the number of minerals on the list and the overall demand are expected to rise. Particularly notable is the projected surge in demand for aluminum, copper, silicon, and nickel. For instance, recent assessments indicate a significant rise in aluminum demand, newly recognized as a strategic raw material, from 32 million tonnes in 2020 to an estimated 137 million tonnes by 2030. Similar trends are observed in other countries, where research organizations highlight increasing demand for critical minerals driven by the transition to clean energy. Mongolia's initial step in participating in this global landscape is to internationally announce its list of critical minerals. Accompanying this announcement, it's crucial to stipulate a scheduled update for the list of raw materials. This proactive approach will facilitate broader i n ternational understanding of critical minerals across various sectors, emphasizing the importance of technological localization. Our country has unveiled its long-term strategy, "Vision-2050," which places the mining sector at the forefront of economic priorities, with a particular focus on creatin g an export-oriented economy. As part of this strategy, plans are in place to develop a high-tech heavy industrial complex utilizing coal, copper, silicon, and lithium deposits. Moreover, there will be intensified exploration and research efforts aimed at rare earth elements. In line with this, the tripartite meetings involving Mongolia, the Republic of Korea, and the United States regarding rare earth elements—considered top priorities in the critical mineral lists of these countries— have made significant progress since last year.

Additionally, Mongolia's successful partnership with Great Britain continues to flourish. In March, the country hosted the "Mineral Processing and Circular Economy" business forum in London, during which Mongolian representatives expressed keen interest in collaborating with foreign investors on the exploration and research of rare earth elements and critical minerals. This fruitful collaboration led to a visit by David Cameron, the Minister of Foreign Affairs, Commonwealth, and Development of the United Kingdom, to Mongolia in April. During his visit, an interministerial memorandum of understanding was signed between David Cameron and Ganbaatar. J, the Minister of Mining and Heavy Industry, paving the way for joint detailed research on rare earth elements, exchange of geological scientific information, and specialist training initiatives. It appears that in response to the global situation, the Mongolian government has taken proactive measures and attained an initial outcome. Concurrently, the demand for critical minerals is expected to persistently rise. By establishing a comprehensive list, foreign investors will have a selection of raw materials for potential investment, prompting their direct engagement. Thus, compiling a list of critical minerals could serve as one avenue for the government to attract foreign investment.

Mining Insight Magazine, May 2024 №5 (030)