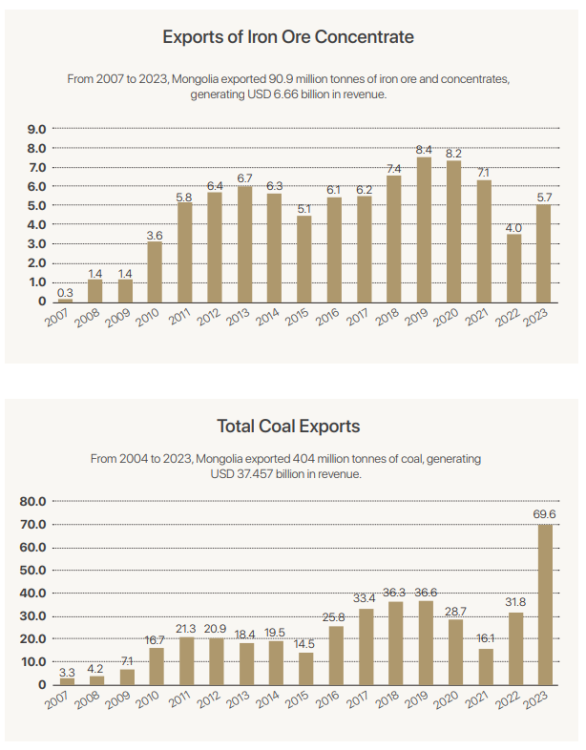

Over the past 17 years, Mongolia has exported 91 million tonnes of iron ore, 404 million tonnes of coal, and 23.6 million tonnes of copper concentrate, generating significant revenue. The export of iron ore has brought in USD 6.6 billion, coal USD 37.5 billion, and copper concentrate more than USD 20 billion. 17 years ago in 2007, when new mines came into operation, the export of iron ore and copper had increased significantly. At that time, only 300,000 tonnes of iron ore were exported annually, whereas today, 6-7 million tonnes are exported consistently. During this period, coal exports surged, and copper concentrate exports tripled following the launch of the Oyu Tolgoi mine. The focus on mineral exports is straightforward: most of these exports involve raw, unprocessed minerals, particularly coal and iron ore. Only three or four companies exporting these raw materials operate first-stage processing or washing plants. How long will this reliance on raw exports continue? The question of when Mongolia will begin processing its raw materials domestically to produce final products is now more pressing than ever in both the mining sector and political discourse. The topic of further processing raw materials and constructing value-added facilities was once just empty promises from unprogressive politicians and the bluster of unscrupulous companies. However, over the past two years, the development of production technology parks with processing plants in the iron ore and copper sectors has intensified.

Mongolia’s largest iron ore company, Boldtumur Yeruu Gol, has been successfully implementing its “Altanshireet Industry and Technology Park” project since 2019. This 140-hectare complex will include a wet iron ore concentration plant, a coal washing plant, a coke plant, iron ore pelletizing plant, and a cast iron plant. Currently, a wet concentrator with a capacity of 2 million tonnes of iron ore and a coal plant with a capacity of 1.5 million tonnes have been put into operation. The project aims to produce 500,000 tonnes of cast iron annually in Mongolia, which is a key raw material for the steel industry. The park is expected to be fully operational next year, with a total investment of USD 520 million. Compared to other companies, this project is unique in that the first factories have already been constructed, investment and financing have been secured, and the project is fully underway. It also stands out as the only “Industrial and Technology Park” of private sector in Mongolia’s mining industry. The “Darkhan Metallurgical Plant,” part of the “Erdenes Mongol” group, is also advancing the “Mining-Metallurgical Complex” project. This initiative plans to establish a “Mini Direct Reduced Iron Plant,” a “Wet Concentrator and Pelletizing Plant,” and a “Steel Production Complex.” The project is scheduled for implementation between 2024 and 2028. Preliminary estimates suggest that the direct reduced iron plant will require an investment of USD 45.7 million, while the wet concentrator and Pelletizing plant will need USD 285.7 million.

Mongolia’s largest iron ore company, Boldtumur Yeruu Gol, has been successfully implementing its “Altanshireet Industry and Technology Park” project since 2019. This 140-hectare complex will include a wet iron ore concentration plant, a coal washing plant, a coke plant, iron ore pelletizing plant, and a cast iron plant. Currently, a wet concentrator with a capacity of 2 million tonnes of iron ore and a coal plant with a capacity of 1.5 million tonnes have been put into operation. The project aims to produce 500,000 tonnes of cast iron annually in Mongolia, which is a key raw material for the steel industry. The park is expected to be fully operational next year, with a total investment of USD 520 million. Compared to other companies, this project is unique in that the first factories have already been constructed, investment and financing have been secured, and the project is fully underway. It also stands out as the only “Industrial and Technology Park” of private sector in Mongolia’s mining industry. The “Darkhan Metallurgical Plant,” part of the “Erdenes Mongol” group, is also advancing the “Mining-Metallurgical Complex” project. This initiative plans to establish a “Mini Direct Reduced Iron Plant,” a “Wet Concentrator and Pelletizing Plant,” and a “Steel Production Complex.” The project is scheduled for implementation between 2024 and 2028. Preliminary estimates suggest that the direct reduced iron plant will require an investment of USD 45.7 million, while the wet concentrator and Pelletizing plant will need USD 285.7 million.

However, the project is still in its early stages, with many challenges yet to be addressed. The two companies mentioned above are the largest iron ore exporters in Mongolia, having exported around 70 million tonnes over the past 17 years. Consequently, they are now focused on developing next-stage production parks to process iron ore and produce value-added final products. Meanwhile, the “Industrial and Technology Park” project, implemented by Erdenet Mining Corporation (EMC), one of Mongolia’s largest mining companies, is progressing steadily. This major initiative includes the construction of a copper smelter, a molybdenum concentrate processing plant, and a cathode copper plant. Approximately USD 40 million is being invested in the park’s infrastructure, including energy, water supply, and railways. The copper smelter alone requires an investment of more than USD 760 million. EMC’s Industrial and Technology Park represents the largest mega-project to be developed in the next four years. The prospect of Mongolia having a cast iron processing plant is becoming increasingly realistic as the country aims to develop its processing and heavy industry, leveraging its abundant raw material resources. However, three critical factors must be addressed. First, sufficient reserves of raw materials must be secured, along with stable extraction levels. Second, a stable tax and legal environment is essential. Finally, with these two factors in place, heavy industry projects can be “brought to life” through significant investment inflows. Mongolia is rich in iron ore, copper, and coal reserves. As shown in the graph, production levels have steadily increased over the past decade, indicating that the country meets the requirements for establishing the next stage of heavy processing plants. The inclusion of this goal in the State Policy, starting with the Government Agenda, suggests that the legal framework is largely in place. However, issues related to investment and financing remain uncertain, particularly for projects undertaken by state-owned companies. Heavy industry is crucial for any developing country. Nearly all developing and developed nations have established a strong heavy industry sector, particularly in steel production. The United States and European countries have been producing steel for over 100 years, enabling them to build major infrastructure and achieve high economic growth. Similarly, developed Asian countries like Japan, South Korea, and Taiwan began producing steel and developing metallurgy 50 to 60 years ago, laying the foundation for their economic development. In recent decades, China, Mongolia’s southern neighbour, has become the world leader in steel and iron production, driving its rapid economic growth. India, which is expected to rival China in economic growth, has emerged as the world’s second-largest steel producer.

Mining Insight Magazine, №07, 08 (032, 033)