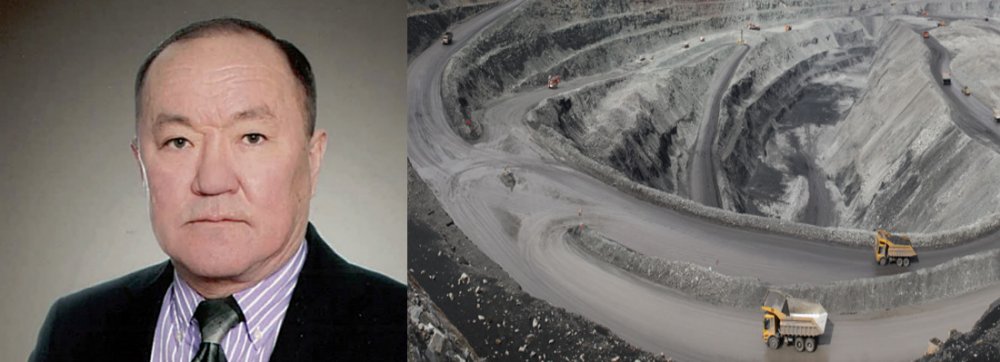

Tergel.A of Mining Insight talked with the Chairman of the Board of Directors of “Usukh Zoos” LLC Ch.Chinbat about the new opportunities for the export of thermal coal from Mongolia and the solution to the construction of a railway terminal in Shiveekhuren port.

Tergel.A of Mining Insight talked with the Chairman of the Board of Directors of “Usukh Zoos” LLC Ch.Chinbat about the new opportunities for the export of thermal coal from Mongolia and the solution to the construction of a railway terminal in Shiveekhuren port.The Government approved the new classification of coal, as a result of which the standard pricing method of coal export was announced in August. How do you see its implications?

This is very fair. The royalty is deducted as a reference price regardless of coal classification, quality, and difference in selling prices. For example, a 5 percent tax is deducted from the price of USD 240 US dollars (MNT 768,000). However, when the coal is sold at CNY 320 per tonne, the royalty is deducted at the standard price, and the remainder falls short to cover the workers’ wages and transportation costs. This can potentially bankrupt coal companies.

How many tonnes of coal does Usukh Zoos LLC annually produce?

One-third of our mine’s total reserves are coking coal. In general, we stick to our mining design. In other words, 2.5-3 million tonnes of coal are extracted annually as estimated in the 16 years of the mining plan. It means not digging. So, sometimes there is a case where only energy coal is produced. Oxidized coal from us is also suitable for Chinese power plants. The country’s power plants burn coal with a caloric value of 4,000 kcal. Our country’s thermal power plants convert 30 percent of the coal they burn into energy, compared to 52 percent in China. They import coal with a higher calorific value than ours, mix it with their lignite of 2200-3000 kcal, bring it to 4000 kcal, and burn it in their power plants.

One good thing about China is that they buy thermal coal based on calorific value. What is your company’s coal price at the mine?

rate fluctuations. Currently, coal of class A, B, and F are sold at CNY 230-810 depending on the caloric value of 5900-6400 kcal, and CNY 650-1300 for export. We have established the “Monzol Inner Mongolia Trade” LLC across the border. It is a Mongolia-invested company in China. We have our warehouse at Sekhe port. They place a lot of trust in our company because they have assets on the Chinese side.

Do you think the current global situation is opening up certain opportunities for coal, especially Mongolian thermal coal?

Yes. In addition to power plants, China uses coal to heat blast furnaces in steel mills. Not just thermal coal, the prices of coking coal and iron ore have risen in recent years. But the price is normalizing again as China’s iron smelting industry is facing certain issues. Due to the power shortage, the country is taking measures to restrict electricity consumption and temporarily shutting some factories. Once the blast furnace is on, it can not be stopped for 30 years. To reheat it, it needs to be fired for a month. The problem is that the bricks lining the furnace crack when reheated. Therefore, in order not to turn off the blast furnace and to not lose temperature, thermal coal is used to barely hold them together. That is why steel factories have 6 months of raw materials for continuous operations. The blast furnace will have to shut down even if they have two months of supply. And now that Russia is stopping natural gas exports to Europe, Germany is interested in buying energy coal from us. Japan, which no longer imports coal from Russia, is also looking for an opportunity to buy thermal coal from us.

Our country needs to make full use of it. Did your company receive such an offer?

We are agreeing with the Germans to monthly supply 65,000 tonnes of thermal coal and 780,000 tonnes annually.

The Japanese buyers requested an offer for 5000 kcal coal. They wanted to buy coal at the Qinhuangdao port, north of Tianjin, China. From our side, we expressed that we cannot cover the transportation to the Chinese port. We are ready to deliver to Sekhe port. We are in talks to supply a small amount to Japan as a test. If possible, we will negotiate for a higher volume.

Is it expensive to transport coal from Mongolia to seaports?

The cost of transporting coal from Sekhe port to Tianjin and Qinhuangdao ports by rail is CNY 350. It costs CNY 35 to unload at the port and load them onto the ship. It costs about USD 60. For example, let’s say our company sells its thermal coal for USD 180 per tonne. It includes a Chinese VAT of USD 20. So it will cost about USD 240 to load on the ship. Also, it is not easy to transport coal between China’s domestic transport. This problem can be handled by the buyers as both Japan and Germany are capable. They will have a stronger influence on China over Mongolia.

How do you see the possibility of increasing the coal export volume at Shiveekhuren?

A maximum of 16.5 million tonnes of coal was exported through Shiveekhuren port. This was by auto vehicles only. So, container transport and railway terminal will certainly push up the number. If we transport 20 million tonnes by rail and 10 million tonnes by heavy-duty vehicles, the total will be 30 million tonnes.

Will the auto terminal be operational by September?

It will probably be put into operation at the end of September. The auto terminal alone is not enough to expand the capacity of coal exports at the Shiveekhuren border checkpoint. That is why they are pursuing the construction of a railway terminal. It will be a 3.98 km long four-track terminal. It means that a single driver can pull 50 wagons or 100 containers on a single railway track. 60,000 tonnes of coal will be delivered through the railway terminal daily. Only one railway line will enter from the Chinese side. A single locomotive with an empty container. It will transfer to a narrow gauge rail at the terminal.

Considering the rail gauge shift, how much will the cost be?

It was estimated that a tonne of coal will cost USD 1.5 and USD 48 for one container. However, the cost of loading a tonne of coal will be estimated at USD 3 to cover the construction investment. The company will finance the construction of the railway terminal. The necessary financing is settled by loans and repaid off the profit from coal exports.

How is the progress so far?

In 2018, the government approved a resolution to establish a joint venture “Shiveekhuren Railway” with “Nariinsukhait Railway”, in which “Mongolian Railway” SOE will own 51 percent of the state’s share. The government resolution needs to be amended for “Usukh Zoos” LLC to finance the railway construction. The government is not allowing amendments. Therefore, we decided to establish a company in line with the government resolution. I met with the director of “Mongolian Railways” SOE P.Gankhuu and informed him of the establishment of a joint company “Shiveehuren Railway”. This issue has been submitted to the State Committee. Our progress depends on how quickly they respond.

If the decision is made, how long will it take to construct the railway?

About two months. Earth and foundation works will be done in two weeks. We have the necessary equipment and vehicles. The policy and decision of the government to build a railway on the Nariinsukhait-Shiveekhuren route had been made a long time ago, but the current government has decided to extend it to the Artssuur-Nariinsukhayt-Shiveekhuren route.

How do you feel about this?

I believe the refusal of Nariinsukhait-Shiveehuren railway construction and the readjustment to the Artssuuri-Shiveekhuren route have further reduced the possibility of Mongolians building the railway themselves. The vertical railway to the West would have to be built along the Great Lakes Depression. But that would stretch the 1255 km railway plan. Numerous additional structures, such as bridges and tunnels across mountains and lakes, will have to be constructed. The costs will increase. At the cheapest, USD 4.5 billion is needed. In comparison, the cost of the Tavantolgoi-Gashuunsukhait route railway is USD 1.7 billion, but it is still not finished yet. A railway terminal will be built at the Gashuunsukhait checkpoint, additional funds are needed. This railway line has a height difference of 32 meters from the railway on the Chinese side.

Will a bridge of this size be sufficient?

Even after building a bridge, locomotives will have to drag their loads uphill. After that, you will have to drop the coal at the Chinese border. The Minister of Road and Transport Development talked about transporting coal to the border by rail and then by heavy-duty vehicles to the buyers in China. So it is no different from having no railway. Quite the contrary, it is worse. It is easier to ship directly by road or container than to unload and load again.

The Chinese side expressed their willingness to invest in our coal exporters to form a consortium to construct a railway in the Artssuur-Narynsukhait-Shiveekhuren route. However, they only wish to make a deal with a company or a consortium, and not with the government.

“Nord Honghe”, which built over 600 km long Linhe railway in China, is also interested. Any company that will build this railway must first agree with the Russian side on the amount of coal to be sent through Mongolia. By building a railway in the Artssuur-Narynsukhait-Shiveekhuren direction, it will open a transport coal route from the Tuva region of the Russian Federation. There are no large mineral mines to be transported from northern Mongolia. It may be used for transporting 3-2 million tonnes of coal from “Aspire Mining” in Khuvsgul province. Railroads can profit only when there is cargo to transport. The profit should cover the investment. Assuming that the Russians will transport 5 million tonnes of coal from Kyzyl, it means that the USD 16.5 billion costs will be recovered after 50 years. On the other hand, the distance from Kyzyl to the Chinese market is 1600-1700 km, therefore, about USD 60 will be added to the price of one tonne of coal. Of this, USD 50 is the cost of transportation within Mongolia. If we assume that 60 tonnes of coal will be loaded in one wagon, it is USD 3000. In other words, the country will earn USD 750 million from the transport of 15 million tonnes of coal in a year.

Mining Insight Magazine July & August 2022, №07,08 (008, 009)