The Law on Mining Products Exchange has now been in effect for over six months. During this period, in addition to coal, iron ore, concentrate, and fluorspar have been included in the trading schedule of the exchange. Out of the 258 auctions conducted for mining products on the Mongolian Stock Exchange, 241, or 93 percent, were successful. Coal alone has been featured in 148 auctions. Iron ore and concentrate auctions have occurred 93 times since September 15, with no buyers at the fluoride auction on October 30. Subsequently, no further fluoride auctions have been announced. Prior to the official implementation of the exchange law on June 30, 2023, trial trading for mining products intended for export commenced in January 2023. During this pre-law period, coal auctions were held independently, resulting in 54 successful auctions. Consequently, mining products were exported in a total of 295 auctions over 12 months.

The Law on Mining Products Exchange has now been in effect for over six months. During this period, in addition to coal, iron ore, concentrate, and fluorspar have been included in the trading schedule of the exchange. Out of the 258 auctions conducted for mining products on the Mongolian Stock Exchange, 241, or 93 percent, were successful. Coal alone has been featured in 148 auctions. Iron ore and concentrate auctions have occurred 93 times since September 15, with no buyers at the fluoride auction on October 30. Subsequently, no further fluoride auctions have been announced. Prior to the official implementation of the exchange law on June 30, 2023, trial trading for mining products intended for export commenced in January 2023. During this pre-law period, coal auctions were held independently, resulting in 54 successful auctions. Consequently, mining products were exported in a total of 295 auctions over 12 months.

The introduction of exchange trading into the Mongolian mining industry has yielded remarkable results in its inaugural year. The trading of mining products on the exchange in 2023 can be broadly categorized into two halves: the first six months before the official law's implementation and the subsequent six months after the official law came into effect.

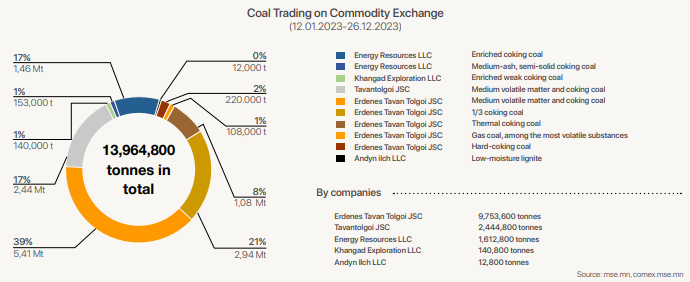

One-fifth of coal exports were transacted through exchange trading

During the initial 12 months of mining exchange operations, a total of 13,964,800 tonnes of coal were sold in 202 coal trades. The ministry in charge reports that Mongolia achieved a recordhigh coal export of 68 million tonnes in 2023. Notably, one-fifth or 20 percent of the coal exported was traded on the exchange during this period. The key determinant for the continuation of stock exchange trading lies in the level of activity and success exhibited by the companies in the coal auction. Erdenes Tavan Tolgoi JSC, Energy Resources LLC, Tavan Tolgoi JSC, Khangad Exploration LLC, and Andyn Ilch LLC engaged in coal trading on the exchange. Throughout the auction period, Energy Resources LLC notably participated in a maximum of 10+107 auctions, accounting for over half of the coal auctions. The company witnessed a significant surge in its trading presence following the enactment of exchange laws. Other companies, such as Erdenes Tavan Tolgoi JSC (35+30), Khangad Exploration JSC (5+6), Tavan Tolgoi JSC (4+4), and Andyn Ilch LLC (0+1), also achieved successful trades. It is noteworthy that state-owned companies are obligated to participate in the Law on Mining Products Exchange, while private sector enterprises engage voluntarily.

Some varieties of coal have been excluded while some were added

In the first half of exchange trading, hard-coking coal products were sold but were subsequently removed in the latter half of the year. These products, initially produced by Erdenes Tavan Tolgoi JSC, saw changes in the last six months. During this period, Erdenes Tavan Tolgoi JSC introduced gas coal with highly volatile matter, while Energy Resources LLC added semi-solid coking coal with medium ash content. Additionally, in December, Andyn Ilch LLC commenced the sale of low-moisture lignite, marking its participation in stock exchange trading since December. Throughout the 12 months of auctions, a total of 9 coal types were registered in the Mongolian Stock Exchange (MSE). Among these, Erdenes Tavan Tolgoi JSC traded five, Energy Resources LLC traded two, and Tavan Tolgoi JSC, Khangad Exploration LLC, and Andyn Ilch LLC each traded one type of coal. It is noteworthy that Erdenes Tavan Tolgoi JSC and Tavan Tolgoi JSC produce a product of medium volatile matter, coking coal. Over the past 12 months (January 12, 2023 - December 26, 2023), 339 trading numbers were registered in the Mining Products Trading System (comex. mse.mn). Among these, 45 transactions did not receive bids from buyers. 30 of these bid-less trades are from the first six months preceding the law's implementation, suggesting successful coal exchange trading in the last six months. An interesting observation is that there were 21 cases of non-submission of price offers in May and June. Furthermore, when categorizing the 30 trades without price offers by coal type, two-thirds of the weight was attributed to two products: medium volatile matter, coking coal, and enriched coking coal. However, in the last six months, four coal trades received no bids. These include enriched medium-ash, semi-solid coking coal, thermal coal, and low-moisture lignite. Among the remaining 11 trades, 95 percent were fluorspar, while the rest comprised iron ore and concentrate.

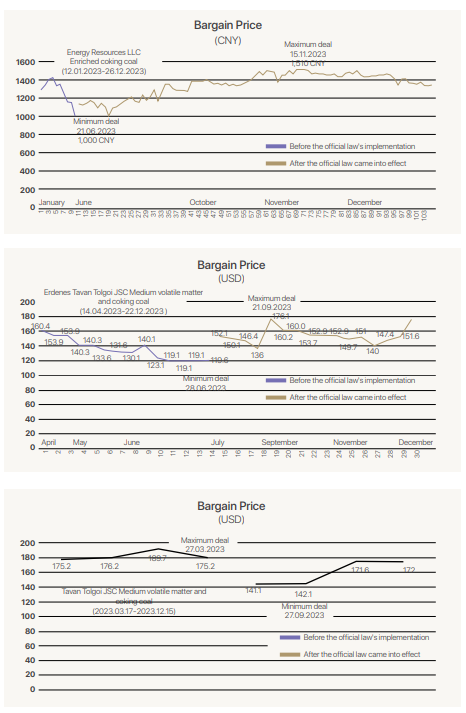

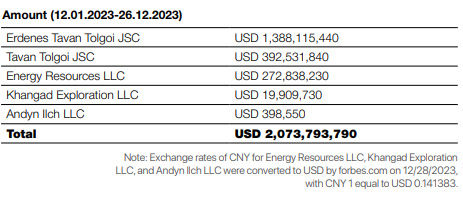

Coal Price

Erdenes Tavan Tolgoi JSC emerged as the leading seller of coal on the exchange, with coking coal, medium volatile matter, and coking coal constituting 1/3 of the trading varieties, contributing to almost 80 percent of the trading volume during the 12-month trading period. Notably, gas coal, among the most volatile substances, was traded once. The company achieved success with 65 auctions in its inaugural trading year, generating sales totaling USD 868 million. Tavan Tolgoi JSC recorded sales of USD 390 million through 8 auctions, focusing on medium volatile matter and coking coal. Energy Resources LLC actively participated in the highest number of auctions, especially during the latter half. However, the coal's selling price did not experience a sharp increase compared to the previous half. In the first half, 32,000 tonnes of coal were sold in 6 transactions, whereas in the latter half, 12,800 tonnes of coal were traded regularly. Over the last 6 months, the company engaged in 12 auctions, involving semi-solid coking coal with medium ash and enriched coking coal. The sales of these two coal types amounted to CNY 1.8 billion in stock market trading. In 11 auctions featuring enriched weak coking coal, Khangad Exploration LLC. achieved sales worth CNY 140 million for this specific coal type.

The most actively traded product on the mining exchange is enriched coking coal. Over the past 105 auctions, the average transaction price stood at CNY 1,340. Although the minimum deal reached CNY 1,000, it witnessed an increase from the initial call price. The initial call price for concentrated coking coal has risen to CNY 1,330 since October 4, compared to the range of CNY 900-1250 observed in the first half of the exchange.

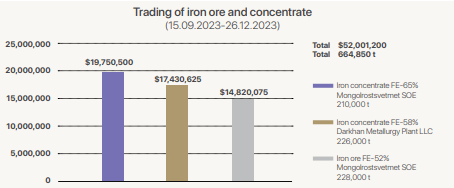

A total of 660,000 tonnes of iron ore and concentrates were exchanged

Iron ore and concentrate trading commenced officially on September 15, with 93 out of 103 scheduled call trades, covering three types of products. Mongolrostsvetmet SOE participated in the auctions with 65 percent iron concentrate, and 52 percent iron ore, and Darkhan Metallurgy Plant LLC engaged in trading 58 percent iron concentrate. Together, these two companies traded more than 660,000 tonnes of products, totaling USD 52 million.

Mongolrostsvetmet SOE conducted 62 trades, trading 438,000 tonnes of iron ore and concentrate, and 31 trades, exchanging 228,000 tonnes of iron concentrate. Beyond coal and iron concentrates and ores, fluorspar is another mining product listed on the exchange. On October 30, Mongolrostsvetmet SOE offered 3,250 tonnes of CAF2-95% fluorspar, but no bids were received. Since then, no further trades have been announced. Looking ahead, copper trading is set to commence on January 1, 2024, with Erdenet Mining Corporation SOE participating in the trade. However, for the products of Oyu Tolgoi LLC, the price will be determined by the exchange rate in London.

Mining Insight Magazine, №12 (025)