BAYARTOGTOKH.B

BAYARTOGTOKH.BThe poor will only be poorer and the vulnerable will only look for welfare with the current pace of the economy.

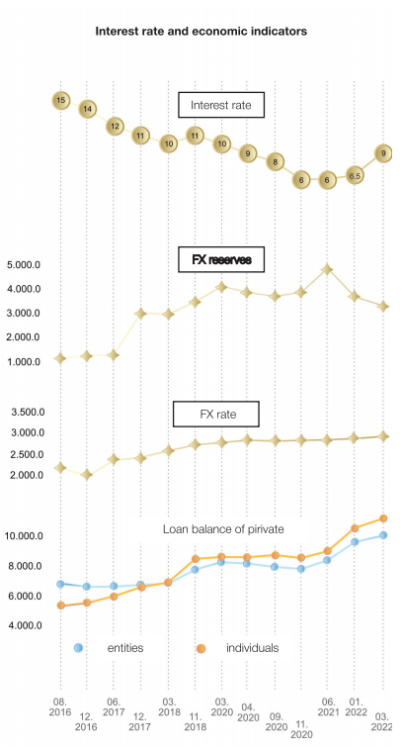

The Monetary Policy Committee (MPC) of the Bank of Mongolia decided to increase the policy rate by 2.5 percentage points to 9.0 percent in March, which had already increased the rate twice this year. This begs several questions; Would this interest rate decision impact the economy and moderate the fear of crisis? Many are wondering if the decision is targeted at rising dollar prices or shrinking businesses. If we look at the current situa - tion, annual headline inflation reached 14.4 percent. The official US dollar exchange rate reached MNT 3,096.72 and has increased by almost 9 percent in a short period while the foreign exchange reserves have decreased by almost USD 1 billion during this period. As of March 2022, the total outstanding loans by commercial banks to private enterprises reached an all-time high of MNT 10.1 trillion. During this time, re - tail loans increased sharply and reached MNT 11.2 trillion, which is 10 percent higher than corporate loans. The total amount of retail and corporate loans is equal to MNT 21.2 trillion and will the growth rate of these loans be maintained in the future? How will the policy rate impact loans, inflation, and exchange rate fluctuations?

At a time when the tension that has arisen in international relations recently has become an additional source of uncertainty in the foreign and domestic economy, these main indicators are likely to change depending on how the MPC’s interest rate decision will impact.

How is the Central bank’s latest rate decision against higher inflation and rapid increase in exchange rate different from the Central bank’s policy so far? As a result of the impacts of tight monetary policy over the past 6 years, public spending has shrunk significant - ly. In August 2016, the Bank of Mongolia raised the policy rate by 4.5 percentage points to 15 percent. Since then, the bank began reducing the availability of foreign currencies from the domestic market and increasing foreign exchange reserves. This plan was formulated by Bayartsaikhan.N, the former Minister of Finance who was appointed as the Bank of Mongolia governer and was taken over by his predecessor Zol - jargal.N. Following his statement on the inadequate level of foreign exchange reserves, MNT declined sharply and he had no other choice but to raise the policy rate.

At this time, foreign reserves equaled USD 1.1 billion and we were in deflation, and not inflation. In addition to that, the total amount of outstanding loans to enterprises was MNT 6.8 trillion, which was MNT 3.3 trillion lower compared to March 2022. Between 2016 and 2018, the policy rate gradually declined to 11 percent. During this period, official foreign exchange reserves tripled from USD 1.1 billion to USD 3.4 billion. In other words, the Central bank raised enough foreign currency to meet its six-month import needs within two years. The USD rate wasn’t fully stabilized at the same time when foreign reserves rose sharply to USD 3.4 billion. The foundation for the current inflationary issues was laid at this time. In De - cember 2018, 1 US Dollar equaled MNT 2,643.

The corporate loans increased by MNT 1 trillion and the share of non-performing loans in total outstanding loans rose to a historic high.

Policymakers started to pay attention and talk about the initiatives to reduce non-performing loans. Since the policy rate reached 15 percent by the end of 2018, the largest growth was observed in loans. In particular, retail loans jumped from MNT 5.3 tril - lion to MNT 8.5 trillion, an MNT 3.4 trillion increase. In 2018, Mongolian GDP grew by 6.9 percent with 8.1 percent inflation.

The unemployment rate came out at 7.8 percent at the end of 2018, which fell by one point compared to 2016. Corporate loans expanded by MNT 1.06 trillion to MNT 7.89 trillion, which contributed to economic ac - tivity. The reduction in interest rates has also stimu - lated people’s interest to borrow. Now, let’s take a look at the economic situation in 2019-2022 when the policy rate was reduced from 10 percent to 6 percent, which is the most stable mone - tary policy we had. At that time, foreign exchange re - serves were worth USD 4.3 billion. In 2019, the GDP grew by 5.1 percent, however, it shrank by 5.3 percent in the following year due to the pandemic. But it is said that the inflation rate was the most stable in this pe - riod. For instance, the USD exchange rate remained very stable at MNT 2,800 and there was no risk to exchange rates despite the pandemic. Moreover, the percentage of non-performing bank loans decreased, the weighted average interest rate dropped to 14 percent, while the average monthly household income increased by 15 percent. The interest rate shrank to 6 percent and it had a significant impact on the growth of total loans.

In 2019-2022, both corporate and retail loans have steadily increased. If credit increases, the balance of the central bank bills should decrease. However, it in - creased along with loan issuance, and in June 2021, when the policy rate was stabilized, the balance of the central bank securities reached MNT 10.1 trillion, which jumped 12 times compared to August 2016. During this period, the USD exchange rate was stable. The monetary policy of the Bank of Mongolia has focused on the exchange rate, not the inflation since 2016. And the policy is still in place. The downside risk is that the middle class suffers the most from the result of this policy.

In the first quarter of 2022, inflation was accompanied by a rise in exchange rates and cut purchasing capacity by 35 percent. In other words, the actual purchasing capacity of a household with an income of MNT 1 million has decreased to MNT 650,000.

In the first three months of the year, the pres - sure on the household began to affect low- and medi - um-income people. The Bank of Mongolia was afraid of the depreciation of the MNT, but it is currently facing the second big fear-inflation. Citizens made the most out of the policy rate when it was within a single digit. In these 2 years, the corporate loans increased by MNT 1.9 trillion, or 23 percent, and the retail loans increased by MNT 2.7 trillion, or 31.4 percent.

Although it is undeniable that the pandemic is a priority factor, from the second quarter of 2018, the policy rate has fallen to 10 percent and retail loans have surpassed government loans. Thus, as of last March, the gap has widened to MNT 1.1 trillion. According to the International Monetary Fund, it is very bad news that Mongolia’s economy will grow by only 1 percent. The World Bank, the International Monetary Fund, and the Asian Development Bank have predicted that jobs and income will be at risk. As the share of non-performing loans in total loans increases, the banking sector will have less access to new loans. If the loan is stopped, it will be unclear whether the companies will run out of working capital, or keep their jobs. A year ago, the Bank of Mongolia predicted a 5 percent economic growth in the “Monetary Policy Guidelines 2022” which was approved by the Parliament of Mongolia. However, due to uncertainty, the Monetary Policy Committee abruptly adjusted its growth forecast to 2.6 percent. This year’s economic prediction for the central bank has halved. The monetary policy outlook for private sectors and businesses has led them to reconsider their investment, business plans, and revenue growth and decline of the year. Generally, the central bank has seldom lowered its economic outlook and this is the first case.

Many economists consider it a sign that they do not fully understand the real situation. Looking at the current economic situation, the worst-case scenario, which has never happened before, is happening today. The risks of inflation, the balance of payments, and the foreign exchange have taken full control of the Bank of Mongolia.

Every time the government or parliament officials talk about the “health” of the economy, they start mentioning the pandemic and geopolitical tensions between Russia and Ukraine as an introduction. By this statement, they are trying to warn that the economy would not have deteriorated like this if there hadn’t been any pandemic or war.

On April 5th, 2022, Prime Minister Oyun-Erdene.L stated that “The big economic crisis is set to start soon”. But the Central bank Governor, who is sitting down with the cabinet ministers, hasn’t resisted this statement. The Minister of Finance, the Governor of the Bank of Mongolia, and the Prime Minister conceded the deterioration of main economic indicators and in response to that, approved a draft law similar to the “Price Stabilization Program” implemented by Zoljargal.N. However, the budget of this program is five times less compared to 2013. During the Democratic Party’s rule, the Bank of Mongolia implemented a monetary policy to protect the middle class and safeguard average income, while during the Mongolian People’s Party, the focus was on exchange rates and inflation-oriented monetary policy. Unfortunately, the poor are getting poorer, and the economic environment is likely to become more unhealthy, in other words, pushing the vulnerable groups into a path with no other way out than to only wait for social welfare. In addition to that, expenditures on public welfare and protection will increase as a result.