bold@mininginsight.mn

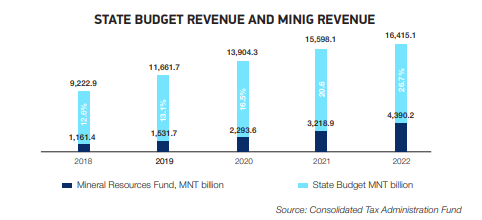

The mining industry in Mongolia has reached an all-time high in revenue, according to the General Department of Taxation, with companies holding mining licenses contributing MNT 4.39 trillion to the consolidated budget. This represents approximately 27% of the budget, with coal being the primary driver of this growth.

Thanks to the removal of port bottlenecks, new export routes, and stable prices in China, the coal industry has seen significant growth this year. Coal alone has contributed MNT 2.062 trillion to the budget, surpassing the entire mining industry's tax revenue for 2018. Despite the physical volume of coal exports not reaching 2018 and 2019 levels, export income and tax income have increased by two to three times. A critical concern regarding Mongolia's mineral resource sector is whether local people, especially those in the vicinity of mining operations, are able to benefit from the significant increase in income generated.

Unfortunately, the most urgent challenge facing the industry is the misunderstandings and mistrust between mining companies, local border administrations, and citizens, resulting in local resistance. Many local administrations and citizens feel that they are not benefiting from the mining industry's revenue and that they are not included in local development plans. As a result, there is a pressing need to address these issues and ensure that local communities can fully participate in the benefits of Mongolia's mining industry. Over 90% of the revenue generated by Mongolia's mining sector is from royalties and CIT (Corporate Income Tax). As a result, it is essential to carefully consider how the revenue from these two taxes is allocated and spent to ensure that the country and local communities benefit from the mining sector's contributions. In 2022, mining companies in Mongolia paid a substantial amount of MNT 2,912 billion for royalties. Despite various challenges faced by the industry, royalties alone made up about 18% of the state budget income. Moreover, in 2021, revenue from royalties exceeded the total tax revenue paid by the mining sector by 27%, while in 2020, it was equivalent to 90% of the total tax revenue.

The revenue collected from royalties by mining companies in Mongolia is allocated to various funds, including the Budget Stabilization Fund, the Future Heritage Fund, the Unified Local Development Fund, and the state budget. In 2022, of the MNT 2.912 trillion earned by royalties, 79 percent, or MNT 2.296 trillion was allocated to the Stability Fund and the Future Heritage Fund, and spent on welfare programs such as child allowances. An additional MNT 200 billion was allocated to the Unified Local Development Fund and used for local development initiatives. These figures illustrate the significant impact of mineral resource royalties on not only the state budget but also the welfare of all citizens. One of the significant shifts towards supporting local development and increasing budget and investment was the decision to allocate 40 percent of CIT to the local budget, which was made last year. The Law on Budget stipulates the provincial and capital budget tax revenue in Article 23.6, while Article 26.3.10 designates "40 percent of corporate income tax."

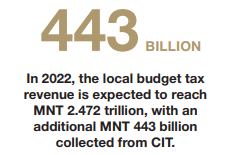

These changes to the law were approved in December 2020 and will be implemented in 2022. As a result, the General Department of Taxation reported that MNT 443.1 billion in CIT will be allocated to the provincial and capital budgets in 2022, with an original budget allocation of MNT 588.2 billion, but with only 75 percent performance. In 2022, the local budget tax revenue is expected to reach MNT 2.472 trillion, with an additional MNT 443 billion collected from CIT, which constitutes an 18-20% increase in local tax revenue. The decision to allocate 40% of CIT to local budgets, as stated in Article 23.6 of the Law on Budget, is a significant step towards supporting local development and ensuring budget independence, not only for mining revenue but also for other businesses operating in the provinces. This policy change is directly related to the economic activities and income of enterprises. In 2021, the General Department of Taxation reported MNT 4 trillion collected as income tax, of which MNT 1.36 trillion was CIT paid by companies holding exploitation licenses.

Orkhon province has the highest CIT income among all provinces, resulting in an increase of MNT 94 billion in the province's budget. However, except for four provinces, the rest did not receive the originally budgeted amount. Orkhon, Dornogovi, Sukhbaatar, and Khovd provinces exceeded the budgeted amount by 38% to 145%. The decision to allocate 40 percent of CIT to local budgets has reduced the subsidies received by provinces from the general state budget. The impact of this government decision on addressing the criticism and opposition of local administrations remains to be seen.