- MSE’s "special" role in transparency –

MYAGMARSUREN. E

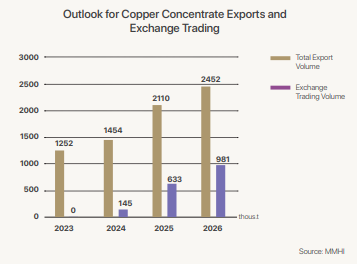

In 2025, Mongolia anticipates a significant surge in copper concentrate exports, with projections indicating a growth of over 40 percent compared to the previous year. Approximately 630,000 tonnes are poised for trading on the exchange, representing more than half of the mineral raw materials earmarked for export. This optimistic outlook is underpinned by several factors. Firstly, trading mining products on the stock exchange has prompted a shift towards a more pragmatic discourse, with stakeholders openly discussing the benefits. This shift can be attributed, in part, to the fallout from the coal theft scandal and the timely access to digital trading information available on the stock market. Moreover, the lack of transparency regarding the countries and companies purchasing coal has been addressed through the registration of over 270 companies, primarily from nations such as China and Singapore, to engage in coal and other raw material transactions on the Mongolian Stock Exchange (MSE). This underscores the pivotal role played by the exchange in fostering transparency within the mining industry.

However, as copper is poised to join coal on the exchange, questions arise regarding potential challenges and the future landscape of market participants. What hurdles might arise with the introduction of copper trading, and what new entrants can be expected in the stock market? These are critical questions that warrant further exploration and analysis.

However, as copper is poised to join coal on the exchange, questions arise regarding potential challenges and the future landscape of market participants. What hurdles might arise with the introduction of copper trading, and what new entrants can be expected in the stock market? These are critical questions that warrant further exploration and analysis.

Why were copper trades started with EMC?

As per the Law on Mining Products Exchange, state-owned enterprises (SOEs) are mandated to engage in exchange trading. Consequently, entities like Erdenes Tavantolgoi JSC, Darkhan Metallurgical Plant JSC, and Mongolrostsvetmet SOE have historically participated in trading their products on the MSE. Adding to this list, the SOE Erdenet Mining Corporation (EMC) will also partake in exchange trading. On February 28, 2024, both the factory's copper and molybdenum concentrates were included in the "Types and Categories of Products to be Traded on the Stock Exchange," as outlined in Government Resolution No. 223. The minimum trading price for these products is stipulated to be no less than the monthly price announced by the London Metal Exchange. In response to this decision, the Ministry of Mining and Heavy Industry (MMHI), along with the MSE, jointly convened a discussion on "Commercial Trading of Copper Concentrate" on March 18, 2024. During the deliberations, Minister Ganbaatar. J announced that a six-month trial for selling copper concentrate would commence. Initially, it was specified that EMC would participate in this trial. EMC, engaged in copper trading, affirmed that its products fully comply with China's requirements, with minimal levels of toxic substances. Nonetheless, Purevee. Ya, head of EMC’s foreign relations and export department, expressed willingness to subject the products to analysis in additional laboratories, alongside their certified and external laboratories. Traditionally, EMC initiates shipment after completing 95 percent of product sales. However, with sales via the exchange, shipment will occur only after full payment completion. Furthermore, the factory management highlighted the benefits of bank-mediated payment transfers, citing risk reduction and expedited fund circulation. During the trial commercial period, each product batch is estimated to be relatively small, comprising 2,000 tonnes. Over 200 representatives from more than 10 countries, including China, Russia, the USA, Australia, and Canada, participated in the discussion, both in-person and online, regarding the exchange's new product trading.

Will the exchange trades affect earnings?

The primary concern for mining companies revolves around whether participation in exchange trading will impact their revenue. During the discussion, the MMHI clarified that the royalties will be assessed based on the exchange-traded deal price, suggesting no new tax or payment conditions beyond this. However, the MSE applies a 0.1% deduction for each trade of mining products, by its regulations. Additionally, brokers will deduct operational expenses. While brokerage firms, integral participants in stock exchange trading, have yet to engage in mining products trade, they have indicated imminent participation.

Acting as intermediaries, brokers facilitate the buying and selling of exchange-traded products on behalf of companies. Presently, four companies have officially joined MSE: TDB Securities LLC, Golomt Capital LLC, BDSec LLC, and Ard Securities LLC. As per the Exchange Law, brokers are responsible for registering and executing trading contracts. As of March 25, 2024, this responsibility has been assumed by MSE. Brokerage firms will handle the sale and purchase of mining products and will calculate their operational expenses, regulated by the MSE. The 0.1 percent deduction by MSE amounted to USD 2.2 million last year. However, this figure pales in comparison to the increased volume of deals. Last year, out of the USD 2.2 billion worth of mining products, over USD 150 million represented the incremental auction price, indicating profitability for the involved parties. Moreover, the participation of companies suggests they were not unduly pressured. For instance, since the implementation of the Law on Mining Products Exchange (June 30, 2023), Energy Resources LLC emerged as the most successful trader, with 108 successful trades. Since the beginning of the year, they have ramped up their trading volume to 12,800-19,200 tonnes per transaction. Additionally, Erdenes Tavantolgoi JSC successfully participated in two auctions, each exceeding 1 million tonnes in 2024. Despite China's commencement of coal import tax collection from non-free trade agreement countries like Mongolia since January 2024, the auctions are expected to proceed smoothly. During PDAC 2024, another copper producer, Oyu Tolgoi LLC, expressed its intention to explore participation in exchange trading. By law, legal entities with government participation are mandated to sell their products on the exchange. Consequently, Erdenes Oyu Tolgoi LLC, which owns 34 percent of Oyu Tolgoi LLC, is eligible to participate in trading. While EMC is anticipated to sell all its products on the stock exchange after completing offtake contracts, the decision is still pending for Oyu Tolgoi LLC.

Acting as intermediaries, brokers facilitate the buying and selling of exchange-traded products on behalf of companies. Presently, four companies have officially joined MSE: TDB Securities LLC, Golomt Capital LLC, BDSec LLC, and Ard Securities LLC. As per the Exchange Law, brokers are responsible for registering and executing trading contracts. As of March 25, 2024, this responsibility has been assumed by MSE. Brokerage firms will handle the sale and purchase of mining products and will calculate their operational expenses, regulated by the MSE. The 0.1 percent deduction by MSE amounted to USD 2.2 million last year. However, this figure pales in comparison to the increased volume of deals. Last year, out of the USD 2.2 billion worth of mining products, over USD 150 million represented the incremental auction price, indicating profitability for the involved parties. Moreover, the participation of companies suggests they were not unduly pressured. For instance, since the implementation of the Law on Mining Products Exchange (June 30, 2023), Energy Resources LLC emerged as the most successful trader, with 108 successful trades. Since the beginning of the year, they have ramped up their trading volume to 12,800-19,200 tonnes per transaction. Additionally, Erdenes Tavantolgoi JSC successfully participated in two auctions, each exceeding 1 million tonnes in 2024. Despite China's commencement of coal import tax collection from non-free trade agreement countries like Mongolia since January 2024, the auctions are expected to proceed smoothly. During PDAC 2024, another copper producer, Oyu Tolgoi LLC, expressed its intention to explore participation in exchange trading. By law, legal entities with government participation are mandated to sell their products on the exchange. Consequently, Erdenes Oyu Tolgoi LLC, which owns 34 percent of Oyu Tolgoi LLC, is eligible to participate in trading. While EMC is anticipated to sell all its products on the stock exchange after completing offtake contracts, the decision is still pending for Oyu Tolgoi LLC.

Copper first, uranium next

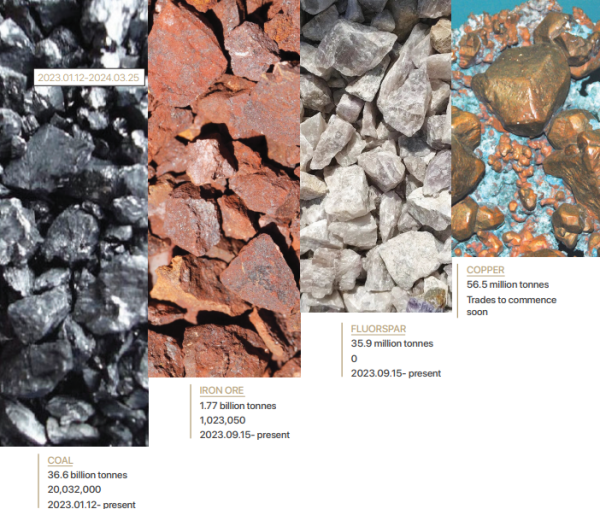

According to data from the Customs General Administration, Mongolia exports eight types of raw minerals. Currently, conditions for the sale of four products—hard coal, iron ore concentrate, fluorspar ore concentrate, and brown coal—have been established. Additionally, the commencement of copper and molybdenum concentrate exports will contribute significantly to mining products’ trading on the exchange. Trading of copper and molybdenum concentrates is set to commence due to the absence of product information for these commodities in the call trading schedule of the MSE as of today, March 25, 2023. Participants must make reservations at least 7 days in advance to engage in mining products trades. Recognizing the increasing global demand for copper, not only in China but also internationally, Mongolia, possessing the sixth-largest reserves, must act responsibly in this regard. For further details, including daily exchange trading information, tracking procedures, and settlement procedures, visitors can access the Mining Products Trading menu on the Mongolian Stock Exchange website (mse.mn). The current Exchange Law encompasses products from their inception to the point of securing a buyer. However, our country is actively pursuing a policy of diversifying its mining and oil products, which includes rare earth elements, coal-bed methane gas, and uranium. Notably, China stands as the primary producer of rare earth elements. Additionally, there is potential for beneficial collaborations between coal bed methane gas companies and counterparts in the southern region for pipeline exports. Regarding uranium, Badrakh Energy LLC highlights that if a buyer emerges, exports can be directed to any country. Uranium could potentially become a product eligible for exchange trading from newly initiated projects, opening up possibilities for supply to neighboring nations. However, before venturing into these endeavors, the successful trading of copper concentrate in 2024 holds paramount importance. Despite being eligible for exchange trading, fluorspar remains a product shrouded in secrecy. Although initially slated for trading on September 15, 2023, no bids were received from buyers after Mongolrostsvetmet SOE submitted a participation request on October 30. Consequently, there have been no further plans for the commercialization of fluorspar. Despite Mongolia exporting over 1 million tonnes of fluorspar last year, and with projections indicating an increase from the previous year, both the industry and the public seem disinterested. It is crucial to recognize the unique role of exchange trading in fostering transparency, a role whose clarity hinges directly on the attitudes of the companies involved. Therefore, significant emphasis should be placed on the trading of copper concentrate and other products on the stock exchange.

Mining Insight Magazine, March 2024 №3 (028)