The world’s lithium market is at the center of attention for investors.

Although Mongolia is far behind other countries, policymakers are discussing the future of lithium exploration at the policy level. Needless to say that Mongolia has always lagged in every opportunity created by the cycle of high prices in the world’s mining and minerals sectors. During the 20 years of growth of China’s commodity market triggered by industrialization and urbanization, Mongolia has only been able to supply copper, coal, and a small amount of iron ore. The exploration sector has been abandoned for the last 10 years and only a few deposits have been discovered. Compared to the leaders in the mineral sector, such as Australia, North and South America, Mongolia’s achievements are small. Mongolia has the opportunity to participate in the market of critical minerals, which has been developing rapidly for 10 years, especially in the last 5 years, including the main raw materials for electric vehicles and batteries.

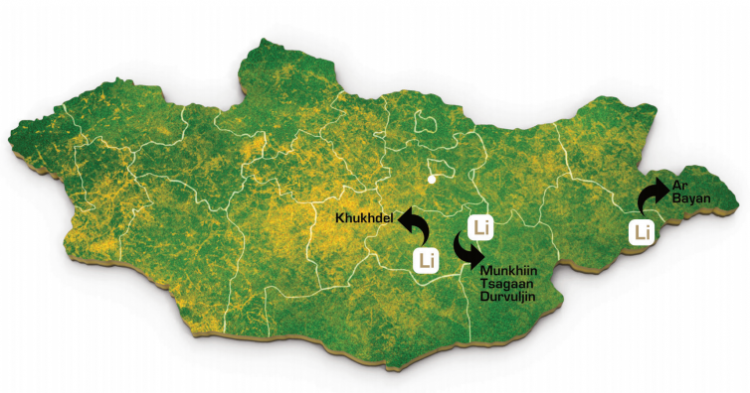

Mongolia’s main goal should be to keep up with this new opportunity. In this cycle, the high growth of certain types of raw materials does not depend on one or two countries. It is the result of a global green transition and a huge technological revolution. It has a wider range than previous supercycles. Exploration for several metals, which will play a key role in such a transition economy, is intensifying in key mining regions. While investment in lithium and cobalt exploration alone has increased several times, Mongolia’s exploration sector has the potential to attract it. What do we have? The amount of lithium reserves registered in the Unified Mineral Resources Fund of Mongolia is 713,000 tonnes. Currently, five lithium projects are being implemented in Mongolia. Three of them have mining licenses.

KHUKHDEL DEPOSIT. The deposit, located in Dundgovi province, has 23,500 tonnes of lithium reserves. The estimated reserves include 283.9 million tonnes of ore and 443,600 tonnes of lithium carbonate with an average grade of 0.156 percent. Alkalli Metal Mongolia LLC holds mining (MV-017303) and (XV-012685) exploration licenses for the deposit.

MUNKHTIIN TSAGAAN DURVULJIN DEPOSIT. The deposit located in Dundgovi province has 2.27 million tonnes of ore with an average grade of 0.65 percent, 14,575 tons of pure lithium, 4,286.1 tonnes of ruby with a grade of 0.15 percent, and 0.622 tonnes of cesium with an average grade of 0.03 percent. Lithium Mining LLC (MV-021251) holds a mining license.

ARBAYAN DEPOSIT. This is a tungsten-lithium deposit in Erdenetsagaan soum of Sukhbaatar province. The feasibility study for open pit mining of this deposit in 2019 was discussed by the Minerals Professional Council. The holder of the mining license (MV-011124) is Central Asian Minor Metals LLC. In addition, Toronto-listed ION Energy publicly announced its lithium exploration project. The company holds exploration licenses for the Baavgai Uul project in Sukhbaatar province and the Urgakh Naran project in Dornogovi province. Based on these projects, which are actively advancing in Mongolia, ION Energy is aiming to become one of the key players in the fastgrowing lithium market in Asia. The company was one of the first companies to enter Mongolia for lithium exploration following the shift in the market. ION Energy’s main focus at the moment is the “Baavgai Uul” project. The project covers an area of 81,000 hectares.

As part of the project, the first drilling program for the lithium “White Wolf” section was completed in the fall of 2021. A total of 222 boreholes were drilled at a distance apart of 1 km, with a yield of about 13 percent. Preliminary parameters of the drilling sample show a lithium content of 1502 ppm. Samples are currently being examined. Before the acquisition of ION Energy, the project had a peak lithium content of 811 ppm. Hydrogeological sampling and lithium exploration testing will begin next April. As a result of the drilling, new copper and nickel deposits were discovered in the Baavgai Uul exploration area. The Urgakh Naran project is located 150 km from Baavgai Uul. The project covers an area of 19,000 hectares and is a lithium brine deposit. Ion Energy is the sole owner of the project. The first exploration work began this February. In February, ION Energy and Aranjin Resources agreed to set up a joint exploration company. As a result, the two sides have the opportunity to conduct mutual exploration in their Mongolian-owned areas. Under the joint venture, ION Energy has pledged financing of USD 500,000 and USD 3 million from Aranjin Resources for three years of exploration. The first drilling of the Canadian-invested ION Energy project has revealed high levels of lithium.

This is an example of Mongolia’s high lithium potential. It stretches from the southern border of Mongolia through Govi Altai to Bayankhongor, Umnugovi, and Dornogovi provinces, the largest mineral region in Central Asia. Experts predict that large deposits, especially rare earth elements, are likely to be discovered in this mineral zone. The global investment in the exploration industry reached USD 11.2 billion last year to an eight-year high. This is 35 percent higher compared to 2020. In terms of investment attraction, Canada leads with USD 2.1 billion. Lithium exploration investment is relatively low compared to top metals such as gold and copper. But the overall financing in the sector surged by almost 20 times in the last 10 years to about USD 200 million. Australia, Argentina, Canada, and Chile are attracting the majority of lithium exploration investments. In Mongolia, however, exploration investment has declined sharply in recent years. In 2020, MNT 120 billion (about USD 35 million) was invested in exploration. Therefore, there is a crucial need for Mongolia to attract investment in exploration and establish new mineral resources.

This is why lithium exploration is being launched in Mongolia to attract the attention of the global exploration industry. With its high-tech raw materials and mineral geological potential, Mongolia can become an attractive country for investors.

Other countries are also urging investors to invest in copper and lithium, not coal or iron ore. Mongolia has announced that it will have an innovative, technology-based, diversified, value-added, and industrialized economy. Sufficient raw material resources will surely be the basis of such an economy. The goal of the mining sector to export the next stage of processing and value-added products to end-users should be achieved only after the mineral resources are identified and determined. Otherwise, the next revolution will take place in the direction of high technology, while the country remains stuck in building a railway just to transport coking coal and iron ore, and to produce steel. Demand for minerals has also changed.

Mining Insight Magazine, №02(003) Febraury 2022