MISHEEL.E

misheel@mininginsight.mn

Karsten Haustein, a climatologist at the University of Leipzig in Germany, has predicted that last July might have marked the hottest summer in 120,000 years. Alongside his forecasts, UN Secretary-General Antonio Guterres highlighted that global warming is transitioning into an era of global boiling. Furthermore, the US National Oceanic and Atmospheric Administration (NOAA) research reveals that the average global temperature has not dipped below freezing since 1976. In light of these developments, what steps can Mongolia and its citizens take to address this escalating heat? Notably, in a period when we heavily depend on the mining sector, we are exploring numerous possibilities for our energy and heat sources. One such option under consideration is the coalbed methane. The coalbed methane gas sector is a nascent industry in Mongolia.

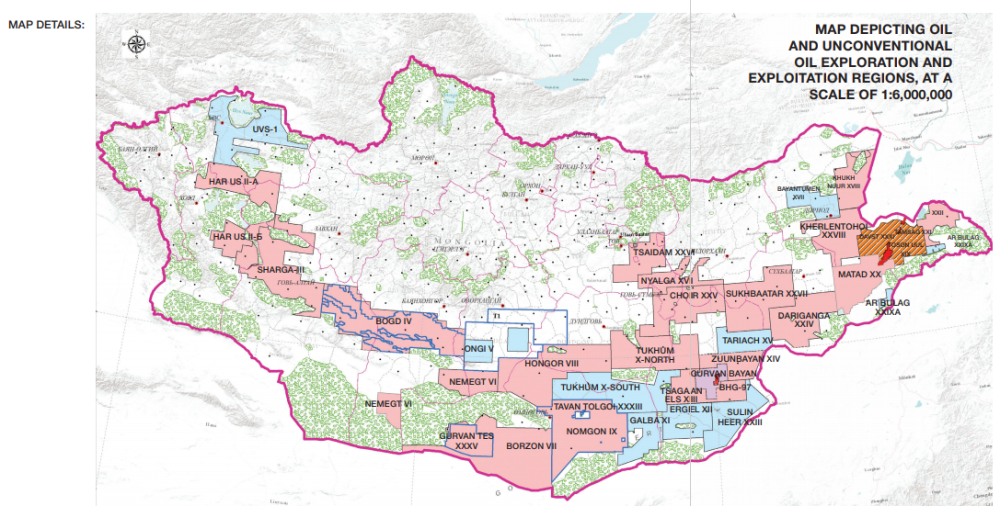

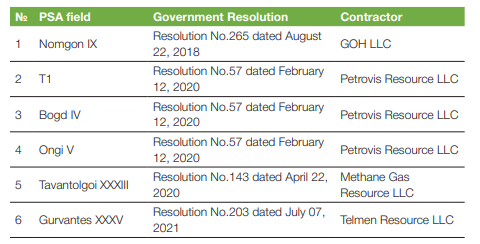

Presently, there are six fields operated by four companies under Product Sharing Agreements (PSAs). These areas are currently experiencing active exploratory drilling. Below, you'll find information on the companies holding PSCs, as provided by the Mineral Resources and Petroleum Authority of Mongolia (MRPAM).

POTENTIALS OF COALBED METHANE

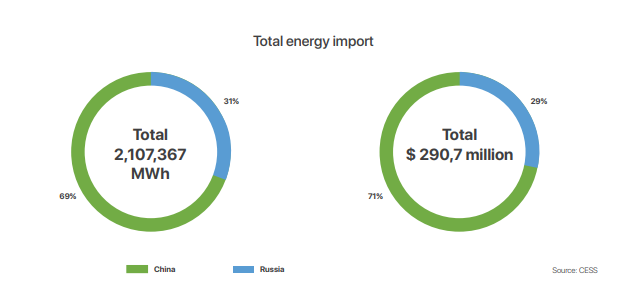

In Mongolia, coalbed methane is currently in the exploration phase. Beyond its applications in heat and energy production, our country possesses the potential for utilization in transportation and household settings. Mongolia imported electricity worth USD 290 million from its two neighboring countries in 2022. Additionally, the import of liquefied gas and other gaseous hydrocarbons amounted to USD 18 million. Taking this into account, it signifies a market potential of at least USD 300 million for Mongolia's methane gas.

A comprehensive analysis of imported liquefied gas, gaseous hydrocarbons, and electricity:

- In 2022, Mongolia imported liquefied gas and other gaseous hydrocarbons worth USD 15.1 million from the Russian Federation and USD 3.6 million from the Republic of Korea. Specifically, one liter was purchased from Russia for MNT 995 and from South Korea for MNT 5,206.

- In 2022, Mongolia imported 1,454,161.38 MWh of energy from China for USD 206.9 million, and 653,206.21 MWh of energy from Russia for USD 83.8 million. This translates to one MWh of energy purchased from China for USD 89.7 and from Russia for USD 79.2. In terms of Mongolian Tugrik (MNT) conversion (as of 25.08.2023), one kWh of energy was imported from the southern neighbor for approximately MNT 311 and from the northern neighbor for about MNT 275. Year-to-date, Mongolia has spent USD 76.5 million on energy imports from China and USD 32 million from Russia.

- Regarding exports, Mongolia does not have an electricity export agreement with China, leading to no forward exports in that direction. However, surplus energy worth USD 354,000 was exported to Russia, equivalent to selling one kWh for MNT 48. In Mongolia, one kWh of energy is typically sold to households for MNT 110-130 and to the mining sector for MNT 105- 390.

- Notably, Mongolia's energy consumption is showing an annual growth rate of approximately 7-8 percent.

Coal plays a crucial role in our country's economy. Globally, coal mining contributes to the release of 52.3 million tonnes of methane annually, surpassing emissions from oil and natural gas production, as highlighted in a study by the Global Energy Monitor. Interestingly, coalbed methane gas is recognized as a cleaner energy alternative compared to oil and natural gas. In essence, Mongolia, with its abundant coal resources, must strive to strike a balance in this inverse relationship. The key to achieving this equilibrium lies in adopting an environmentally friendly approach through the utilization of coalbed methane.

PERSPECTIVES OF COMPANIES ENGAGED IN COALBED METHANE EXPLORATION DRILLING

As evident from the provided statistics, our nation has yet to establish an energy export market. To facilitate export expansion, Mongolia must consider entering into an energy agreement with China. While the domestic energy and liquefied gas market remains accessible, it is essential to recognize that extraction companies cannot independently penetrate this market; they require strategic partnerships. Hence, "TMK Energy" entered into a memorandum of cooperation with "Dachin Tamsag," a subsidiary of "PetroChina," in the previous year. "Dachin Tamsag" possesses extensive expertise in oil drilling, extraction, and transportation. "TMK Energy" also announced in August that they will cooperate with "Terra Energy" in exploration work, which will reduce costs for them. Some analysts in the Australian mining industry speculate that the signing of this memorandum is likely linked to the geographical proximity of the Gurvantes XXXV field to the Chinese border, facilitating the transportation of methane gas to that region. Another company actively involved in the exploration of coalbed methane gas is Takhi Resources, a subsidiary within the "Petrovis" group. This affiliation grants them a distinct advantage in terms of domestic distribution. As the company is in the process of planning an initial public offering (IPO), specific details are not available for release at this time. Elixir Energy is actively involved in the Gobi H2 project, alongside their work on methane gas in Mongolia, particularly the Nomgon IX project. In the previous year, they formalized a memorandum of understanding with Terras Energy for the Gobi H2 hydrogen project. Elixir Energy offers a diverse range of services within the renewable energy sector, encompassing production, storage, and research. Regarding Elixir Energy's collaboration with Terras Energy, it is evident that they have found a capable partner to successfully execute the hydrogen project. This was further affirmed during Elixir Energy's participation in the Asia Clean Energy Forum held in Manila, the capital of the Philippines, last June. At the forum, it was mentioned that Terras Energy possesses the capacity to continue with the project. In essence, constructing a pipeline and transporting hydrogen is a more profitable avenue for them. Additionally, if it can be connected to China's network, it opens up possibilities for laying pipelines for other coalbed methane gas projects as well. "Jade Gas," the parent company of "Methane Gas Resource" LLC, inked a memorandum of understanding with "Xanadu Mines" in December of the previous year. This agreement outlines the provision of up to 120 MW of energy to support the production activities of the copper-gold Kharmagtai project. Remarkably, the distance separating these two deposits spans 80 kilometers, making this collaboration mutually advantageous. Furthermore, "Xanadu Mines" has expressed its intention to procure energy from Mongolia. Recent developments include their connection to the Southern Power Grid to facilitate their exploration efforts. Looking ahead, reports indicate that two areas are currently in the process of establishing PSAs, with one of them situated in the Central Province.

LOCAL RESISTANCE

Coalbed methane holds the potential to evolve into a competitive industry in Mongolia. However, one of the significant challenges faced by new projects is resistance from local communities. This issue has led to a standstill in one of the six coalbed methane PSA fields. Interestingly, it was not only the residents but also the "Ongi River Movement" from Ulaanbaatar that encouraged the protests.

The T1 field, operated by Takhi Resources, encompasses nine sub-districts across Dundgovi and Uvurkhangai provinces. Notably, the Ongi River flows through four sub-districts within the T1 area: Bayangol, Taragt, Saikhan-Ovoo, and Zuunbayan-Ulaan. Coalbed methane gas is a relatively novel concept in Mongolia, underscoring the importance of providing comprehensive and balanced information not only to local citizens but to the broader public from the project's inception. While local objections may not arise in every PSA field, it is crucial for companies with established PSAs to effectively communicate their exploration and project plans to the local communities to foster accurate understanding. On the other hand, there is a notable absence of regulations to ensure the stability of already signed PSAs from the government.

GLOBAL COALBED METHANE MARKET, RESOURCE AVAILABILITY, AND CONSUMPTION TRENDS IN CHINA

The global coalbed methane gas market achieved a value of USD 18.2 billion in the previous year. This figure is projected to continue its upward trajectory, reaching approximately USD 25.7 billion by 2029, representing a growth of around 30 percent. As indicated by a study from the U.S. Energy Information Administration (EIA), China's consumption of various gas types is expected to triple by 2040 compared to 2020, reaching nearly 60 billion cubic feet. This growth extends to coalbed methane consumption, which is also anticipated to roughly triple. Importantly, it is estimated that imports will contribute to supplying 32 percent of the total gas consumption as China focuses on developing its domestic infrastructure. In 2021, a 548-kilometer coalbed methane gas pipeline was constructed, linking Shanxi, a neighboring province of Inner Mongolia, to Hebei province, with the capability of connecting to the Tianjin port LNG terminal. Furthermore, China is working towards the production of carbon-free steel by 2060 as part of its emissions reduction objectives. In essence, China's domestic demand is poised for continued expansion. The global coalbed methane gas reserves have been identified in more than 60 countries, with proven reserves estimated to range between 4,000 to 6,500 trillion cubic feet. Russia leads the world in coalbed methane gas reserves with 2,824 trillion cubic feet, followed by the United States with 1,737 trillion cubic feet, China with 1,100 trillion cubic feet, Canada with 500 trillion cubic feet, Australia with 500 trillion cubic feet, Indonesia with 435 trillion cubic feet, Poland with 424 trillion cubic feet, France with 368 trillion cubic feet, Great Britain with 100 trillion cubic feet, and Germany with 100 trillion cubic feet, ranking within the top 10 globally.

Mining Insight Magazine, №07, 08 (020, 021)